Summary

- The UK government asked businesses to brace up for Brexit under the campaign "New start: let's get going."

- As per the UK's event organizers, venues and suppliers report, close to 30,000 jobs in the UK are at risk due to the increased uncertainty about the resumption of trade fairs and job exhibitions.

- The FTSE-100 advanced by 1.33 percent to 6,176.51 (as on 13 July 2020, before the market close at 12.34 PM GMT+1).

- Polymetal made a final dividend payment of 0.42 US cents per share for FY19.

- Kaz Mineral's Baimskaya project would significantly increase the Company's copper production.

- Kaz Mineral estimated the full-year FY2020 copper production to be in the range of 280-300 kt.

Given the above market conditions, we will review two basic materials stocks - Polymetal International PLC (LON:POLY) and KAZ Minerals PLC (LON:KAZ). The shares of both POLY and KAZ were trading up by 1.81 percent and 4.74 percent, respectively (as on 13 July 2020, before the market close at 12.20 PM GMT+1). Let's review their financial and operational updates to understand the stocks better.

Polymetal International PLC - Gold prices supported the increase in revenue for the current period

Polymetal International is engaged in the exploration, extraction, processing and reclamation of gold, silver, copper, zinc concentrates and platinum metals in Russia and Kazakhstan. The Company has nine operations in two countries, and it is the second-largest gold producer in Russia.

Q1 FY2020 Trading update (ended 31 March 2020) as reported on 20 April 2020

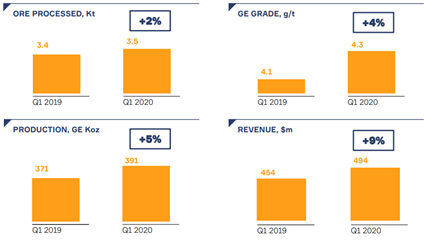

The Company generated revenue of USD 494 million, which was up by 9 percent year on year, underpinned by high gold prices despite a drop in sales volume. Sales volume declined by 7 percent due to the slowdown in concrete shipment to China amid Covid-19 in February. The gold equivalent (GE) production increased by 5 percent year on year to 391 thousand ounces (koz). The Company processed 3.5 metric tonnes of ore that increased by 2 percent year on year. The refineries in Q1 FY20 remained operational; the concentrate supply to China was affected in February that late resumed back to normal. The Central bank of Russia suspended the purchase of gold, but the commercial banks continued to buy in the first quarter. The movements were restricted due to the coronavirus both in Russia and Kazakhstan; however, strategic industrial companies continued to operate. The Company made a final dividend payment of 0.42 US cents per share for FY19 that translated to a total dividend payout of 0.82 US cents per share.

Q1 FY20 Results

(Source: Company Website)

Asset Acquisition and Disposal

- In May 2020, the Company sold the North Kaluga asset for USD 27 million.

- In April 2020, VTB Bank invested USD 71 million in Veduga for 40.6 percent stake whereas Polymetal retained the remaining stake

- In March 2020, Sopka was sold for USD 10 million and 1 percent Net Smelter Return (NSR). Polymetal acquired a 9.1 percent stake in Tomtor for USD 20 million.

- The sale of Kutyn is in progress, and the final decision is expected to be made in Q3 FY20.

Share Price Performance Analysis

1-Year Chart as on July-13-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Polymetal International PLC's shares were up by 1.56 percent against the previous day closing and trading at GBX 1,624.00 (as on 13 July 2020, before the market close at 12.10 PM GMT+1). Stock 52-week High and Low were GBX 1,758.00 and GBX 965.05, respectively. The Company had a market capitalization of £7.53 billion.

Business Outlook

In FY20, the all-in sustaining costs and total cash costs of the Company are expected to be in the range of USD 850-900 per ounces of GE and USD 650-700 per ounces of GE, respectively. The Company estimates 17 percent production upside between 2020-2025E. The production is expected to be supported by Nezhda, POX-2 and Veduga. In a recent development, the Company stated that the Far East and Arctic Development Fund and Central Bank of Moscow would fund the grid power line construction of Nezhda project. The grid construction is expected to be completed by Q2 FY22, and the power grid facility would be leased out to Polymetal. Nezhda asset is expected to start production from the end of 2021.

KAZ Minerals PLC (LON:KAZ) – Strong quarter production for copper and gold

Kaz Minerals is a copper company engaged in open-pit mining in Kazakhstan, Kyrgyzstan and Russia. The Company manages Bozshakol and Aktogay open-pit copper mines. It employs around 16,000 people. In January 2019, the Company acquired assets (Baimskaya project) in the Chukotka region of Russia.

Q1 FY2020 (ended 31 March 2020) as reported on 30 April 2020

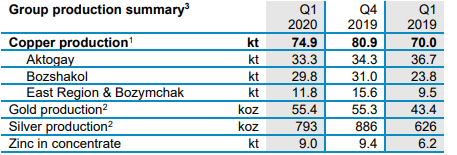

The copper production increased by 7 percent year on year to 74.9 thousand tonnes (kt); production was 70.0 kt in Q1 FY19. The gold production was 55.4 thousand ounces (koz) supported by increased ore throughput at Bozshakol asset. As on 31 March 2020, the Company had a net debt of USD 2.7 billion. The Kaz recommended a final dividend of 8.0 USD cents per share for FY19 that translates to a full-year dividend of 12.0 USD cents per share.

Asset wise production

The copper production at Aktogay was 33.3 kt due to lower sulphide ore throughput; the production was 34.3 kt in the previous quarter. The copper production at Bozshakol was 29.8 kt despite the higher ore throughput of 8,040 kt due to lower average copper grades; the copper production was 31.0 kt at an ore throughput of 7,844 kt in Q4 FY19. The gold production increased from 41.8 koz in Q4 FY19 to 42.3 koz due to higher production volumes. At East Region and Bozymchak, the copper production was 11.8 kt whereas gold and silver production were 12.5 koz and 443 koz, respectively.

Group Production Summary

(Source: Company Website)

Share Price Performance Analysis

1-Year Chart as on July-13-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Kaz Minerals PLC's shares were up by 4.62 percent against the previous day closing and trading at GBX 546.10 (as on 13 July 2020, before the market close at 12.10 PM GMT+1). Stock 52-week High and Low were GBX 598.20 and GBX 256.20, respectively. The Company had a market capitalization of £2.46 billion.

Business Outlook

The FY20 guidance for total copper production is in the range of 280-300 kt, of which Aktogay and Bozshakol are expected to contribute 120-130 kt and 110-120 kt, respectively. The gold production at Bozshakol is expected to be 140-150 koz for the full year. In FY20 the sustaining capital expenditure is expected to be close to USD 170 million, whereas expansionary spending is likely to be in the range of USD 545-595 million. The sulphide ore capacity at Aktogay is expected to be double from 25 to 50 Mtpa by 2021. The Company expects Baimskaya to start production from 2026 and it would contribute actively in long term growth of copper production. The nominal development budget for Baimskaya is close to USD 5.5 billion between 2018-26. The project is expected to have an average annual production capacity of 250 kt copper and 400 koz gold; the project life is estimated to be 25 years.