Summary

- Healthcare is perhaps the only one of the few sectors which are in the thick of business activity in these trying times in the United Kingdom.

- UK is home to some global pharmaceutical giants which have unparalleled technological advancement across the industry.

- Companies such as GlaxoSmithKline PLC, AstraZeneca PLC, and many others have been making the headlines in recent times with reference to coronavirus vaccine development.

Overview of the Healthcare Sector

Healthcare as an industry has a lot of ground to cover up along with the immense potential to grow. The healthcare sector comprises of companies, which foray into manufacturing of medical devices, drugs, providing healthcare facilities and medical insurance services or any other company otherwise facilitating patient care in medical-related products or services. In addition, testing labs are very niche and an underrated segment. However, the coronavirus pandemic has led to the expansion of medical research labs.

The onslaught of the coronavirus pandemic has exposed the healthcare sector in the UK. This also meant that the countries must prepare for future pandemics, as history suggests that they are inevitable. Healthcare systems would always be in demand as long as the human race exists. From birth to death, we all consume healthcare services directly or indirectly. It is a defensive sector. Despite the challenging environment due to Brexit uncertainties and coronavirus pandemic, healthcare stocks are still the most sought-after choice of investors.

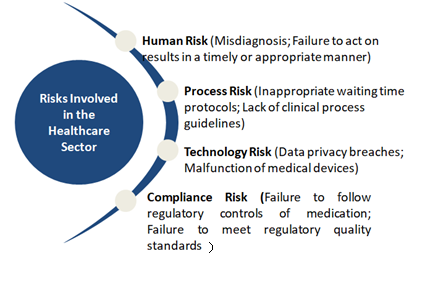

What are the Risks Associated with the Healthcare Sector?

What is the Present Scenario of the Healthcare Sector?

The global economy and the financial markets have witnessed the impact of the Covid-19 pandemic and the lockdown it triggered. However, there is still no clarity on the more profound effect that it is having across the businesses and the industrial sectors. Perhaps only one of the few sectors which are in the thick of business activity in these trying times in the United Kingdom is the Healthcare sector. Responsible for keeping the healthcare of the country adequately provisioned, the sector has gained prominence for the country in this trying time.

The industry has seen a high level of activity as the National Health Services and hospitals across the country cram for more and more medicines, ventilators, testing kits and protective kits as they wage war against the invading virus that has crippled the British society and its economy same as that of after the world war two. With the fight against the pandemic expected to continue for a few more months to come, the industry will continue to play its part as the soldier and the saviour of the British people.

Healthcare Stocks of the United Kingdom

The UK is home to some global pharmaceutical giants which have unparalleled technological advancement across the industry. Companies such as GlaxoSmithKline PLC, AstraZeneca PLC, and many others have been making the headlines in recent times with reference to coronavirus vaccine development. The world has underpinned its hope on these leading healthcare companies to find a cure for the coronavirus pandemic. In addition, these companies are known for their other life-saving drugs as well.

Lockdown has seen a long-overdue revival in the fortunes of the UK's innovative life sciences companies with some eye-catching movements. In context with the above discussion, let's focus on the performance of some top FTSE 100 healthcare stocks.

AstraZeneca PLC

AstraZeneca PLC is a British pharmaceuticals company is a British pharmaceutical company that is involved in the development production, commercialisation and marketing of prescription medicines having an international footprint.

AstraZeneca PLC (LON: AZN) stock last traded at GBX 8,340.00 on 28 August 2020 down by 0.91 per cent from its previous close. The 52 low/high price range was GBX 6,221.00/9,320.00. It was having a market capitalisation (Mcap) of £110,454.52 million. The company recorded a positive price return of 8.88 per cent on a YTD (Year to Date) basis.

GlaxoSmithKline PLC

Glaxo SmithKline Plc is the United Kingdom based global pharmaceutical major. The company makes a wide variety of medicines and vaccines, having its presence all across the world and is amongst the top ten largest global pharmaceutical companies.

Glaxo SmithKline Plc (LON: GSK) stock last traded at GBX 1,513.00 on 28 August 2020, down by 1.47 per cent from its previous close. The 52 low/high price range stood at GBX 1,374.60/1,846.00. It was having a market capitalisation (Mcap) of £75,802.08 million. The company recorded a negative price return of 14.99 per cent on a YTD (Year to Date) basis.

Hikma Pharmaceuticals PLC

Hikma Pharmaceuticals Plc is the United Kingdom domiciled pharmaceuticals company engaged in the R&D, production, and marketing of, branded generic as well as in-licensed pharmaceutical products of all forms.

Hikma Pharmaceuticals Plc (LON:HIK) stock last traded at GBX 2,371.00 on 28 August 2020, up by 0.64 per cent from its previous close. The 52 low/high price range stood at GBX 1,701.50/2,575.00. It was having a market capitalisation (Mcap) of £5,429.80 million. The company recorded a positive price return of 19.45 per cent on a YTD (Year to Date) basis.

Smith & Nephew PLC

The United Kingdom based medical technology company; Smith & Nephew PLC boasts of its innovation in the field of medical equipment technology. The manufactures its equipment in three categories of Orthopedic Advanced Wound Management, ENT and Sports Medicine.

Smith & Nephew PLC (LON: SN.) stock last traded at GBX 1,521.50 on 28 August 2020, up by 0.10 per cent from its previous close. The 52 low/high price range stood at GBX 1,152.50/1,990.00. It was having a market capitalisation (Mcap) of £13,309.03 million. The company recorded a negative price return of 16.93 per cent on a YTD (Year to Date) basis.

Conclusion

These healthcare companies are some of the popular companies which have sound fundamentals and are among the top choices of the UK equity income managers. Once this pandemic is under control, experts think governments will inject cash into diagnostic testing, and general healthcare improvements and then big healthcare sector businesses like these would get an additional boost.