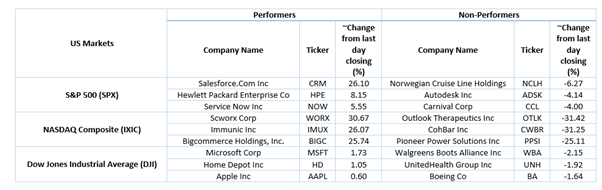

US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 27.68 points or 0.80 per cent higher at 3,471.30, Dow Jones Industrial Average Index expanded by 18.01 points or 0.06 per cent higher at 28,266.45, and the technology benchmark index Nasdaq Composite traded higher at 11,645.23, up by 178.75 points or 1.56 per cent against the previous day close (at the time of writing, before the US market close at 1:45 PM ET).

US Market News: The Wall Street opened mixed after the reports that the hurricane Laura is expected to hit the Gulf of Mexico. The US durable goods orders were up by 11.2 percent month on month in July 2020 against an expected increase of 4.3 percent. Among the gaining stocks, Salesforce.com shares surged by around 27.2 percent after the company reported revenue of USD 5.1 billion that was above streets expectation. Urban Outfitters shares were up by about 20.9 percent after the company reported better than expected revenue. HP Enterprise was up by close to 6.6 percent after the company reported revenue of USD 6.8 billion that was above market expectation. Among the decliners, Nordstrom shares were down by about 5.5 percent after the company reported a loss per share of USD 1.62. Toll Brothers was down by close to 2.3 percent although the company announced an increase in signed contracts.

US Stocks Performance (at the time of writing)

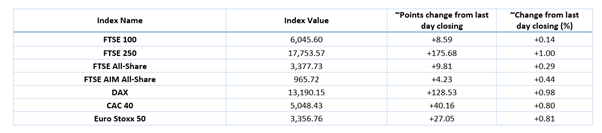

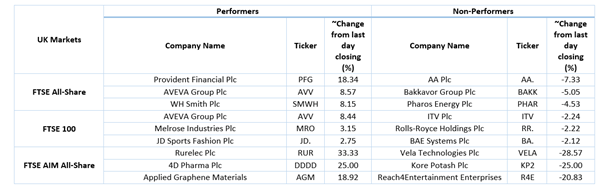

European News: The London market traded in the red amid reports that Gatwick airport would slash close to 600 jobs, whereas the European market advanced after a report that Eurozone is growing as ECB expected in June 2020. Meanwhile, FCA highlighted that the mortgage payment deferral in the UK would end on 31 October 2020, but it would review the situation for the next stage of support. As per the data released by the UK government, 64 million meals were consumed since starting of August 2020 under the government’s “eat out to help out” scheme. Among the gaining stocks, Provident Financial was up by close to 19.1 percent although the company reported a loss in H1 FY20. Polymetal was up by about 0.6 percent after the company declared the interim dividend of USD 0.40 per share. Perpetual Income and Growth Investment Trust were up by about 0.6 percent after the company announced the first interim dividend of 3.4 pence per share for the current fiscal year. Puretech Health was up by around 0.1 percent after the company received USD 100 million from the sale of shares of Founded Entity Karuna Therapeutics. Among the decliners, Pharos Energy was down by close to 4.5 percent after the company reported lower revenue in H1 FY20. Vodafone Group shares were down by close to 0.9 percent after the company published the prospectus for capital securities.

European Indices Performance (at the time of writing)

FTSE 100 Index Chart

1 Year FTSE 100 Index Performance (26 August 2020), before the market closed (Source: Refinitiv, Thomson Reuters)

Stocks traded with decent volume*: (LLOY) LLOYDS BANKING GROUP PLC; (BARC) BARCLAYS PLC; (BP.) BP PLC.

Sectors traded in the positive zone*: Technology (+2.06%), Consumer Cyclicals (+0.91%) and Basic Materials (+0.81%).

Sectors traded in the negative zone*: Telecommunications Services (-0.94%), Utilities (-0.90%) and Healthcare (-0.80%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: WTI crude oil (future) price and Brent future crude oil (future) price were hovering at $43.54 per barrel and $46.31 per barrel, respectively.

Gold Price*: Gold price was trading at USD 1,955.50 per ounce, up by 1.68% from previous day closing.

Currency Rates*: GBP to USD and EUR to GBP were hovering at 1.3208 and 0.8953, respectively.

Bond Yields*: U.S 10-Year Treasury yield and UK 10-Year Government Bond yield were trading at 0.697 per cent and 0.301 per cent, respectively.

*At the time of writing