Significant gold mineralization at the high-priority Kingsley gold target has been intercepted by Kingston Resources Limited (ASX:KSN) at its 75%-owned flagship Livingstone project in Western Australia during follow-up drilling.

Drilled a total 106 holes for approximately 8000 meters covering the western side of Kingsley the combination reverse circulation and aircore program which commenced last month, as well as the Dampier and Drake prospect areas within Livingstone, 140km northwest of Meekatharra. Located within the Find-Stanley area, it was designed to extend and infill mineralization at Kingsley which is considered to be the projectâs biggest geochemical target and has previously shown significant grade, continuity and thickness. [optin-monster-shortcode id="wxhmli4jjedneglg1trq"]

With results including 5m at 6.56g/t gold the last round of drilling at Kingsley identified grade along a strike length of 2 kilometres. From 30 out of a total 76 holes have so far included 20m at 2.94 g/t gold from 4m. 16m at 1.25g/t gold from 128m and 8m at 3.03g/t gold from 12m. Including 4m at 2.36g/t gold, other highlights have been 2m at 1.65g/t gold from 48m and 8m at 1.58g/t gold from 36m and 16m at 1.33g/t gold from 32m.

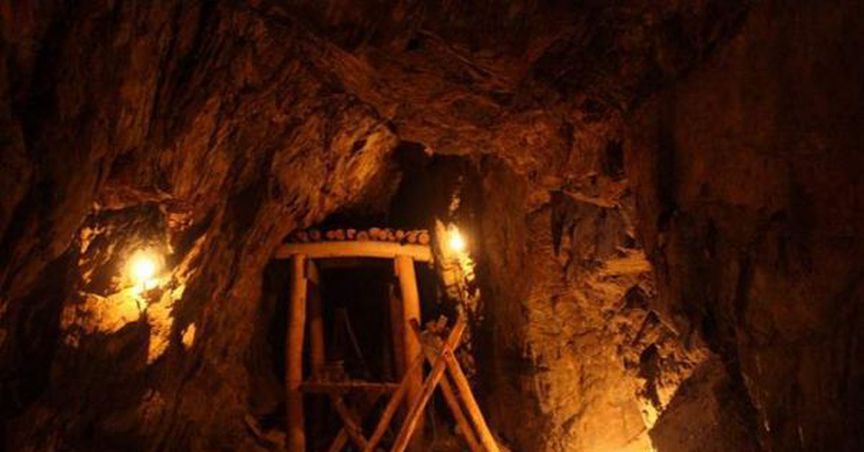

The Livingstone Gold Project, located in the Peak Hill mineral field of Western Australia, is a flagship exploration project, 75% owned by the company with a current JORC2004 of 49,900 ounces of inferred mineral resources.

Kingston Resources informed that assays are pending for 76 holes across the Kingsley, Drake and Dampier. It includes the hole which covers the further 350m of untested strike, west of previous drilling undertaken at Kingsley prospect.

Managing Director of Kingston Resources Limited, Andrew Corbett confirmed the development of Kingsley as a series of highly mineralized structures over a large strike area. He said the shallow intersections Kingsley prospect has delivered a significant additional value to 75% company owned Livingstone project located in Western Australia.

The company intends to report further drilling results from the testing pending on 76 more holes from the Kingsley, Drake and Dampier prospects.

Whereas, the companyâs world class Misima Gold Project in PNG has shown result of total mineral resource of 82.3 Mt with Gold 1.1 g/t and Silver 5.3 g/t, as per the estimates released by the company on 27 November 2017.

Despite reporting significant results from follow-up drilling at Livingstone Gold Project, the stock of Kingston Resources Limited was hitting the ground. Since morning Kingston Resourcesâ stock fell 4.545% to last trade $0.021 on 11 October 2018. In the past one year, KSN stock has witnesses an attractive performance change of 37.50% but it has been slipping down since last three months. This translates a plunge of 12% over the past three-month period.

The Income available from dividends remains attractive for many investors.

We take a look at the best yields on the market and assess what they say about a companyâs prospect.

One Thing is certain, though, Australia interest rates are still low, making income difficult to come by and keeping the focus for many investors on high yielding stocks. Kalkineâs team of analysts bought you handpicked report for âTop 25 Dividend Stocks For 2018.â

ASX-relevant Special Reports are published year-round to provide a detailed analysis into an investing opportunity or a potential risk to your portfolio.

Click here to get your free report.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkinemedia.com and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.