Initial Public Offering (IPO) offers investors a chance to become an owner in the company. On the other hand, with the help of an IPO, a company can raise capital without adding additional debt liability to their balance sheet, making IPO one of the most popular ways of raising capital from the market

In recent times, due to the increasing geopolitical uncertainties and trade issues among the major countries, many investors these days are being extra careful in investing their money. In the past few months, we have seen that many IPOâs have failed, creating a layer of tension in the IPO market. The list of the failed IPOs is fairly long and includes popular names like Latitude Financial group, Onsite Rental, WeWork and many more.

Although there are many benefits of raising capital through IPO, one must note that IPO also invites a lot of attention from investors. Scrutiny from investors could sometimes cost a lot to companies. A recent example of this is WeWork, a leading provider of office and workspace solutions.

In August 2019, WeWork filed its IPO Paper to U.S. Securities and Exchange Commission, wherein it announced that that it is planning to raise a maximum of $1 billion via IPO.

Reasons behind WeWork IPO

- To increase the companyâs capitalization and financial flexibility

- Enable access to the public equity markets for the company and its stockholders

- Create a public market for its Class A common stock

The IPO offering invited a lot of attention causing investors to raise question about the profitability of the company. Investors were also concerned about the leadership style of WeWorkâs then CEO Adam Neumann. The scrutiny by investors caused the CEO to resign and ultimately lead the company to withdraw its IPO in September 2019.

Investors and shareholders concerns play a key role in determining the future of an IPO. A classic example of this is Latitude Financial Group. Latitude lodged its prospectus with the Australian Securities Exchange (ASX) in September 2019, and later withdrew it from the market in October 2019 due to the company boardâs and the shareholdersâ low confidence about the strong aftermarket for Latitude.

Although many popular IPOs have failed in recent times, it has not stopped players to come in the equity market and raise capital from investors. As per recent market news, one company which is heading towards an IPO, is Nuchev, a health and nutrition solutions company in Australia. Leading media houses has reported that this infant formula stock is set for its IPO.

About Nuchev

Nuchev is an Australian based, globally oriented health and nutrition company which manufactures and sells various premium goat formula products into the Australian and Asia markets. With its highly skilled and experienced management team lead by its CEO Ben Dingle, the company intends to expand into other health and nutrition products in the future.

Who is Ben Dingle?

Mr. Ben Dingle is a Chief Executive Officer and Executive Director of Nuchev.

- Director of Nuchev since April 2013;

- Significant commercial experience from the New Zealand dairy industry;

- Co?founder of New Zealandâs Synlait Milk, which was founded in 1999;

- An MBA and Master of Marketing from The University of Melbourne, as well as a Bachelor of Agriculture from Massey University;

- Experienced director and is a graduate of the New Zealand Institute of Company Directors;

- He is also a member of the Australian Institute of Company Directors.

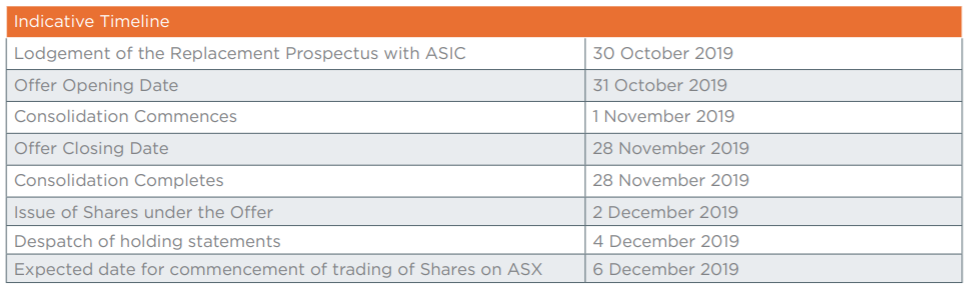

Amaero International to complete its IPO

One company which is on the verge of completing its IPO is Amaero International Ltd, an Australian company specialising in the manufacturing of large format complex components in metal. Under the IPO, the company is offering of between 30 million and 40 million New Shares, to raise a minimum of $6 million and maximum of $8 million.

The purposes of the Offer are:

- to raise capital to fund the Companyâs growth and expansion and to take advantage of specific client opportunities within the US;

- to gain access to capital markets, which it expects will give it added financial flexibility to pursue growth opportunities;

- to provide national and international defence and aviation clients with confidence that the Company can support their growth ambitions for additive manufacturing;

- to provide a liquid market for the Companyâs shares and an opportunity for others to invest in the Companyâs growth; and

- to provide the Company with the benefits that attach to the increased profile that arises from being a listed entity.

A look at Macarthur Minerals Limitedâs IPO

Minerals exploration company Macarthur Minerals Limited expects to close its IPO on 25 November 2019. Under the Offer, the company is offering 20 million Shares in Macarthur at an Offer Price of $0.25 per Share to raise a minimum of $5 million with the ability to accept oversubscriptions of up to a further 10 million Shares to raise a maximum of $7.5 million.

The Offer is to facilitate the dual listing of the Company on the ASX. The Board believes that a dual listing on the ASX will provide the company with increased opportunities to access capital from institutional investors and an opportunity for non-institutional investors in Australia to participate in the advancement of the Companyâs Projects. (before costs).

The Companyâs flagship project, the Lake Giles Iron Project, is comprised of the Moonshine Magnetite Project and the Ularring Hematite Project, located in the region which is a well-established mining district with one existing Iron Ore producer and several projects in the exploration and development stages.

(Source: Macarthur Minerals Limitedâs prospectus)

An investor who is looking to invest in an IPO, should take carefully go through companyâs historical performance, its risks, objectives as well as macroeconomic events which could have an impact on the companyâs operations.

To know more about the upcoming IPOs, Click here.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)