Highlights

- Invictus Energy has received firm commitments from its investors for a capital raise of AU$10 million (before costs) through private Placement

- Placement has been cornered by Mangwana Capital, local Zimbabwean partners and the Board

- Under the Placement, IVZ will issue 83,333,333 new fully paid ordinary shares at an issue price of AU$0.12 per new share

- Invictus will use the funds from the Placement for the preparations for the Mukuyu-2 appraisal well program and Phase 2 exploration program

- IVZ is planning to begin 2D seismic program next month, while Mukuyu-2 drilling program will start in Q3 CY23

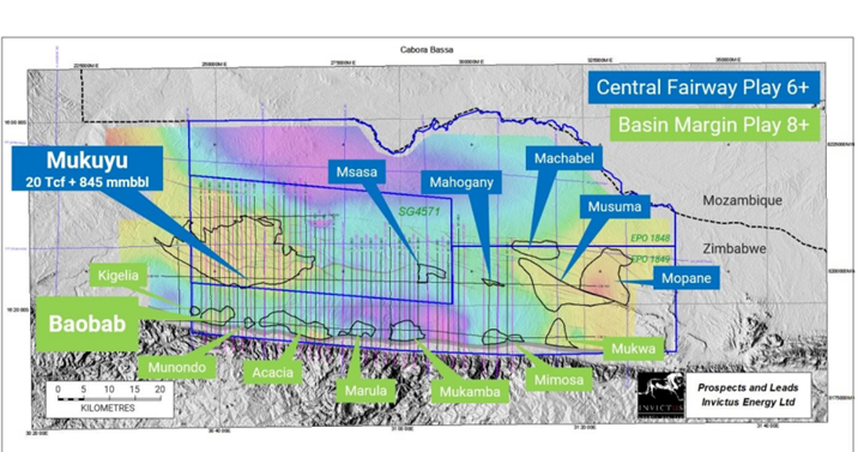

Invictus Energy Limited (ASX:IVZ) has received firm commitments from sophisticated and institutional investors for a capital raise of about AU$10 million (before costs) through private Placement, at $0.12 per share. This announcement comes as IVZ decides to take forward preparations for an exploration campaign in the Cabora Bassa Basin, Zimbabwe.

Image source: Company update

According to the company, it is on track to spud the Mukuyu-2 appraisal well in the third quarter of 2023, targeting multiple hydrocarbon (gas-condensate and potentially light oil) bearing intervals encountered in the Mukuyu-1/ST1 well in the Upper Angwa, Pebbly Arkose and Post Dande formations.

The funds from the Placement will be directed towards preparations for the Mukuyu-2 appraisal well program and Phase 2 exploration program. It will be used for 2D Seismic & Processing of Eastern leads on trend with Mukuyu to drill ready targets.

PAC Partners served the part of the lead manager for the Placement, while Evolution Capital played the role of the Co-Managers and book-runner.

As per the terms, Evolution Capital and PAC Partners will get lead manager listed options on a ratio of one-for-eight. Lead manager options will be issued under the Company’s ASX Listing Rule 7.1 allowance.

Key details of the Private Placement

The Placement Shares which are not subject to an approval from shareholders (72,500,000), will be issued out of the Invictus’ available placement capacity under ASX Listing 7.1A, with Placement Shares likely to be issued on 14 of this month, the Placement Options will be issued subject to IVZ filing a prospectus likely to be issued in concert and as part of the Share Purchase Plan (SPP) offer.

Per the Placement, total 83,333,333 new fully paid ordinary shares (New Shares) will be issued by the company at an issue price of AU$0.12 per new share, with a 20% discount to the last traded price of IVZ shares as on 3 April 2023, being the last trading date before the Placement, and a 10.7% discount to the 15-day VWAP prior to that date.

Placement participants will be entitled to a one-for-two listed option for every share issued, exercisable at AU$0.20 (67% premium to the Placement price) for three years.

Also, the attaching options which have been issued through the transaction are likely to offer meaningful additional capital to the IVZ balance sheet, at a materially higher valuation than the Placement, should the Company continue to achieve exploration success during its appraisal drilling program.

Directors, Mr John Bently, Mr Robin Sutherland and Mr Gabriel Chiappini intend to subscribe for new shares issued under the Placement subject to shareholder approval. In addition, shares placed to Mangwana Capital and the Company’s local partner will also be subject to shareholder approval.

Invictus will offer its current eligible shareholders, a chance to take part in a non-underwritten SPP, which will be undertaken on the same terms as the Placement after its completion.

Mukuyu-2 Overview & 2D Seismic

The company in its release informed that it is advancing the preparation activities for the Mukuyu-2 appraisal program as well as Cabora Bassa Phase 2 exploration campaign.

Under the 2D seismic acquisition program, Invictus will cover the eastern portion of EPO 1848 & 1849. This will include its experience from the successful CB21 Seismic Survey acquisition.

Likely to begin in May, the 2D seismic campaign will be undertaken with the objective of maturing different leads along the proven play on trend to the east of Mukuyu and additional leads along the highly prospective Basin Margin play.

With acquisition of modern 2D seismic, Invictus will be able to mature several leads, formerly detected on reprocessed vintage seismic data, to drillable prospects. Drilling of the first well in the Mukuyu appraisal program, Mukuyu-2, is also as per prior guidance, with an anticipated spud date early in Q3 2023.

To confirm a gascondensate discovery, Mukuyu-2 will target numerous hydrocarbon bearing intervals present in the Mukuyu-1/ST1 well in the Upper Angwa and Pebbly Arkose formations.

Also, the appraisal well will also be done to test the Post Dande horizon away from the major east-west fault on the southern flank and the deeper potential in the remaining Upper Angwa formation. These have not been encountered in the Mukuyu-1/ST1 program due to it being thicker than predrill estimates, allowing additional upside potential.

The Mukuyu-1/ST1 well encountered gas pay to total depth, interpreted from wireline logs and fluorescence in multiple reservoirs throughout the 1,500-metre interval penetrated in the Pebbly Arkose and Upper Angwa.

The Mukuyu-2 well design will be based on the experience obtained from the drilling of the successful Mukuyu-1/ST1 exploration well to enhance drilling efficiency and reducing operational risks.

The company will begin the maintenance and upgrade campaign for Exalo’s Rig 202 this month. It is expected to be concluded before the rig move and spud of Mukuyu-2.

Moreover, the long lead and well services tenders are underway. Invictus has got a go-ahead for submission of proposals by major service providers for the next campaign. This will enable IVZ to tailor the service provision for Mukuyu-2.