Cryptocurrencies have received unprecedented mainstream acceptance this year. Institutional investors and crypto mining firms have been beefing up their crypto inventories across North America. Canadian exchanges-listed companies, especially, have been making their fortune by participating mining and trading in digital tokens.

Let’s explore some Canadian companies that hold and deal in cryptocurrencies.

Bitfarms Ltd (TSXV:BITF)

The Toronto-based crypto mining company deals in Bitcoin (BTC) and other altcoins.

Bitfarms mined and deposited 1,006 Bitcoin tokens in custody, which were valued at nearly US$ 39 million as on May 27, 2021.

The firm is mining and collecting around 7.8 bitcoins per day for a cost of US$ 9,500 apiece (as on May 27, 2021), with about one per cent of the largest cryptocurrency’s network. It uses eco-friendly hydropower to operate its graphic processing units (GPUs).

In the first quarter of 2021, it mined 598 BTC with an operational expense of nearly US$ 8,400 per piece and garnered 548 bitcoins worth US$ 32.4 million. It earned a total profit of 19.2 million in Q1 2021.

Its stock has increased by 37 per cent year-to-date (YTD), outperforming Bitcoin that has grown 25 per cent this year.

Hut 8 Mining Corp (TSX:HUT)

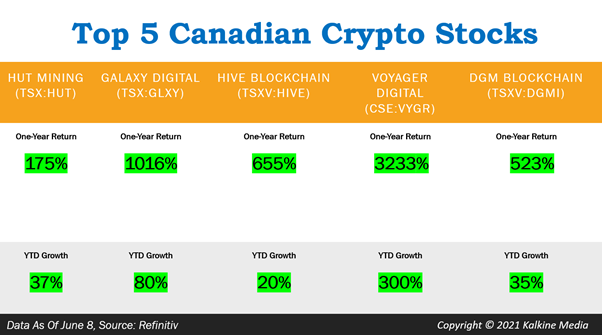

The crypto mining company has been recording quite a high amid the evolving cryptocurrency market. Hut 8 made a triple-digit surge in its equity growth apiece in the past year, led by the crypto frenzy.

It follows ‘HODL’ strategy, which stands for "hold on for dear life". The company ensures to generate more fiat money to fund expenses, to avert selling its crypto holdings.

The firm had a total digital asset inventory of 3,271 BTC in its balance sheet, worth US$ 242.4 million as on March 31, 2021. It earns interest on its 1,000 BTC as part of its conventional yield plan.

DMG Blockchain Solutions Inc (TSXV:DMGI)

The blockchain firm provides peer-to-peer transactions and generates its profit from the crypto mining operations.

In the first quarter of 2021, DMG Blockchain spent US$ 15 million to add more Bitcoin tokens to its kitty. The company reported that it earned nearly US$ 2.9 million over the past six months in Bitcoin price appreciation (reported on May 27).

The crypto technology company also entered a collaboration with Argo Blockchain Plc (US: ARBKF, OTC:ARBKF), a UK-based digital currency mining firm. The partnership was to promote the Crypto Climate Accord (CCA) to outline objectives like the transparency of renewable energy usage in their mining operations.

DMG Blockchain has a 27,000 square foot mining data center and 85MW power source in British Columbia.

Hive Blockchain Technologies Ltd (TSXV:HIVE)

Stocks of this technology firm have soared by multiple folds in the last one year. Once a penny stock, now it has a market cap of over C$ 1 billion.

Hive Blockchain retains all mined Bitcoin and Ethereum tokens and stores them in offline or cold wallets. As on March 31, 2021, it held more than 320 BTC and 20,030 Ethereum tokens.

The Vancouver-based crypto miner has signed a contract with a Swedish energy producer Bodens Energi Nät AB for 10 MW of clean energy power for its GPU data facility in Sweden.

Galaxy Digital Holdings Ltd (TSX:GLXY)

The crypto brokerage firm has witnessed a four-digit rise in its equity in the last one year, guided by the crypto-boom amid the pandemic crisis.

Galaxy Digital posted a total digital asset of over US$ 2 billion in the first quarter of 2021, compared to that of US$ 850 million a year ago.

It expects a crypto mining speed of 1,995 Petahash per second (PH/s) at its data centers by the end of 2022.

In the first quarter, it launched Bloomberg Galaxy Crypto Index (BGCI), which had yielded more than 118 per cent on a YTD basis by March-end this year.

Morgan Stanley has also begun offering access to its digital asset clients to bitcoin funds, which also include the Galaxy Institutional Bitcoin Fund and the Galaxy Bitcoin Fund.

Three CSE-listed Macro-cap Crypto Companies

Cypherpunk Holdings Inc (CSE:HODL)

Cypherpunk engages in cryptocurrencies investment using its advanced technologies. It also has a crypto coin index, ‘Cypherpunk Index’, which focuses on privacy-focused coins and ranks them by market cap.

In mid-April, the company reportedly purchased 68.16 BTC for a total amount of nearly C$ 5 million, including transaction charges and other expenses. At that time, the average price per token was around US$ 58,092. After this purchase, the firm’s Bitcoin inventory swelled to 350 BTC.

However, the company bought Bitcoin at an inflated price, which backfired later. Thus, its stock plunged as much as 16 per cent in 2021 (as on June 8).

The crypto stock is still holds a one-year growth of 310 per cent.

Copyright © 2021 Kalkine Media

BIGG Digital Assets Inc (CSE:BIGG)

BIGG Digital owns and invests in crypto operations that are compliant and regulated. The company operates in cryptocurrencies through its subsidiary the Netcoins. Its stock has rocketed 1480 per cent in the last one year and swelled 210 per cent YTD.

Netcoins is a crypto brokerage app that offers a platform where Canadians can understand, buy and sell cryptocurrencies. The app reported record monthly revenues of nearly US$ 1.95 million in May.

In the first quarter of 2021, the crypto registered revenues of US$ 3.4 million, an increase of 337 per cent on a quarter-over-quarter (QoQ) basis. Its platform’s quarterly trading volume holds an all-time high of US$ 264 million. Its net income comes from the trading fee that is above one per cent.

Voyager Digital Ltd (CSE:VYGR)

Voyager Digital manages a crypto asset brokerage that offers institutional and retail investors a crypto asset trading platform. It is offering Bitcoin and more than 50 altcoins on its platform.

It is one of the leading equity performers in this segment, with a one-year return of 3,233 per cent.

In the third fiscal quarter of 2021, its total revenue was US$ 60.4 million, a massive 16x QoQ rise against US$ 3.6 million. This surge came from its crypto holdings and digital coins trading platform.

The crypto-asset platform expects to add more crypto coins by the end of June 2021, as its trade in altcoins drove a volume surge of 45 per cent in Q3 FY21.

The above constitutes a preliminary view and any interest in stocks should be evaluated further from investment point of view.