The benchmark index S&P/ASX 200 closed at 6,825.8 on 30 July 2019, inching up 0.28% from its previous close. Meanwhile, S&P/ASX 200 Financials (Sector) also inched up 18.9 points to close at 6,495.1 on the same day.

The financial services sector accounts for the largest contribution towards the economy of Australia, which also has the worldâs fourth?largest pool of investment fund assets. Moreover, the investment fund assets pool is the largest in the Asian region. Below discussed are two stocks operating in the Australian financial services sector. Let us take a look at their recent updates and performance on the Australian Securities Exchange.

AMP Limited

About the Company:

AMP Limited (ASX: AMP), serving as a wealth manager in Australia and New Zealand, offers solutions and services related to insurance, superannuation, investment, retirement income, among others. The company gives financial advice as well as offers products like home loans, deposits, saving accounts and SMSF products through AMP Bank. Through AMP Capital, the company is engaged in serving its clients with managing investments in equities and fixed income, as well as diversified, multi-manager and multi-asset funds.

AMP Snapshot (Source: Companyâs Report)

Unlikely Transaction of AMP Life:

On 15 July 2019, the company announced that it is highly unlikely to proceed with the sale of AMP Life (the Australian and New Zealand wealth protection and mature businesses) to UK-based insurance company Resolution Life, as the company is facing challenges in meeting the condition requiring it to get the approval of the Reserve Bank of New Zealand (RBNZ).

As per the RBNZ requirement, a change in the control for AMP Life is required in a form that matches with the current branch structure, exempting AMP Life from several legislative requirements in New Zealand. AMP is disappointed for not meeting the required condition, as the sale of AMP Life was a part of the companyâs strategy for growth. The company is currently working with Resolution Life to find a solution, which would require the negotiation of new terms, though it is not certain. The solution would focus on meeting the interests of policyholders, both in New Zealand and Australia, as well as addressing the regulatory requirements and providing certainty of execution.

H119 Expectations:

AMP Limited is unlikely to pay an interim dividend for the first half of 2019, as the board is expected to continue its prudent approach to capital management, factoring in the uncertainty regarding the AMP Life transaction. Moreover, the company, for the first half of 2019, anticipates reporting Level 3 eligible capital surplus more than the minimum regulatory requirements. The capital surplus is likely to be in line with Board limits for target capital surplus.

Q119 Financial Updates:

The company reported growth in assets under management (AUM) in wealth management segments for the markets of Australia and New Zealand as well as AMP Capital, during the first quarter of the year 2019, backed by stronger investment markets.

During the first quarter of 2019, the company registered a 5% rise in the AUM of Australian Wealth Management segment to $ 129.3 billion, a 4% increase in the AUM of AMP Capital segment to $ 194.6 billion and a 7% increase in the New Zealand Wealth Management segmentâs AUM to $ 11.9 billion. Also, there has been $ 127 million growth in AMP Bankâs total loan book to $ 20.1 billion and $ 218 million increase in the deposit book to $ 13.5 billion during Q119.

Australian wealth management segment witnessed net cash outflows of $ 1.8 billion during the first quarter of 2019 compared with net cash outflows of $ 200 million in the same period of 2018. New Zealand wealth management segment witnessed net cash outflows of $ 52 million in Q119, down from $ 53 million in the year-ago period. Meanwhile, AMP Bank reported a strong retail deposit growth, in addition to a modest increase in lending. The transaction was done with the companyâs joint venture partner AIMS Financial Group.

Stock Performance:

With a market cap of $ 5.39 billion and 2.95 billion outstanding shares, the stock traded flat at $ 1.830 on 30 July 2019. Over the past one month, three months and six months, the stock has delivered negative returns of 14.49%, 19.74% and 20.43%, respectively. It has an annual dividend yield of 7.65% and a PE ratio of 183x, while its EPS stands at $ 0.010.

Commonwealth Bank of Australia

About the Bank:

Commonwealth Bank of Australia (ASX: CBA), Australiaâs largest lender, offers wide range of financial services, comprising of retail banking, institutional banking, funds management, investment and broking services. The bank has offices in New Zealand, as well as in regions including Asia, Europe and North America. Operating since 1912, the bank serves a customer base of 15.9 million. The bank has over 800,000 shareholders. It focuses on ensuring the financial wellbeing of people, businesses and communities.

Q3 FY19 Trading Update:

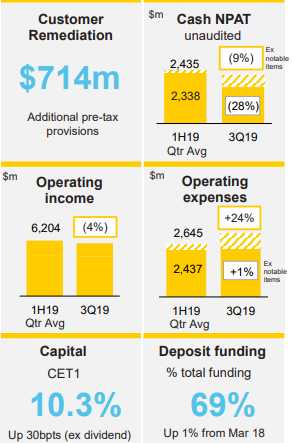

For the third quarter of FY2019 ended 31 March 2019, CBA posted an unaudited statutory net profit of approximately $ 1.75 billion, while its cash net profit from continuing operations stood at approximately $ 1.70 billion. During the third quarter, the bankâs profit was affected on the back of pre-tax additional customer remediation provisions of $ 714 million ($ 500 million post tax). Moreover, the bankâs operating income declined by 4% due to seasonal cycle, temporary headwinds and rebased fee income.

Q3 FY19 Highlights (Companyâs Report)

In Q3 FY19, the Commonwealth Bank of Australia reported a 3% fall in net interest income, as two days were less in the quarter. The bankâs pre-tax customer remediation provisions stood at $ 714 million. The provisions included $ 334 million due to Aligned Advice remediation. Moreover, operating expenses of $ 704 million and $ 10 million in discontinued operations were included in the customer remediation provisions.

Stock Performance:

With a market cap of $ 147.37 billion and 1.77 billion outstanding shares, the stock traded at $ 83.400 on 30 July 2019, up 0.18% from its previous closing price. Over the past one month, three months and six months, the stock has delivered positive returns of 1.13%, 10.84% and 16.68%, respectively. It has an annual dividend yield of 5.18% and a PE ratio of 16.22x, while its EPS stands at $ 5.132.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.