15年間の信頼と革新、顧客感謝プロモーション実施

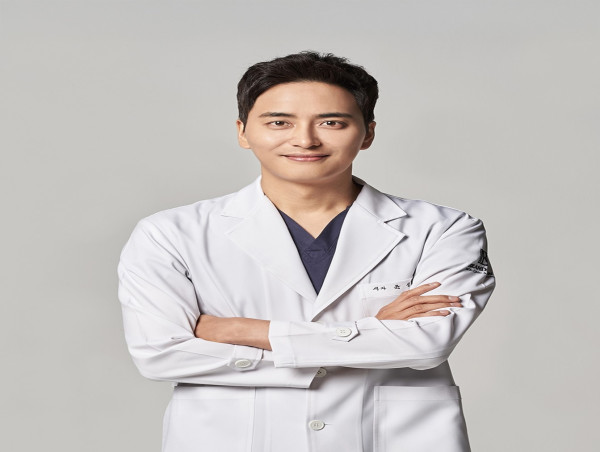

SEOUL, SOUTH KOREA, January 31, 2025 /EINPresswire.com/ -- ブランニュークリニックは、開院15周年を迎え、2月の1ヶ月間にわたり、感謝の気持ちを込めた特別プロモーションやさまざまなイベントを開催すると発表しました。ユン・ソンウン院長が率いるブランニュークリニックは、最新の医療技術とプレミアムサービスを提供し、韓国の美容医療分野でリーディングポジションを確立、顧客の信頼を基盤に成長を続けています。

ブランニュークリニックは、2011年に輪郭注射とスカルプ注射を開発し、美容医療のトレンドを牽引してきました。さらに、2015年にはサーモン注射と赤ちゃん注射を組み合わせた「ヨナ注射」を開発し、顧客一人ひとりに合わせた施術ソリューションを提供しています。このような継続的な研究開発への取り組みが、ブランニュークリニックの成長を支え、顧客からの信頼を築く原動力となっています。

この度、15周年を記念して、感謝の気持ちを込めた特別プロモーションが実施されます。2月1ヶ月間、公式SNS(インスタグラム、カカオトーク、YouTube)をフォローした顧客を対象に、コラーゲン注射10cc、ウルセラ200ショット、チューンライナー、輪郭注射15A+15Aなどの特典が提供されます。詳細は公式ウェブサイトでご確認いただけます。

また、お買い上げいただいた顧客を対象に、オフラインイベントも開催されます。2月1日から28日までの期間中、約300点の景品が用意され、参加者には抽選で景品が贈られます。景品には、バウチャー商品券、YSEトナー、バレット無料駐車クーポンなどが含まれています。

さらに、2月7日から14日までは、「感謝のコメントイベント」も開催されます。公式SNSで15周年を祝うコメントを投稿することで、チキン、ヨーグルトアイスクリーム、オリーブヤング商品、コーヒーギフト券など、さまざまな景品が当たるチャンスもあります。

ユン・ソンウン院長は、「この15年間、顧客の皆様のご愛顧と信頼のおかげで、ブランニュークリニックは成長を続けてきました。今後も、顧客の健康と美しさをサポートするクリニックとして、最高の医療環境とサービスを提供し続けます」と感謝の気持ちを伝えました。

Hojun Lee

BrandnewLab

+82 70-8894-4313

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()