Summary

- Around 10,000 new Tesco joinees would be working to select and pack grocery orders for home delivery.

- During the coronavirus pandemic, home deliveries accounted for approximately 13.5 per cent of the total grocery market, which is almost double from 7.4 per cent in pre-lockdown period.

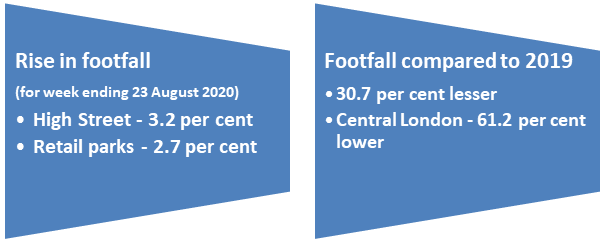

- Latest numbers from Springboard indicate a rise in shopper footfall by close to 4 per cent across all retail destinations in the country.

The fear of contagion and social distancing norms has led shoppers to go online during the coronavirus pandemic. This phenomenon is expected to remain for long-term in the buyer’s psyche not only till the pandemic decimates but maybe also beyond. And, the retailers are gearing up to provide a good shopping experience to their customers. In order to meet the changing demands of the customers, Tesco Plc (LON: TSCO) is planning to build a strong team to lure new customers as well as better service the existing ones. The retailer announced to permanently retain its workforce of 16,000 people whom the company took in during the pandemic to support its online grocery trade that has recorded a substantial increase.

On the other hand, the retail industry as a whole has witnessed some encouraging trends with rise in footfall numbers after the government eased the lockdown restrictions. According to the latest numbers from Springboard, during the week ending 23 August 2020, shopper numbers across all the UK retail destinations soared by 4.1 per cent as compared to the week before. We would discuss the retail industry scenario, amidst the surge in online shopping, Tesco’s plans to increase its head count to meet the changing customer behavior, and the research data by Springboard.

Rising online sales: A look at Tesco and overall industry

During the pandemic, Tesco’s online groceries sales rose 16 per cent, an upward scale of around 9 per cent at the beginning of 2020 or before the pandemic hit the country. Talking about doubling its online capacity, the supermarket said, that it has prioritised servicing the vulnerable customers by ensuring that they get the food they need. In 2020, Tesco is expecting online sales of £5.5 billion, a considerable climb from £3.3 billion recorded in 2019. It is to be noted that the spurt in online shopping at Tesco mirrors the swift growth in online sales across Britain.

In the UK, home deliveries during the coronavirus pandemic accounted for approximately 13.5 per cent of the total grocery market, which is almost double from 7.4 per cent before the lockdown imposed in end-March 2020. Given the stay-at-home orders during the lockdown, adoption of work from home, closure of schools and colleges, the overall grocery sales rose significantly as Britishers cooked more at home instead of buying food from restaurants, coffee shops, and canteens.

On 25 August 2020, at 13.31 PM, the company’s stock (LON: TSCO) was trading at £226.00 down 0.49 per cent from its previous day’s close of £227.00. The 52-week low high range was recorded as 211.20 and 258.90. With a market capitalisation (Mcap) of £22,231.24 million, the stock provided a negative return on price, which was minus 11.26 per cent on a year to date (YTD) basis. The total volume of shares traded at the time of reporting was recorded at 5,537,909.

Details of the plans announced by Tesco to support its online business

Tesco highlighted that the new roles will support the retailer to continue meeting the rise in online demand for the long-term. On 24 August 2020, the supermarket chain said that from the 16,000 new staff, there would be around 10,000 new roles for workers, who would be engaged in selecting and packing grocery orders for home delivery, besides 3,000 drivers.

In addition, the retailer would employ people in stores and distribution centres for various purposes. Tesco informed that since the outbreak of the pandemic, it had already hired 4,000 other permanent staff from around 40,000 temporary workers. It is to be known that Tesco employed these temporary staff to meet the increase in demand, besides covering up for those who were forced to self-isolate during the pandemic. Many of these temporary workers, including pilots, staff from the pubs, and others who were put on the furlough scheme from their usual jobs, have now returned to their works or found new jobs elsewhere. The supermarket firm has purchased 400 extra vans and changed shopping hours to facilitate picking up of more orders and expand its services.

Also read: Tesco Plc Removes Contract Cleaners, Shops to be Cleaned by Staff

Also read: UK Supermarkets Bracing Up for A Face-Off with Online Market Place-Tesco And Ocado In Focus

In addition to the permanent roles, Tesco would support the government’s Kickstart work placement scheme by offering placements to 1,000 youth.

Plans of other supermarkets and online retailers

The announcements made by Tesco is followed by some of the recent plans from AO World, the electrical goods specialist operating the online platform AO.com, the DIY chain Kingfisher, and delivery firms like DPD and Hermes to hire more workers to successfully meet the rise in online orders and requests for home deliveries.

Also read: Online Buying: Jump In AO World’s Revenue; AO World, Kingfisher, Hermes, And DPD To Increase Hiring

Also read: Britons Shopping Online: Waitrose, M&S, Next, And Asda To Strengthen Online Division

Also read: Is Retail Landscape changing for good?

The surge in online sales has compelled other supermarket chains like Sainsbury’s, Asda, Morrisons, and Waitrose, among others to strengthen their delivery networks. In order to increase their market shares, Waitrose and Marks & Spencer (M&S) have already announced their partnerships with Ocado, a British online supermarket company for grocery. Amazon, the e-commerce retail giant, has also increased its schemes and offers by providing free delivery of grocery items to its customers who have subscribed to the online shopping platform’s Prime membership.

Retail industry scenario and how experts view the rising trend in online shopping

Several industry insiders believe that partnerships such as those announced by Waitrose and M&S would provide the shoppers with an option to choose from the best and quickest services available in the market. Retail industry experts also observe that the growth in online sales is not likely to increase the supermarket chain’s profitability, at least in the short-term. The companies would have to invest in over head charges of new employees, purchase of new delivery vans, and other equipment for delivery systems to grow the online business and attract buyer’s demand.

Some industry analysts suggest that the shift towards larger online orders call for bringing increased efficiency measures from the retailers and supermarket companies. The recent rise in overall sales value of Britain’s grocery market in revenue terms has considerably helped the retailers who were not doing so well in the pre-pandemic times. Though a marginal profitability due to increased online sales, it is an indication that the UK supermarket chains could emerge shining if they are able to en-cash on the customer’s new shopping behaviour by investing in the needs to meet their demands.

Also read: Retail industry faces ‘COVID-19 hangover’ as consumers spend with caution

Also read: Is The UK Retail Spending Approaching Pre-Pandemic Levels?

Also read: Covid-19 Impact: Job Redundancies Continue to Rise in High Street Retail

The shift in online shopping has added to the troubles of the high street retailers, many of those who were already financially strained even before the outbreak of the corona virus pandemic and were forced to take some tough decisions when hit by the lockdown restrictions. Some of the prominent names like M&S, John Lewis, Liberty, and Boots have announced store closures, redundancies, and job cuts. The retail sector, supposedly one of the worst hit due to the coronavirus-led crisis has estimated around 32, 725 job cuts, since the lockdown began. These are the numbers that were made public by major businesses in the sector.

Increase in footfall across all retail destinations in the UK

According to the latest report by Springboard, a data firm, there was a 4.1 per cent increase in footfall across all UK retail destinations in the week ending 23 August 2020 as compared to the week before. On 24 August 2020, Springboard said that around 7 per cent jump in London and the south east resulted in the increased footfall.

Some facts from Springboard data

Despite this rise, footfall was still 30.7 per cent lesser than the consecutive period in 2019. Even after the easing of lockdown restrictions and government’s orders to reopen the shops, big city centres are still suffering from the coronavirus-led crisis as both shoppers and workers are failing to return. As compared to 2019, Central London reported 61.2 per cent lower shopper numbers, while regional cities recorded a decline of 49.8 per cent. Mentioning that the rebound in footfall provides hope to the retailers, Springboard, observed that increased quarantine measures on a number of overseas holiday destinations could have helped to increase the footfall.

Conclusion

The fear of contagion and social distancing norms during the coronavirus pandemic has accelerated the online shopping behavior; many experts agree that the trend is likely to sustain itself in coming times as well. As Britishers are increasingly going digital for their shopping needs, retailers have realised the need to put both manpower and systems in place to cater to the growing needs of the customers. Online shopping is considered easier for the shoppers to continue shopping or switch to other players with just a click of the button to suit their needs. Online business comes with its own challenges and demands and it remains to be seen how the retail industry would gear up to overcome them and provide a better shopping experience to the customers as well as stay ahead of the competition.