Highlights

- Emmerson generated £7.2 million in total as oversubscribed placings to fund the development of the Khemisset project.

- Oriole Resources reported 70.00m grading 1.46 grammes per tonne gold and 10.00m grading 1.69 g/t gold, respectively, at Faré and Madina Bafé.

Mining operations came to a standstill during the pandemic. Reopening of the economy and resumption of operations in the sector has resulted in a resurgence of investor interest in mining stocks. Several investors keen on diversifying their portfolios are investing in these stocks to leverage the increasing mining activities. The prices of mining stocks are directly dependent on the economic conditions and often demonstrate a boost during periods of expansion.

(Data source: Refinitiv)

Here we take a detailed look at two mining stocks and explore the investment prospect in them.

Emmerson Plc (LON:EML)

Emmerson is a natural resource exploration and production company. The company is primarily focused on the Khemisset Potash Project development, located in Northern Morocco.

Emmerson generated a total of £7.2 million as oversubscribed placings to fund the development of the Khemisset project. In February 2021, it received a Mining Licence for the Moroccan Ministry of Energy, Mines and the Environment’s project.

Emmerson’s cash and cash equivalents for the year ended 31 December 2020 stood at £1,143,000.

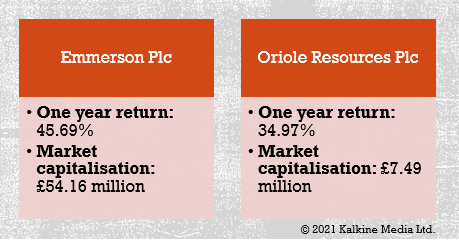

The shares of Emmerson closed at GBX 6.50 on 8 September 2021. The shares of the company have given a return of 51.16% in the last one year to shareholders, and the market cap stood at £54.16 million.

Oriole Resources Plc (LON:ORR)

Oriole Resources is an AIM-listed natural resources exploration firm focussed on West Africa. The company’s cash balance as of 30 June 2021 was £0.87 million. The company’s pre-tax loss for the six months ended 30 June 2021 was £0.87 million (2020: profit of £0.17 million).

Oriole Resources reported 70.00m grading 1.46 grammes per tonne gold and 10.00m grading 1.69 g/t gold, respectively, at Faré and Madina Bafé at its Senala project in Senegal.

Oriole Resources’ shares closed at GBX 0.48 on 8 September 2021. The shares of the company have given a return of 33.39% in the last one year to shareholders, and the market cap stood at £7.49 million.

Bottomline

Investors keen on investing in mining stocks must carefully analyse the fundamentals of these companies. As the mining industry is cyclical, prices of mining stocks hovered in direct relation with the pandemic from the beginning to recovery in 2021.

.jpg)