Summary

- The UK government is going to introduce UKCA marking, which would be effective from January 2021 onwards

- Medical devices manufacturers would be given a grace period by the MHRA to make a transition to the new regulatory regime

- CE marks and certificates would continue to get recognition until 30 June 2023

Health care equipment & devices manufacturers/ distributors are likely to bear some additional cost and efforts due to the new UK product safety marking. The medical supplies, along with health care devices and equipment, were being traditionally shared across the European Union. With Brexit deadline nearing, the UK must have its own safety marking for its healthcare equipment and products.

In the background of regulating medical devices post a No-deal Brexit, the British government has proposed a new regime for Great Britain, Northern Ireland, and the European Union. Earlier, CE marks and certificates issued by European Economic Area-based Notified Bodies on Medicines and Healthcare products were considered to be as a standard benchmark across the European Union and would continue to get recognition until 30 June 2023, according to the MHRA (Medicines and Healthcare products Regulatory Agency).

Do read: AstraZeneca-Oxford Vaccine to Roll Out by Early Next Year, Other Vaccines Also Advance to Next Stage

What is the UKCA marking?

Manufacturers/ distributors of medical devices would need a new UK product marking known as UKCA (UK Conformity Assessed) mark to place their products in the Great Britain market. The manufacturers can apply for UKCA marking on their products from 1 January 2021. Notably, products might still require a CE marking for sale in the European Union as UKCA may not be recognised in these markets.

All the medical devices manufacturers would be given a grace period by the MHRA to make a transition to the new regulatory regime from January 2021 onwards. England, Scotland, and Wales can have their own regulatory regime in place from January 2021.

New Regime would translate to additional costs

In case Britain leaves the EU without a deal, the products need a new hallmark, confirming that the product meets certain legal requirements and has been tested. The new symbol of UKCA would lead to an additional cost, which might burden the manufacturers.

The device manufacturers would have to change their packaging, advertising or might even have to bring about some changes in terms of technical aspects for using the new logo which could attract huge costs, though it may not be a recurring and would be a one-time cost. Notably, the device manufacturers are already struggling due to the coronavirus pandemic as the focus has shifted from developing equipment to finding a cure for the novel coronavirus across the industry.

Several manufacturers would have to spend huge money to comply with the new regime requirements in order to place their product in the market and for existing products as well in a short span of time. However, the new mark endorsed by the MHRA would provide confidence to consumers that the product has been tested and it meets the regulatory requirements.

In addition, UK based manufacturers could have to get their export products stamped twice- UKCA for Great Britain and Northern Ireland along with CE for EU markets. This could lead to another bottleneck in the supply chain for UK based manufacturers as EU might not recognise tests done by the UK.

Any UK based new product which is to be placed in the EU market may have to undergo a reassessment by an EU-recognised assessment body which would eventually lead to bottlenecks in the supply chain along with increased overheads.

Let us have a closer look at the businesses which might get impacted due to the new regime announced by the British government.

- Smith & Nephew Plc

The United Kingdom based medical technology company; Smith & Nephew Plc (LON: SN.) boasts of its innovation in the field of medical equipment technology. The company manufactures its equipment in three categories of Orthopedic Advanced Wound Management, ENT, and Sports Medicine. The European region is one of the established markets for the company, which happens to be of strategic importance in terms of revenue generation. It was down by more than 30 per cent during the second quarter period ended 27 June 2020.

The group is expected to face several headwinds due to geopolitical uncertainties in the near term. However, the company has robust financials along with strong leadership, which could guide the company towards growth in the medium term. Smith & Nephew shares traded at GBX 1,544 on 9 September 2020 on GMT 9:18 AM + 1, down by 0.58 per cent from its previous close.

- ConvaTec Group Plc

ConvaTec Group Plc (LON:CTEC) is a British Healthcare company that makes medical devices for critical care, wound care, continence, and ostomy care. The shares of the company are listed on the Main Market of the London Stock exchange and form part of the FTSE 250 index.

The company is closely monitoring Brexit negotiations and has proactively prepared contingency plans to address the potential outcomes such as regulatory changes. The company does not expect any material financial or operational impacts due to Brexit.

The company came out with its half-yearly results on 6 August 2020. Despite the disruptions caused by the pandemic, the company has been able to register a growth of 2.1 per cent in its reported revenues from $889 million in the corresponding period last year to $908 million this year. ConvaTec Group shares traded at GBX 185.10 on 9 September 2020 on GMT 9:32 AM + 1, down by 0.86 per cent from its previous close.

- Tristel Plc

UK based company, Tristel Plc (LON:TSTL) is a developer, manufacturer and supplier of hygiene products, infection, and contamination prevention products. The company has a portfolio of products that are used in disinfecting surfaces in hospitals. This portfolio is referred to Cache Collection by the company. Tristel has acquired a significant number of clients in Western Europe. Servicing these clients could become a tad challenging with the new regime in place with reference to safety marking. Tristel shares traded at GBX 445 on 9 September 2020 on GMT 9:48 AM + 1, down by 1.11 per cent from its previous close.

- Immunodiagnostic Systems Holdings Plc

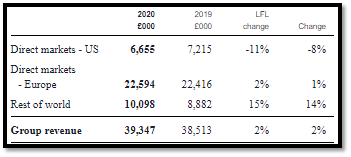

UK based vitro diagnostic solution provider, Immunodiagnostic Systems Holdings Plc (LON:IDH) generates a chunk of revenue from European markets. The company generated revenue of £22,594 thousand from the European markets in 2020, up by 2 per cent on like-for like basis.

(Source: Company’s filings, LSE)

The group is expected to face several headwinds due to geopolitical uncertainties such as regulatory changes due to Brexit in the near term. Immunodiagnostic Systems Holdings shares traded at GBX 210 on 9 September 2020 on GMT 10:01 AM + 1.

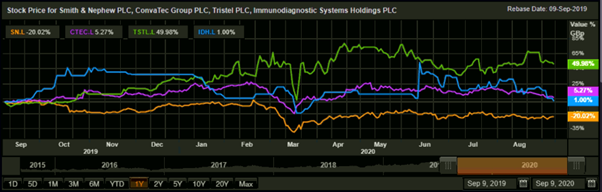

1-year Comparative chart: SN., CTEC, TSTL, and IDH

(Source: Refinitiv, Thomson Reuters)

The UK’s MedTech industry has been well-integrated with the European Union. In case of a no-deal Brexit, UK would have to create its own regulatory mechanisms to protect the consumers. However, this would lead to an incremental cost for the businesses and bottlenecks in the supply chain. Though, the impact on the industry would only become clear after the transition period ends and there is clarity on the trade deal front.