Financial markets in Australia are among the most prominent, fastest growing and most complex market in Asia. With the presence of well-developed financial market, Australia is considered as one of the most important centres of capital markets activity in Asia. Australia has one of the leading groups of contestable funds under management (FUM) across the globe, valued at approximately AUD 1.3 trillion (USD 850 billion).

The financial services industry can be divided into the following sectors-

- Asset-based finance and leasing

- Funds management/Superannuation

- Hedge funds

- Insurance

- Investment banking

- Payment systems, clearing and settlement

- Private banking and Retail banking

- Private equity/Venture capital

The financial industries play an essential role in assisting a vibrant, expanding economy, and the ultimate purpose of the financial system is accelerating balanced growth in the economy by meeting the financial requirements of the industry and the community. Financial services are offered by accounting companies banks, credit unions, and other companies providing payments, banking, securities, insurance, investment, financial advisory services to businesses and consumers.

Financial technology also named as FinTech, will have a vital role for innovations in Australia. This technology is all about promoting technological innovation so that there will be more efficient and consumer focused financial systems and markets.

FinTech drives advancements in financial services that are provided on a regular basis and more significantly, stimulate disruption via innovative new services and products, that can provide advantages to customers as well as other divisions of the economy.

The financial services industry in Australia helps people in managing their wealth and financial security. In this article, we are discussing two ASX listed financial stocks with their performance in most recent quarter.

Let us zoom the lens on- CIW and PPT

Clime Investment Management Limited (ASX:CIW)

An ASX listed company Clime Investment Management Limited (ASX:CIW) is a diversified independent Australian fund manager. The company is engaged in providing services such as portfolio management, administration services, fund management and more to its clients across the world.

Clime is working with the aim of delivering exclusive private wealth advisory and investment solutions curated to meet the requirements of the company’s clients. The investment solutions provided by the company are targeted toward increasing the wealth of their clients to accomplish financial security in retirement.

Quarterly market update of December 2019

On 15 January 2020, the company updated the market with quarterly developments on ASX. The December quarter for 2019 witnessed robust FUM growth and investment performance throughout all investment portfolios. The quick highlights from its update are-

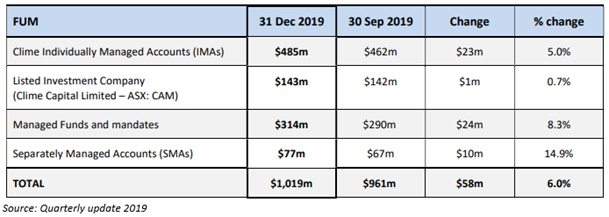

- In terms of FUM growth, Individually Managed Accounts grew 5 per cent; Clime Capital grew 0.7 per cent; Managed Funds grew 8.3 per cent, and Separately Managed Accounts (SMAs) increased by 14.9 per cent. The company revealed that this is a comforting result for the shareholders.

- Interim Reported Profit- On account of strong investment performance for the quarter, CIW anticipates its half-year statutory profit after tax to be materially more significant than the statutory profit after tax of H1 FY19 which was noted at AUD 0.21 million.

- Assets Under Management (AUM)- The investment products and mandates of the company comprise Clime Capital (LIC), Managed Funds, Separately as well as Individually Managed Accounts. As at 31 December 2019, the gross balances across Clime’s investments were nearly AUD 1,019 million, up by 6 per cent from AUD 961 million at 30 September 2019.

- Returns on portfolios of the company are surpassing their relevant index returns for CY2019 and it is noted that, recently, two of Clime’s investment products were ranked in the Top 10 investments by Morningstar, as reported in the Australian Financial Review Chanticleer column on 14 January 2020.

- During the financial year 2019, the company launched two strategic initiatives for improving engagement of client and assets growth under management-

- Clime Private Wealth-Clime provides tailored private wealth advisory services for sophisticated and wholesale investors.

- The second strategic initiative is offering the national community of approximately 25,000 Australian financial advisers with access to the company’s high-quality investment services as well as products.

- Clime Investment Management Ltd had nearly AUD 10.0 million of liquid capital on 31 December 2019.

- The company maintains sound progress on developing and diversifying its revenue streams for becoming an integrated wealth management business.

Additionally, Clime will provide more information and information about dividend would be provided in its half-year update in late February 2020.

Stock Performance-

On 17 January 2020, the CIW stock was trading at AUD 0.640 (at 3:05 PM AEDT), flat with respect to the previous close. The company’s market capitalisation stood at nearly AUD 35.89 million, with almost 56.07 million shares outstanding. The P/E ratio of the stock stands at 24.62X, with an annual dividend yield of 3.52%.

An Australian financial services company Perpetual Limited (ASX:PPT) provides investment products, financial consultation services, funds management advisory, portfolio management, corporate services, custodial and trusteeship services. Perpetual is engaged in protecting and increasing wealth of the company’s clients and operates in three business segments- Perpetual Private, Perpetual Investments and Perpetual Corporate Trust.

Second Quarter 2020 FUM update

On 15 January 2020, the company announced its investments’ funds under management (FUM) as at 31 December 2019, the highlights are-

- Perpetual Investments’ FUM as at 31 December 2019 of approximately AUD 26.3 billion, up by AUD 0.2 billion as compared to the previous quarter.

- Total average funds under management for the three months to 31 December 2019 were nearly AUD 25.9 billion.

- A rise of approximately AUD 0.2 billion in FUM on the previous quarter was primarily attributable to-

- About AUD 0.3 billion of net inflows that comprise- AUD 1.1 billion of net inflows into cash and fixed income; and nearly AUD 0.8 billion of net outflows from Australian Equities primarily from the Institutional and Intermediary channels.

- Distribution payments of approximately AUD 0.1 billion to clients.

Stock Performance-

On 17 January 2020, the PPT stock was trading at AUD 42.490 (at 3:05 PM AEDT), flat compared to the previous close. The company’s market capitalisation stood at approximately AUD 2 billion, with nearly 46.86 million shares outstanding. The P/E ratio of the stock stands at 16.940x, with an annual dividend yield of 5.88 per cent.

.jpg)