ighlights

- DeFi tokens represent protocols that use blockchain to make financial transactions cheaper

- Uniswap (UNI), launched in 2018, has the largest market cap among all DeFi tokens

- Wrapped Bitcoin is an ERC-20 token and can be transacted faster than Bitcoin (BTC)

Decentralized Finance or DeFi is gaining traction among blockchain enthusiasts. Instead of making a rash decision of investing in any cryptocurrency, investors are now looking for potential.

Image source: Pixabay

DeFi has potential to weed out intermediaries. These middlemen including banks and brokers can delay a transaction and make it expensive.

DeFi relies on open-network and smart contracts to cut costs and add speed. People within the DeFi network can connect peer to peer. Although DeFi platforms lack regulatory oversight, they have attracted a substantial share of backers.

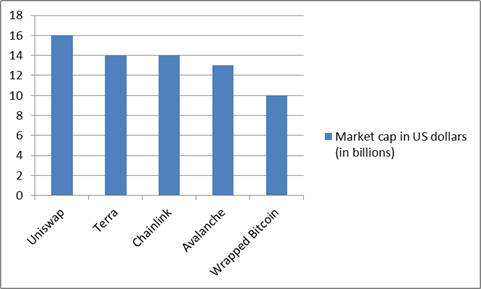

What are the top DeFi cryptocurrencies by market cap

Together, DeFi cryptos command a market cap of over US$130 billion. Let’s find out about the most dominant DeFi tokens by market cap.

Uniswap (UNI)

Uniswap is one of the most popular platforms providing DeFi services. It can be used to trade other DeFi tokens.

The protocol entered the crypto market in 2018. It competes with conventional crypto exchanges with its features like automated trading.

Uniswap claims to provide additional services like infusing liquidity in the token trading space. The governance token of Uniswap’s protocol is UNI. It was first given as rewards to existing users of Uniswap.

Also read: Which is the best DeFi crypto to consider in 2021?

At the time of writing, UNI token commanded a market cap of nearly US$16 billion. The price of one UNI is nearly US$26. It has gained nearly 14 per cent over the past seven days.

Terra (LUNA)

Founded by Daniel Shin and Do Kwon, Terra is another blockchain-powered DeFi protocol. Terra’s idea combines using stablecoins to provide reliable payments systems with the benefits of smart contracts.

Stablecoins are pegged to fiat currencies like the US dollar. Terra’s token is LUNA. It is used to provide stability to the price of stablecoins offered on Terra.

At the time of writing, LUNA commanded a market cap of nearly US$14 billion. The price of one LUNA is nearly US$36. It has gained nearly 20 per cent over the past seven days.

Chainlink (LINK)

Chainlink is a blockchain-based network launched in 2017. It focuses on decentralizing the participation of various stakeholders.

The network is run by a team of node operators. It is a proof-of-stake network and an ERC-20 token. The latter means it uses Ethereum’s network. The native token is LINK.

At the time of writing, LINK commanded a market cap of nearly US$14 billion. The price of one LINK is nearly US$31. It has gained nearly 14 per cent over the past seven days.

Avalanche (AVAX)

Avalanche is a relatively newer entrant in DeFi. Launched in 2020, it is said to be the fastest blockchain-powered smart contract service provider.

Avalanche’s token is AVAX. It is used for multiple tasks on the network including payment of fees. The token is one of the most-watched DeFi cryptos of 2021.

Also read: How Can I Buy Cryptocurrency In Canada?

At the time of writing, AVAX commanded a market cap of nearly US$13 billion. The price of one AVAX is nearly US$60. It has gained nearly 35 per cent over the past seven days.

Wrapped Bitcoin (WBTC)

This is a version of Bitcoin in its token form. Wrapped Bitcoin is also a late entrant in the DeFi space. What separates WBTC from BTC is that the former uses Ethereum’s blockchain. It is claimed that Ethereum is a more advanced form of a decentralized ledger as compared with Bitcoin.

WBTC has a 1:1 ratio with Bitcoin reserves. It can be traded faster than BTC. The circulating supply of the WBTC token is only 205,871 at the time of writing.

Also read: Is Canada working on its own CBDC?

At the time of writing, WBTC commanded a market cap of nearly US$10 billion. The price of one WBTC is nearly US$48,000. It has gained nearly 4 per cent over the past seven days.

DeFi is a sub-group within the wide cryptocurrency market. DeFi tokens listed above have gained over past seven days.

Bottom line

New investors in the crypto space are looking for intrinsic value. DeFi comes with the promise of making the financial landscape faster and cheaper for end users.

By ending the role of intermediaries like banks, DeFi puts more power in the hands of users of the network. The crypto asset space is evolving and DeFi tokens are the latest trendsetters.

.jpg)