Copper prices soared amid US-China trade talks and tensions over partial government shutdown but an agreement in principle by U.S lawmakers to avoid another temporary government shutdown, provided some relief to the investors. To further gauge the trade related tension, market participants were focusing on the trade talk between the U.S and Chinese representatives, as U.S. trade delegate Robert Lighthizer and Treasury Secretary Steven Mnuchin were scheduled to meet China's vice premier in Beijing ahead of the March deadline of 90-days trade truce. Also, in the absence of any strong demand and the continuation of operations in northern Chile and southern Peru after a halt, exerted pressure on copper prices. Codelco, the world's biggest copper maker, needed to suspend exercises at its Chuquicamata and Ministro Hales divisions due to heavy rains which supported the copper prices but soon after the operations resumed the prices dropped in the absence of any robust demand.

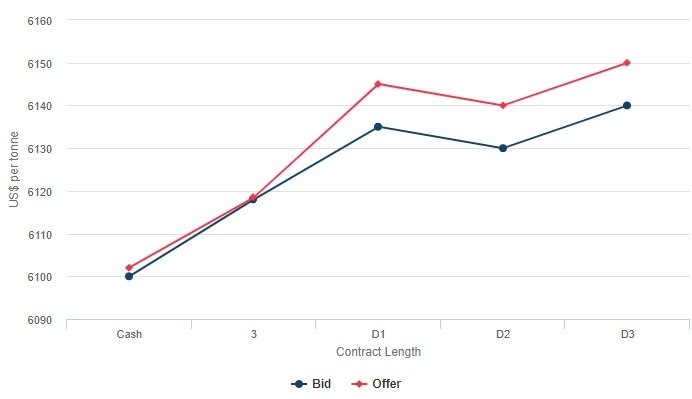

Speculative demand that picked in copper due to the discounted prices and supported the scenario while preventing it from falling to its lowest level for 6 weeks, was later seen to be fading away. The fall in dollar index also exerted pressure on copper, as a cheap dollar marks a cheap valuation for metals. The spread of Offer price and Ask price for copper in London metal exchange (LME) among different contracts has then represented the absence of robust demand in copper amid uncertainty over global economic slowdown, which in turn exerted pressure on copper prices.

How is Global data putting pressure on copper?

How is Global data putting pressure on copper?

Copper as a commodity used for many industrial applications serves as a barometer for the performance measurement of the global economy. The fall in the global economy or signs of it exerts an enormous amount of pressure on copper prices as well, just like for other key commodities. The weaker economic data coming from the globe amid various concerns such as Euro-zone dispute, Brexit, U.S.-China trade talks, etc. are putting pressure on copper prices.

Issues at hand in Europe and then Bank of England stating that Britain faces its weakest monetary development in 10 years, have impacted the commodity scenario as well. Also, a surge in production was noticed which also exerted pressure on copper price with production at the world's biggest copper mine, Escondida, going up 34 percent. The development in Kamoa-Kakula project based in the Democratic Republic of Congo is another concern for a shorter term as the project aims to make DRC world's top copper producer. In the absence of any robust demand, such development instigates some level of fear among market participants and exerts speculative pressure on the prices.

However, the on-going electric vehicle drive and demand for energy storage battery is supporting copper price to some extent, as copper is a raw material for the cathode construction along with nickel, cobalt and other metals. Chinaâs first quarter improvement is also supporting copper prices as China is a major importer of the commodity.

To further reckon the direction of copper, the market participants are eyeing various data such as UK GDP, UK inflation and manufacturing and industrial production, Japan preliminary data on machine tool order and GDP, China trade figure, etc. all due for the week.

Copper was seen to be trading at USD 2.77, as at February 12, 2019 (00:01 GMT).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)