Summary

- The Australian housing bubble seems to have survived the COVID-19 blow as property values continue to see optimistic momentum.

- Australian regional property market has shown a remarkable uptick in demand.

- A range of pandemic-induced factors was observed to champion the lucrativeness of regional property spaces.

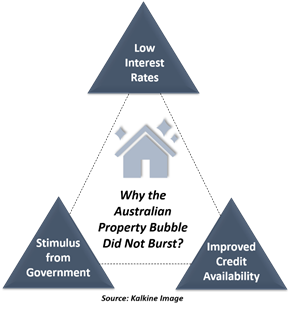

While the cataclysmic pandemic has left majority of industries in a dire strait, the property market seems to be bucking the trend in the land down under. In the thick of COVID-19, Australian housing bubble remained unfazed, witnessing substantial demand as many moved towards investment in a physical asset.

So much so, CoreLogic’s Head of Research, Tim Lawless has indicated that national home value index is expected surpass pre-COVID levels in early 2021 if the current growth trend persists.

At the time when the Australian property sector has dodged off the crushing blow of coronavirus, the wave of transition has shifted the momentum towards regional properties of Australia.

What has been the loss for major cities, has been a gain for the regional space. Through the demand shift, the Australian property space seems to have survived the pandemic downtrends.

In this backdrop, let us explore what is buzzing across Australian property market.

READ MORE: How COVID-19 has Impacted Australian Labour & Property Markets?

Property Market Performance in Australia

Given the demand trends it appears that regional areas are outperforming capital cities in terms of popularity. Nevertheless, the shift has also ensured that Australian overall property market continues to shift even through the worst moments.

As per CoreLogic’s data, Australian home values declined by 2.1% between April 2020 and September 2020. Nevertheless, regional property market was the first to meet up with demand in September and October, overturning the minor declines recorded previously across the combined regional areas. At the same time national index posted a second consecutive monthly rise in November 2020 as dwelling values edged up 0.8% over the month.

ALSO READ: Regional NSW Property Market Records a Price Surge

Property Values Trends: Regional Markets vis-à-vis Capital Cities

Significantly, the combined regional index stood its ground even through the worst of COVID-19 slump, allowing scope for price appreciation in the pandemic era.

In the past three months, there has been an increase in the regional dwelling values by 2.8%. At the same time, the combined capitals index plummeted by 0.7%.

The latest trends for November 2020 show a steeper price rise for regional properties. Significantly, in November, the increase in combined regional dwelling values (1.4%) outstripped that witnessed in the national dwelling (0.7%), reverberating growing attention towards the regional property.

Internal Migration Statistics

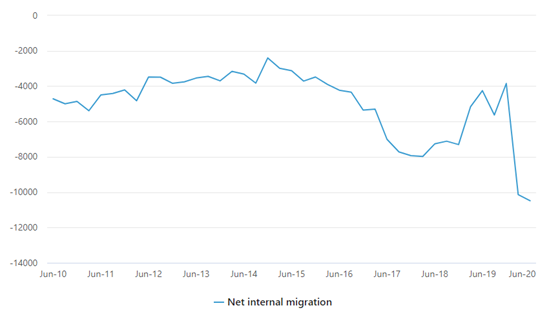

Provisional regional internal migration estimates released by the Australian Bureau of States (ABS) for June 2020 Quarter also indicated similar trends. Capital cities witnessed a net loss of 10.5k people from internal migration- the most extensive recorded net quarterly loss.

Quarterly Net Internal Migration, Source: ABS

Net internal migration loss for Melbourne during the June Quarter was 8000 whereas Sydney saw a net loss of 6000. Furthermore, the closure of international borders has stifled international migration to Australia.

ALSO READ: Why is South Australia lifting the lockdown earlier than expected?

Wave for Regional Property: A Buttress for AU Real Estate

The shift in behavioural changes and transition in landscape stimulated by the pandemic has fostered the demand for regional property units, compensating for the initial downtrends. The pandemic has conjured up several factors that have been together aiding regional property markets.

Work from Home Trends

Amidst the changing business scenario to remote working, the exodus of workers has led to the downfall in demand for capital homes, with people left to concentrate more on investment in regional property.

Price Affordability

Australian property commands one of the highest prices, often being one of the major causes of extensive debt burden on Australians. Moreover, an uncertain future amid economic contraction has triggered the conservative side of the people. A significant difference in the median housing value between that in capital cities and regional locations often tend to make the latter as the affordable price points.

Serene Lifestyle

Those eyeing a relaxed lifestyle away from the hustle and bustle of the city are focusing on regional properties. Significantly, many people are choosing to remain homebody after months of stay-at-home lifestyle. Such a shift in behaviour and psychological settings is facilitating the demand for peaceful homes away from the commotion.

Decrease in International Investments

The relation between Australia and China has turned sour. 2020 saw several allegations and trade barriers between the two nations. There have also been significant changes in the Australian foreign ownership laws while new processing times have been implemented in Australia for foreign investments. The recent turn out of events is acting as headwind for foreign investments, which are primarily concentrated on capital cities and urban centres.

Meanwhile, a decline in the demand for rental spaces also shifts the popularity towards regional areas.

ALSO READ: Proposed NSW Property Tax Regime: Stamp Duty Dilemma

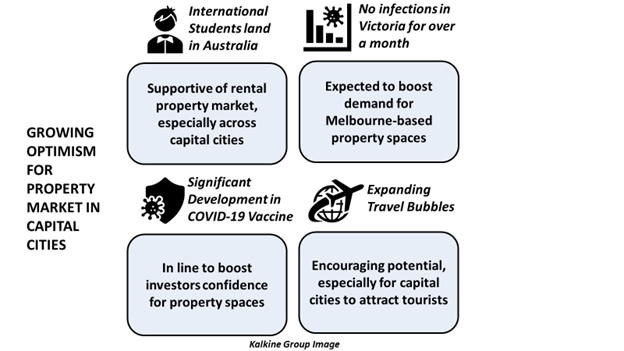

The capital cities are ready move out of the woods as Australia gains significant control over the pandemic situation. Experts opine that property spaces in Australia’s capital cities may soon reclaim their dimmed glory.

A Lens through ASX-listed Real Estate Players

Vicinity Centres (ASX:VCX)

Vicinity centres in its September 2020 Quarterly Update indicated that visitation and retail sales in centres outside of Victoria and the Central Business Districts (CBD) increased over the previous quarter. Portfolio excluding Victorian and CBD centres saw 1.1% September Quarter sales compared to September 2019 quarter, although overall portfolio sales remain down by 32%.

The Company completed its live project in Western Australia-based Ellenbrook Central, a sub-regional shopping centre located ~ 30 kilometres from Perth CBD. A new 6,600 sqm Kmart which was included as a part of the Ellenbrook expansion has shown strong trade since the opening in July this year.

ALSO READ: Victoria Emerges as the Warrior Against Corona War

Stockland (ASX:SGP)

Stockland’s 1Q21 results for the period ending 30 September 2020 showed an improvement as residential businesses experienced improved sales and settlements delivering significant quarterly net sales result, the highest in the past three years.

Furthermore, village living is witnessing enhanced value proposition. While there has been 9% drop on the prior corresponding period (pcp) in quarterly net sales for retirement living due to restrictions across Victoria, sales in other areas (ex-Victoria) increased by 15% over pcp. It signals the enhanced customer orientation towards the support and wellbeing offered by villages.

SCA Property Group (ASX:SCP)

SCA Property Group reported an improvement in tenant sales and rent collection rates excluding Victoria. For the quarter ending 30 September 2020 (Q1 FY21), sales growth of 9% was generated from the total portfolio over pcp. The cash collection rate in September 2020 in Victoria was 67% while that in the rest of Australia was 85%. The group plans on evaluating several acquisition opportunities for neighbourhood centres next year.

Bottomline

There has been an upswing in remote working and other pivotal changes amidst the restriction in movement and changing government inclination. The transformation has been seeping through the lifestyle of people who envision this change as the future of the Australian environment.

Meanwhile, an uncertainty about the duration of the pandemic remains, indicating the continuation of the current shift in trends. Nevertheless, the significant development in vaccines and the increase in domestic travel could be a game-changer in Australian property landscape.