US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 19.07 points or 0.57 per cent lower at 3,332.53, Dow Jones Industrial Average Index contracted by 219.11 points or 0.79 per cent lower at 27,364.95, and the technology benchmark index Nasdaq Composite traded lower at 11,091.64, down by 25.88 points or 0.23 per cent against the previous day close (at the time of writing, before the US market close at 11:50 AM ET).

US Market News: The key indexes of the US market opened in the red ahead of the first presidential debate. The US goods trade gap increased by 3.5 percent to USD 82.94 billion in August 2020. Meanwhile, as per the industry expert’s data, the bankruptcies in New York City increased by 40 percent during the pandemic. Among the gaining stocks, shares of Beyond Meat jumped by nearly 10.8 percent after it announced the partnership with Walmart for expansion of the product distribution. Big Lots surged by close to 7.5 percent after it highlighted a good earnings outlook. Molson Coors Beverage gained by around 3.2 percent after it would launch the first alcoholic beverage of Coca Cola in the US. Among the decliners, Universal Health declined by around 2.0 percent after it announced that its network remains offline after a ransomware attack. IHS Markit was down by about 1.0 percent, although the company reported earnings better than the market’s expectation. Tiffany fell by about 0.5 percent after LVMH filed a suit against the company related to financial mismanagement during the pandemic.

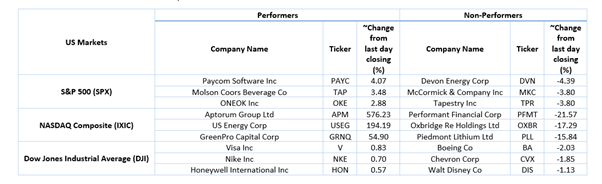

US Stocks Performance*

European News: The London and European markets traded in the red following the weaker investor sentiments due to the covid-19 restrictions. As per the Bank of England’s data, the British mortgage approvals stood at 84,715 in August 2020 that were the highest in the last 13 years. Meanwhile, as per the market expert’s survey, the British house prices are expected to nudge up by 2 percent this year due to the post-lockdown housing market boom. Among the gaining stocks, shares of Ferguson moved up by close to 5.9 percent after it reported a 2 percent year on year increase in ongoing revenue. Mondi rose by around 3.9 percent after it confirmed that Mike Powell would be appointed as CFO and an executive director of the company. Smith & Nephew gained close to 0.1 percent after it announced the acquisition of Extremity Orthopedics business of Integra Life Sciences. Among the decliners, shares of Greggs plunged by around 8.2 percent after it reported subdued performance in August 2020. Card Factory declined by about 4.9 percent after it reported a 6.9 percent fall in like-for-like sales for four weeks in September 2020. Pendragon shed by nearly 3.1 percent after it reported a loss in H1 FY20.

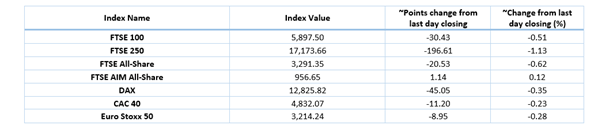

European Index Performance*:

FTSE 100 Index One Year Performance (as on 29 September 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Barclays Plc (BARC); Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Utilities (+3.04%), Consumer Cyclicals (+0.58%) and Basic Materials (+0.37%).

Top 3 Sectors traded in red*: Real Estate (-2.44%), Energy (-1.19%) and Financials (-1.15%).

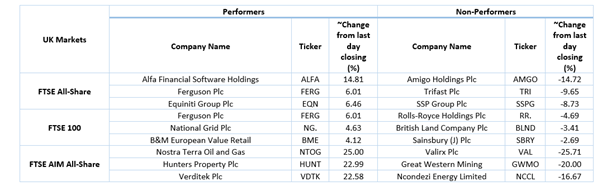

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $41.36/barrel and $39.17/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,901.75 per ounce, up by 1.03% against the prior day closing.

Currency Rates*: GBP to USD: 1.2854; EUR to GBP: 0.9134.

Bond Yields*: US 10-Year Treasury yield: 0.646%; UK 10-Year Government Bond yield: 0.181%.

*At the time of writing