Iron ore markets traded lower on Friday (31st May 2019) with prices of iron ore settling 1.36 per cent lower on Dalian Commodity Exchange at RMB 727.00 as compared to its previous settlement of RMB 739.00.

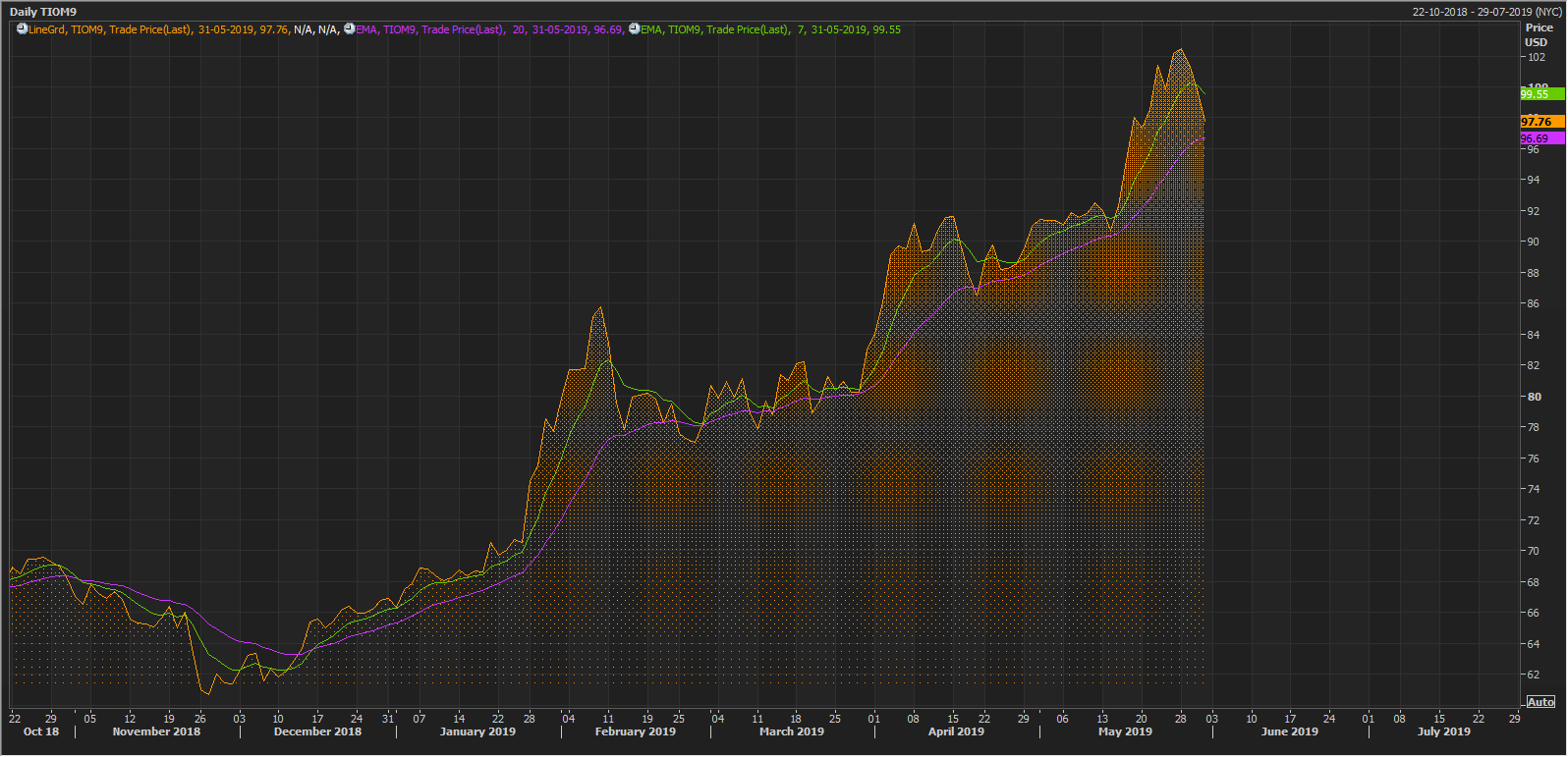

The prices lost value for the fourth consecutive session in the international market and dropped till US$97.76 (June contract (M9)) on Chicago mercantile exchange on Friday, down by 2.11 per cent as compared to its previous close of US$99.87.

TIOM6 Daily Chart (Source: Thomson Reuters)

TIOM6 Daily Chart (Source: Thomson Reuters)

Iron ore prices started the dayâs session on DCE today at RMB 726.0 and fell till the present low of RMB 712.00 (as on 03rd June 2019 AEST 12:38 PM). The prices are declining despite lower inventory across the Chinese ports as they are currently pressurized over falling steel prices and building inventories of steel in the domestic market of China.

DCIOU9 Daily Chart (Source: Thomson Reuters)

DCIOU9 Daily Chart (Source: Thomson Reuters)

As per the data, the iron ore inventory across 35 significant Chinese ports stood at 114.85 million tonnes (for the week ended 31st May 2019), down by 2.91 per cent or 3.44 million tonnes as compared to the previous week inventory of 118.29 million tonnes.

Despite lower iron ore inventories, the falling steel prices are contributing towards the fall in steelmaking raw material prices. The prices of October series steel rebar on SHFE declined by 0.71 per cent to end the day at RMB 3750 a tonne (as on 31st May). The prices further fell today on SHFE and started the dayâs session at RMB 3740.

The fall in steel prices are stopping mills to actively engage in raw material procurement process, which in turn, marked a decline in daily average delivery from the major thirty five ports in China, which declined by 85,000 metric tonnes (as on 31st May) from the level of 2.65 million metric tonnes (as on 24th May).

Steel market in China is currently marking a build-up in the social and mills inventories, which is further exerting pressure on iron ore prices. As per the data, the overall HRC stocks inched up by 1.4 per cent and stood at 2.99 million metric tonnes (as on 30th May), which in turn, marked an increase of 1.9 per cent on a yearly basis.

On the other hand, the steel rebar inventories in China noticed a weaker demand as torrential rain in the south deterred construction demand. The steel rebar inventory marked a decline of 4% (as on 24th May); however, the rebar inventory only declined by 1.4 per cent (as on 31st May), which in turn, marked an increase of 5.5 per cent on a yearly basis.

The rainy season across southern provinces in China, which includes, Hunan, Fujian, etc., disrupted the construction activities and coupled with the slower pace in steel downstream industry & and declining manufacturing activities in China exerted pressure on steel prices, which in a cascade reduced the iron ore demand.

In a nutshell, the iron ore inventories across the significant thirty-five ports in China are declining; however, reduced demand and building steel inventory coupled with slower steel downstream process exerted pressure on iron ore prices in the international market.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice