On 27 August 2019, the S&P/ASX200 index closed 31.1 points higher at 6,471.2 from the prior close. The consumer staple sectoral index settled in red, 0.14% down at 12,010.9. In this article, we discuss three stocks from the Australian Consumer Staples industry, their recent financial results amidst ongoing reporting season and their short positions.

Inghams Group Limited (ASX: ING)

Integrated Poultry Retailer, Inghams Groupâs stock crashed 17.08% following the release of full-year results. According to ASIC short position report dated 21 August 2019, the stock is the most shorted stock at 19.43% of the total product in issue.

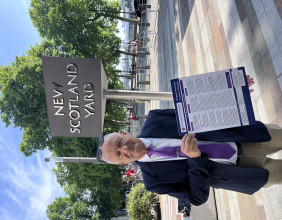

Reportedly, the revenues were up by 4.9% to $2.49 billion in FY2019 compared to revenues of $2.37 billion in FY2018. Statutory NPAT was $126.2 million for the period, up by 10.1% from $114.6 million in FY2018. Meanwhile, the underlying NPAT was $103.2 million for the period, down by 4.4% from $108 million in FY2019.

Besides, profit on the sale of assets, impairment of assets, restructuring, mitavite and finance exit cost makes up the difference between statutory NPAT & underlying NPAT. The company posted statutory EBITDA of $242.2 million for FY2019, up by 14.1% from $212 million in FY2018.

Financial Highlights (Source: ING Investor Presentation - FY2019 Full Year Results)

Further, the company has declared a fully franked dividend of 10.5 cents per share payable on 9 October 2019 to the shareholders on record as on 18 September 2019.

As per the release, chicken remains the competitive protein with 4.3% growth in core poultry across Australia & New Zealand. Feed volumes were down 10.1% during the period. Operating expenses were consistent with the companyâs expectations. Meanwhile, the revenues in Australia were up 5.3% during the year backed by the growth in wholesale and increasing demand for processed products.

Besides, the revenues from New Zealand were up 2.8% during the period, which was attributed to growth in poultry volumes and a decline in demand for dairy feed. EBITDA margins were impacted due to the inability to pass increasing costs.

FY2020 Outlook

Reportedly, the demand for chicken continues to grow, backed by the relative affordability of the chicken as a protein. The current feed cost remains close to historic highs, and outlook for FY2020 relies on the next domestic grain harvest. Margins in Australia has been negatively impacted by higher input costs and channel mix.

Meanwhile, the companyâs processing network rationalisation project has not lived up to the expectations, and resilient customer demand resulted in higher cost, which would impact FY2020 financially. In New Zealand, the business continues to be below the historical profit levels. EBITDA in FY2020 is expected to be below FY2019 levels and a return to growth is expected in FY2021.

Besides, excluding the impact of leasing, the company intends to maintain a payout ratio of 60-70% of underlying NPAT. On 22 October 2019, Inghams would present the new strategic and operational plan.

By the close of trading hours on 27 August 2019, ING was trading at A$3.50, down by 17.08% from the previous close.

GrainCorp Limited (ASX: GNC)

According to ASIC short position report dated 21 August 2019, the GNC stock reported 3.24% of the total product in issue as short positions.

Recently, the Australian agribusiness player notified on the exemption process at Portland port. Accordingly, the Australian Competition and Consumer Commission (ACCC) had considered not to exempt the companyâs grain export terminal in Victoria under the Port Terminal Access (Bulk Wheat) Code Conduct.

Reportedly, the company intends to engage with ACCC during the twenty-eight-day consultation period considering the extremely competitive nature of Victorian grain exports. Meanwhile, the company would continue to serve the export customers of Victoria.

Previously, in July, ACCC had raised concerns on the proposed sale of the companyâs Australian Bulk Liquid Terminals to ANZ Terminals Pty Ltd. GrainCorp would continue to engage with the ACCC for support through the merger review process. Besides, the statement by ACCC had indicated to provide a final verdict on the transaction on 17 October 2019.

On 2 August 2019, the company had reported on the FY2019 earnings guidance. Accordingly, it expects to report underlying EBITDA in the range of $65 to $85 million, and underlying net loss after tax in the range of $70 to $90 million for FY2019.

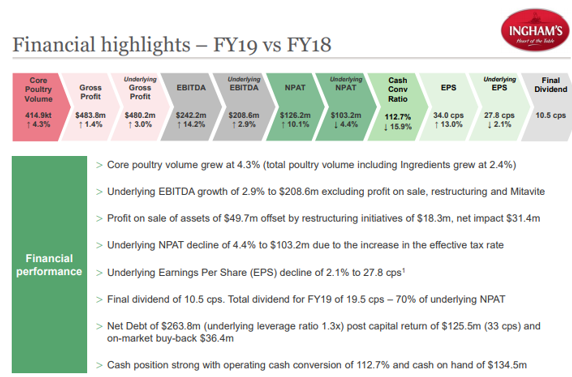

Oil Business (Source: GNCâs Investor Presentation, May 2019)

Reportedly, the ongoing disruption of international grain trade flows and robust Australian wheat markets (expected to increase to $60-70 million from $40 million) had negatively impacted EBITDA. As a result of the reluctance from international market participants to consider new season contract, the company anticipates that the new crop trading opportunities in the last quarter would not materialise.

Besides, the independent crop forecasters are expecting another below-average production year in 2019-20. In June 2019, ABARES had a forecast of winter crop production at 14.4 million metric tonnes, down by 22% to 10-year average to 2018-2019.

Further, the company had entered into a ten-year contract to optimise the eastern Australia grain production risk, effecting FY20 to provide cover for the cash flows volatility and earnings in the low output seasons. More importantly, the trading condition for the rest of the businesses were performing in line with the companyâs expectations.

By the close of market trading on 27 August 2019, GNC was trading at A$7.75, flat from the previous close. Over the year-to-date period, the stock is down by 14.17%. Besides, GNC is down by 8.93% over the last one month.

Coca-Cola Amatil Limited (ASX: CCL)

According to ASIC short position report dated 21 August 2019, the CCL stock reported 2.66% of the total product in issue as short positions.

Recently, the Australian beverage manufacturer and distributer had reported the half-year results for the period ended 29 June 2019. Accordingly, the total revenues were up 5% to $2,427.2 million in 1H2019 compared to revenues of 2,311.3 million in 1H2018. Besides, EBIT was down 3.8% to 289.9 million in 1H2019 compared to $301.4 million in 1H2018. Statutory NPAT was up 6.3% to $168 million in 1H2019 against $158.1 million in 1H2018.

Half Year Highlights (Source: CCLâs 2019 Half Year Results Presentation)

Australian Beverages

Reportedly, the segment had achieved double-digit growth in energy and dairy while diet and no-sugar colas delivered volume growth. The overall volumes were down by 1.2% due to container refund scheme in Queensland, and the Australian Beverage volume declined by 0.3% excluding Queensland during the period.

Indonesia & Papua New Guinea

Reportedly, in Indonesia, the business achieved single-digit volume & revenue growth, and this was attributed to sparkling beverages, value added dairy, effective promotions, festive execution. Besides, the company recorded double digit volume and revenue growth in Papua New Guinea.

New Zealand & Fiji

Reportedly, in New Zealand, the business delivered all-round performance backed by revenue growth in all major channels and better performance in sparkling and still beverages. Despite challenging economic conditions, the company achieved profit growth in Fiji.

Alcohol & Coffee

As per the release, the business has recorded modest revenue growth and double-digit EBIT growth. In New Zealand, the results were strongly backed by Beam Suntory Premix & Spirits portfolio. In Australia, the business increased share in a range of alcoholic beverages.

Corporate & Services

Reportedly, the company had increased investments in group capabilities, IT platforms, and amid lower rental & service earnings, the segment had delivered lower earnings. Besides, the company had booked a profit of $14 million in the sale of SPC business for $40 million.

Outlook

Reportedly, the company expects Australian Beverages to be placed for growth in 2020, underpinned by the completion of further investments through Accelerated Australian Growth Plan. In Indonesia, the company intends to build upon the growth achieved since April 2018, backed by additional marketing expenditure.

Besides, the company expects to report EBIT loss of $12 million in Corporate & Services consistent with the previous outlook. Meanwhile, the company anticipates delivering growth in New Zealand & Fiji, Papua New Guinea and Alcohol & Coffee.

On 27 August 2019, CCL last traded at A$10.77, down by 1.913% from the previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.