Highlights

- Raiden Resources has wrapped up a heritage survey over the Mt Sholl Nickel project, and the survey report is expected in two weeks.

- The company has engaged Topdrill for its maiden drilling program at the project.

- Two diamond drilling rigs are planned to be mobilised, and all regulatory approvals have already been secured.

- The Mt Sholl Ni-Cu-Co-PGE project has indicated the potential to be one of the few open-pit nickel-sulphide mines in WA.

Raiden Resources Limited (ASX:RDN|DAX:YM4) has marked a major development concerning its Mt Sholl Nickel Project located in the Pilbara region. The company has successfully completed a heritage survey over the project and is now advancing to carry out a diamond drilling campaign with a renowned drilling contractor secured.

Triggered by the update, RDN shares jumped over 12.5% to trade at AU$0.009 apiece on the ASX during the early hours of trading on 9 September 2022. The company has a market cap of AU$11.87 million.

Raiden completes heritage survey

The heritage survey on the tenure, which commenced on 29 August 2022, was completed within the stipulated timeline. The main objective of the survey was to identify any sites of cultural value to the aboriginal community on the tenement area and prevent any damage due to exploration and development activities.

The company roped in the services of Ngarluma Aboriginal Corporation for carrying out the survey. The reports will be prepared by the corporation and are expected to be submitted within two weeks.

Raiden finalises Topdrill for Mt Sholl drilling campaign

Post the submission of the heritage survey report, Raiden will commence a diamond drilling campaign over the project.

For the drilling program, the company has engaged Topdrill, which has significant experience in undertaking diamond drilling operations in Western Australia and has a good reputation in the industry.

The payment terms with Topdrill for its services have also been negotiated where Raiden can pay, on its choice, 30% of the invoice amount in its stock. The allotment of the shares would be done using a 5-day VWAP prior to the invoice generation and would be subject to voluntary escrow.

This payment structure will provide flexibility and will allow Raiden to vary the scope of the drilling campaign.

Maiden drilling program over Mt Sholl

The initial plan is to mobilise two drilling rigs for the campaign. The formal contract has already been executed between the two parties, and with this development, RDN has secured all the required logistics and is now in a position to commence the drilling operation.

On Mt Sholl, the plan is to drill up to 5,000m of diamond core, which can vary based on the drilling results and progress of the operation. The aim is to verify selected historical results and test certain geological concepts on the tenure. The core retrieved from the operation will also be used to run metallurgical tests.

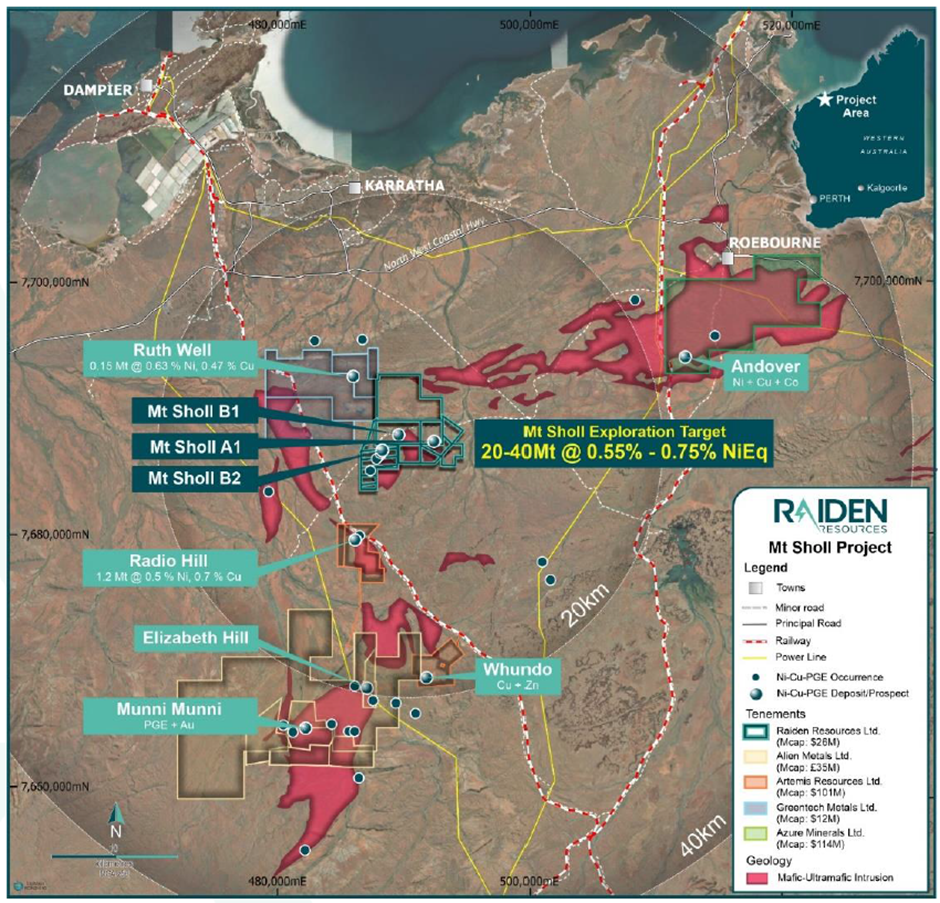

Location of Mt Sholl Project in WA (Image source: RDN update, 9 September 2022)

Raiden is all set to start drilling on the project immediately after the survey report is submitted as all regulatory approvals have already been secured.

The Board of the company believes that Mt Sholl will help in creating significant value for the shareholders as nickel is forecast to become a crucial resource for the battery industry. Mt Sholl has the potential to be one of the few open-pit nickel mines in Western Australia with considerable resources.