Boohoo Group Plc

Boohoo Group Plc (LON:BOO) is an online fashion retailer that started in 2006. They have a portfolio of many fashion brands within the UK from where orders are sent all over the world. They have over 100 new products dropping daily on their website. The companyâs operations are differentiated in three operating segments, namely boohoo, PrettyLittleThing (PLT) and Nasty Gal.

BOO â News Updates

On 14th January 2020, the company announced that it had appointed Brian Small, who is an existing independent Non-Executive Director, as Deputy Chairman of the Board. He would join the board with immediate effect. Brian is currently the chairperson of the group's Audit Committee. The company appointed him in April 2019. Brian would lead the Non-Executive Directors as his position of Deputy chairman on matters where independence is required. Brian would continue as Chair of the Audit Committee and perform his duties until the financial accounts for FY 2019/20 are finalised and published and a new Audit Committee Chair can be appointed.

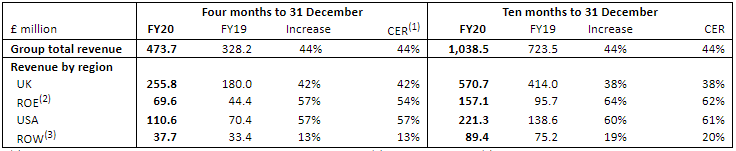

BOO â Trading Update (Four months ended 31 December 2019, GBP, Million)

(Source: Companyâs filings, London Stock Exchange)

In the four months ended 31 December 2019, the companyâs revenue increased by 44 per cent to GBP 473.7 million as compared to GBP 328.2 million in the same period of previous year. In the UK, the revenue grew by 42 per cent while in the USA, it grew by 57 per cent. In rest of Europe, the revenue increased by 54 per cent and in the rest of world, it increased by 13 per cent.  Gross margin during the period declined by 70bps to 53.5 per cent. The company has witnessed strong balance sheet with net cash of GBP 245 million (31 August 2019: £207 million). The company expected revenue growth for the financial year to 29 February 2020 to be 40 per cent to 42 per cent and adjusted EBITDA margin to be 10.0 per cent to 10.2 per cent. In the ten months to 31 December 2019, the companyâs total revenue surged by 44 per cent to GBP 1,038.5 million as compared to GBP 723.5 million in the same period of last year.

BOO â Stock price performance

Daily Chart as on 14th January 2020, before the market closed (Source: Thomson Reuters)

On January 14th, 2020, Boohoo Group Plc shares were trading at GBX 328.58 at the time of writing before the market close (at 1:20 PM GMT), up by 3.30 per cent against the last day closing price. Stock's 52 weeks High and Low are GBX 336/GBX 168.90. The stock price has delivered 68.84 per cent return in the last one year, and 19.48 per cent return in the last three months.

The company made its 52-week high of GBX 336 on 14th January 2020 and made its 52-week low of GBX 168.90 on 27th February 2019.

The average volume of the Boohoo Group Plc shares is 4.16 million, and it has a market cap of GBP 3.69 billion.

Total outstanding shares of the Boohoo Group Plc are 1.16 billion.

The beta of the Boohoo Group Plcâs stock was reported to be at 1.6019. It implies that the stock price movement of the company is more volatile, in comparison to the benchmark market indexâs movement.

Games Workshop Group Plc

Games Workshop Group Plc (LON:GAW) is a miniature wargaming product manufacturing company. The company is engaged in designing, manufacturing and distribution fantasy miniatures, metal soldiers and rulebooks. The company offers its products through its chain of hobby centres, independent toy and hobby shops; independent retailers; and through Internet and mail orders.

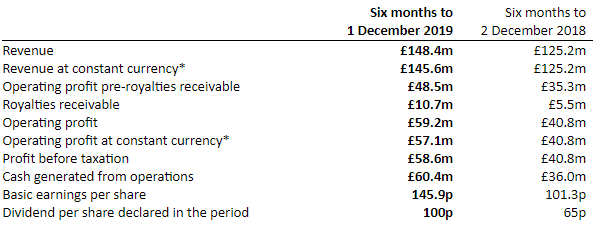

GAW â Financial Highlights â H1 Financial year 2020

(Source: Companyâs filings, London Stock Exchange)

In the first half of the financial year 2020, the companyâs revenue increased by 19 per cent to GBP 148.4 million as compared to GBP 125.2 million in H1 FY2019 while on a constant currency basis revenue was up by 16 per cent. During the period, the company received royalties of GBP 10.7 million as compared to GBP 5.5 million in the first half of the fiscal year 2019. Operating profit of the company grew to GBP 59.2 million against GBP 40.8 million while at constant currency basis, operating profit was GBP 57.1 million. Profit before taxation was GBP 58.6 million versus GBP 40.8 million. The company generated GBP 60.4 million cash in the H1 FY2020 as compared to GBP 36 million in H1 FY2019. Basic earnings per share was 145.9p in H1 FY2020 versus 101.3p in H1 FY2019. The company declared dividend of 100p in the H1 FY 2020 as compared to 65p in H1 FY 2019.

GAW â Stock price performance

Daily Chart as on 14th January 2020, before the market closed (Source: Thomson Reuters)

On January 14th, 2020, Games Workshop Group Plc shares were trading at GBX 6,710 at the time of writing before the market close (at 1:20 PM GMT), up by 5.25 per cent against the last day closing price. Stock's 52 weeks High and Low are GBX 6,960/GBX 2,785. The stock price has delivered 113 per cent return in the last one year, and 45.47 per cent return in the last three months.

The company made its 52-week high of GBX 6,960 on 14th January 2020 and made its 52-week low of GBX 2,785 on 25th March 2019.

The average volume of the Games Workshop Group Plc shares is 117.38 thousand, and it has a market cap of GBP 2.08 billion.

Total outstanding shares of the Games Workshop Group Plc are 32.67 million.

The beta of the Games Workshop Group Plcâs stock was reported to be at 1.3269. It implies that the stock price movement of the company is more volatile, in comparison to the benchmark market indexâs movement.