Quarterly reports highlight the activities of a company during any particular quarter. Amount of cash inflow and cash outflow for that period, available cash balance, and companyâs outlook and estimated cash outflow during the next quarter are among the major aspects that are covered by companies under their quarterly reports.

In this article, we would discuss four Artificial Intelligence (AI) stocks that have recently updated the market with their quarterly results.

Bigtincan Holdings Limited

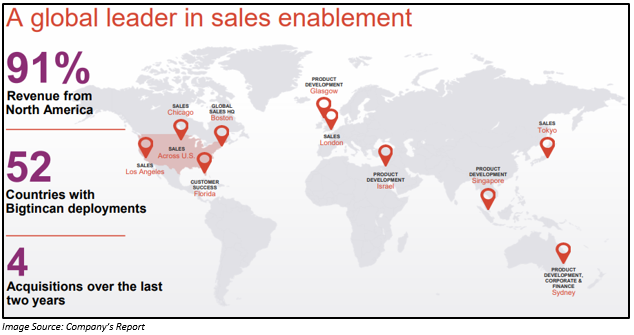

Bigtincan Holdings Limited (ASX:BTH) is an enterprise mobility software provider. Its Artificial Intelligence-powered sales enablement automation platform helps users to learn at a fast pace and sell smartly as well as become more productive every day.

Investor Presentation:

On 8 August 2019, Bigtincan Holdings Limited updated the market with its investor presentation, which was held at Canaccord 39th Annual Growth Conference at Boston.

The presentation covered investment highlights of the company:

- Cloud-based (SaaS) software platform is used for automating sales collateral delivery, as well as providing training and coaching for enterprise organisations.

- Total addressable market is worth more than $ 5 billion in the fast-growing SaaS market space.

- Established customer base of the company includes Sony PlayStation, AT&T, Anheuser-Busch and ANZ with more than 150k licensed users.

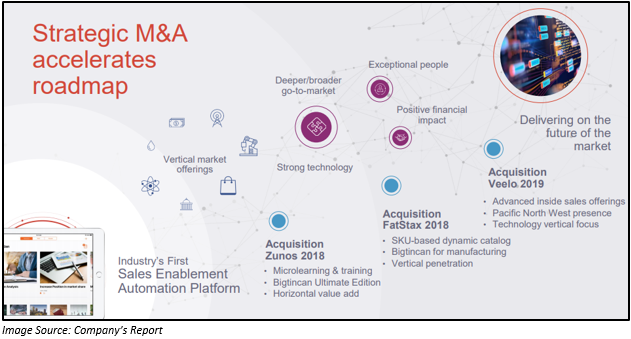

- BTH raised $ 15.6 million in April 2019, which would support the company in accelerating its key strategic priorities like sales and marketing staff expansion, majorly in the US and the UK. The funds would be directed towards the product and technology development as well as M&A opportunities.

- The company comprises of experienced board members with a proven track record in founding and developing companies in terms of content, mobile

- application, digital services and technology.

- The company is on track to achieve its upgraded guidance for revenue growth of 40% year on year in FY19.

Q4 FY2019 Highlights:

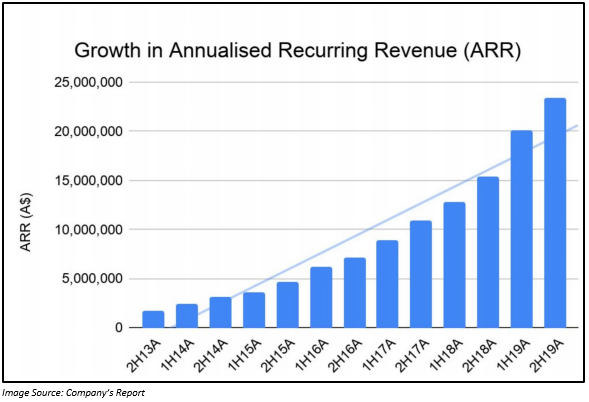

The company reported a 119% growth in customer cash receipts to $ 5.53 million in Q4 FY2019 when compared with the same period a year ago. The ARR increased by 52% to $ 23.4 million YoY. The acquisition of FatStax surpassed top level of earn-out performance target. Its cash balance as on 30 June 2019 is $ 25.4 million. Expected cash outflow in Q1 FY2020 is ~ A$ 7.1 million.

The company plans to release full year results for FY2019 on 29 August 2019.

Outlook for FY2020:

Market: The company would be launching products targeted towards Marketing, Manufacturing and for improving the existing retail and life sciences packages. It would be engaging itself in increasing direct sales resources across the US and the UK.

Customer: It would be working on increasing commitment towards customer success and at the same time, engaging itself in customer acquisition programs.

Channel: The company would also deepen channel development activities to aid growing market development and channel expansion.

Technology: BTH would focus on strong software release cadence across all platforms. It would also expand resources that focus on data science and Artificial Intelligence technologies.

Corporate: It would continue to assess the market for M&A opportunities.

Stock Performance:

The shares of BTH have generated a good YTD return of 65.80%. The shares of BTH opened at a price of A$ 0.455 on 16 August 2019. By the end of the dayâs trading, price of the BTH stock was A$ 0.435, down by 3.333% as compared to its last closing price. BTH has a market cap of A$ 117.87 million with ~ 261.93 million outstanding shares.

Flamingo Ai Limited

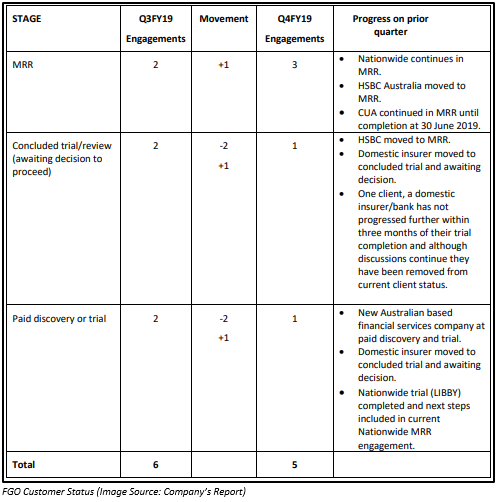

Flamingo Ai Limited (ASX: FGO) is an Enterprise SaaS company in the Artificial Intelligence (AI) field, offering access to a Machine Learning platform as well as competencies that comprise of Cognitive Virtual Assistants for employees along with clients. On 30 July 2019, Flamingo Ai Limited released its Q4 FY2019 results for the period ended 30 June 2019.

Update on Business Strategy:

During the period, the company, under the new leadership, initiated a revised vision, mission and strategic planning process. The company is moving towards a customer-focused Software as a Service (SaaS) product and value proposition, powered by Artificial Intelligence, from the sales of a complex AI technology platform. Its products would be designed for large organisations as well as employees who are willing to maximise their productivity and enable collaboration workflows.

The Virtual Employee Assistant product of FGO would be addressing the problems related to content management and knowledge retrieval, which are being experienced by enterprises. In the next one year, the company would focus on transforming its technology problem. It would then focus on developing content management as well as request tracking competencies. The addition of these competencies with the existing knowledge search and retrieval capability and natural language processing user interface would result in an extensive feature set required to aid the product positioning.

Client Engagement:

The company at present has five engagements across the US and Australia. The product is at various levels of the implementation phase. Below is the table summarising the current position.

The company appointed Mr Olivier Cauderlier as the new CEO of FGO on 11 July 2019.

Other key developments during the period:

- The company received R&D Tax Incentive and EMDG Grant worth $ 1.196 million during the quarter.

- The net cash available with the company by the end of Q4 FY2019 on 30 June 2019 was $ 5.032 million.

- Expected cash outflow in Q1 FY2020 is $ 1.3 million.

Stock Performance:

The shares of FGO have generated a negative YTD return of 66.67%. The shares of FGO opened at a price of A$ 0.005 on 16 August 2019. By the end of the dayâs trading, the price of the share was A$ 0.005, down by 16.667% as compared to its last closing price. FGO has a market cap of A$ 6.72 million with approximately 1.12 billion outstanding shares.

OpenDNA Limited

OpenDNA Limited (ASX:OPN) is an AI and e-commerce marketing company, which provides services like digital marketing and customer acquisition to drive online sales for customers.

Partnership with Perth Airport:

Recently on 6 August 2019, the company announced that it has entered into a partnership with Perth Airport Pty Ltd to sell the latterâs retail products to Chinese travellers in Australia as well as China via online platform.

OpenDNA achieved substantial growth with third consecutive quarter registering growth of more than 300% in cash receipts. In Q4, the company noted cash receipts of $ 763k. A digital marketing company, Blackglass, was acquired during this period. With this acquisition, the company would be able to expand its online marketing and customer acquisition capability. Its e-commerce platform, namely RooLife, went live in Australia and China (owing to high demand for Vitamins, Minerals & Supplements, skincare and health product ranges). An appointment of a dedicated distributor in China was made in order to sell as well as distribute OPNâs AI and Machine Learning technology.

OpenDNAâs Growing Customer and Revenue Database (Source: Companyâs Report)

Outlook:

- Expansion of high-quality customer base in Australia for digital services.

- Digital services expansion in China.

- Help Australian businesses as well as brands to enter into the Chinese market.

- Develop important sales partnership in Tourism & Airports, Diagou and Student channels and Online and Retail sales segments.

Stock Performance:

The shares of OPN have generated a six-month return of 2.94%. The shares of OPN opened at a price of A$ 0.035 on 16 August 2019. By the end of the dayâs trading, the price of the share was A$ 0.034, down by 2.857% as compared to its last closing price. OPN has a market cap of A$ 9.04 million with approximately 258.26 million outstanding shares.

BrainChip Holdings Ltd

BrainChip Holdings Ltd (ASX:BRN) is a neuromorphic computing solutions provider. The solution is a kind of AI that is inspired by the human neuron biology. On 31 July 2019, BrainChip Holdings Ltd released its Q2 2019 results.

Q2 2019 Activities:

During the period, the company introduced AkidaTM Intellectual Property for Licensing to ASIC Suppliers. Neural Network Converter for CNN to SNN translation was also introduced during the period. The company signed a Definitive Agreement with Socionext Americas to work together for the development of Akida NSoC and manufacture the device.

The company also signed a convertible securities agreement with CST Capital Pty Ltd. Under this agreement, in which the company would serve as trustee of the CST Investments Fund, BRN was provided with an advance of US$2.85 million. The company also announced a 1 for 4 Accelerated Entitlement Offering on 26 June 2019, through which it was able to raise ~ $ 10.7 million, at an offer price of $ 0.06 per shares and net of fees.

Q2 2019 Financial Highlights:

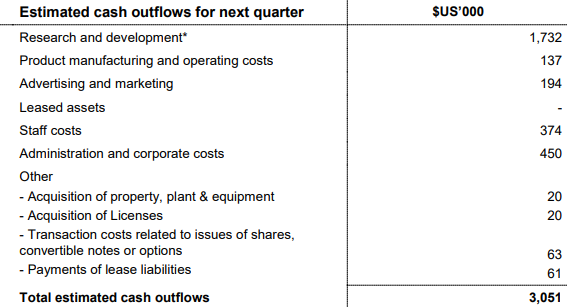

BrainChip Holdings Ltd used US$1.999 million in its operating activities and US$0.019 million in its investing activities. The net cash inflow through the financing activities was US$2.440 million. The net cash and cash equivalent available with the company by 30 June 2019 was US$5.520. Expected cash outflow in Q3 2019 is ~ US$3.051 million.

Source: Companyâs Report

Stock Performance:

The shares of BRN have generated a negative YTD return of 49.40%. The shares of BRN opened at a price of A$ 0.046 on 16 August 2019. By the end of the dayâs trading, the price of the share was A$ 0.044, down by 4.348% as compared to its last closing price. BRN has a market cap of A$ 57.97 million with approximately 1.26 billion outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.