Highlights

- Platina Resources’ tenement package spans 1,487km2 and includes three priority projects.

- The company has commenced maiden aircore drilling at the Beete Project to test the bedrock for gold, lithium, and nickel anomalies.

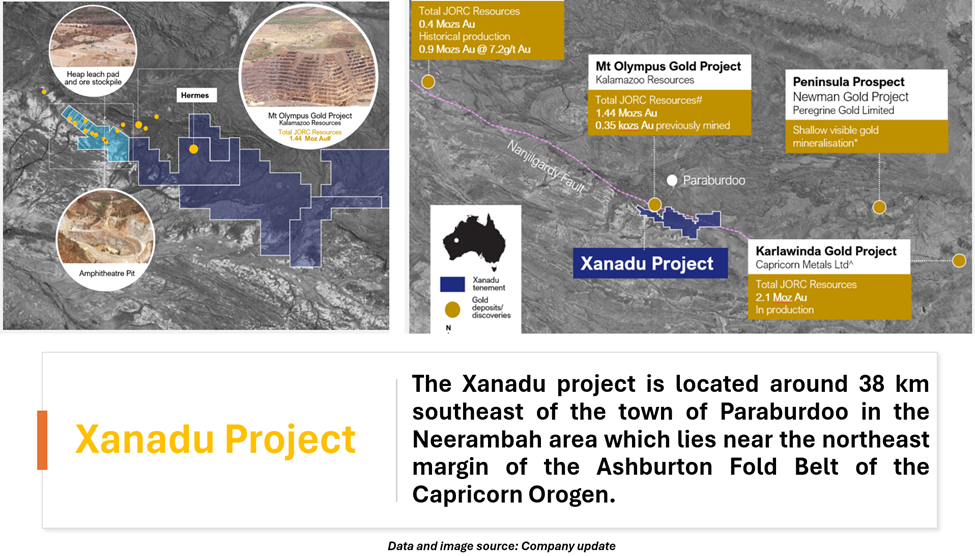

- PGM plans to conduct diamond drilling at Xanadu in Q3 2024.

- The company is well-funded with AU$8.3 million in cash and potential milestone payments of AU$10.7 million.

Platina Resources Limited (ASX: PGM) specialises in gold exploration, with a keen focus on high-potential projects within one of the world’s most prolific mineral provinces. Specifically, the company’s efforts are concentrated in Western Australia's top-tier gold-rich jurisdictions, namely the Yilgarn Craton and the Ashburton Basin.

Gold emerges as a promising opportunity, riding a consistent upward trend in its price trajectory this year. Renowned as a historical safe haven, gold is experiencing heightened demand for various reasons, including concerns over inflation, increased central bank purchases, and currency devaluation. Yet, the commodity encounters supply challenges stemming from declining discovery rates, reduced exploration budgets, and diminishing ore grades. In this context, the landscape presents substantial growth opportunities for both gold exploration projects and companies.

With its sophisticated drilling capabilities and world-class infrastructure, Platina Resources has a large tenement package spanning 1,487km2. It has three priority projects, namely the Beete, Xanadu and Brimstone projects.

Image source: Company update

Maiden aircore drilling at Beete project

The Beete Project, with potential for gold, lithium, and nickel, spans 134km2. It is located 10km south of 1Moz Scotia Mining Centre and north of the Salmon Gums discovery. The area boasts a rich mining heritage, hosting numerous high-grade gold mines along with promising prospects for nickel and lithium.

The Scotia deposit, owned by Pantoro Limited (ASX:PNR), with a resource of 0.9 million ounces (Mozs) and sits 12 kilometres north of Beete. This deposit is integral to the Norseman Gold Project, overseen by Pantoro, boasting a total mineral resource of 4.78 Moz Au, inclusive of the Scotia Centre resource.

In May, the company commenced a maiden aircore drilling program at the Beete Project in Western Australia. The drill program, expected to last around four to five weeks, is aimed at testing the bedrock for gold, lithium and nickel anomalies. Any bedrock anomalies identified through the aircore program will then be followed up with closer spaced aircore drilling and reverse circulation or diamond drilling to test fresh rock at depth.

The drill program includes 200 holes providing full coverage of a 20km strike of north-south trending geology.

“Extremely encouraging” intercepts at Xanadu

The project requires a systematic exploration program to test its full potential. The area has large number of economic-grade and width drill intersections with widespread gold mineralisation in an alteration zone of over 10km long.

Recently, the completion of phase two reverse circulation (RC) drilling at the Xanadu project in the Ashburton Basin revealed a significant extension of oxide gold mineralisation, confirming "extremely encouraging" intercepts. This extension spans an additional 500m westward from the historical Amphitheatre pit, with potential for further expansion down dip and along the westward strike.

The drilling results affirm the potential for a substantial zone of oxide mineralisation at Xanadu West. The company's immediate focus is to investigate deeper airborne electromagnetic (AEM) and induced polarisation (IP) targets with up to four holes, contingent upon the availability of a diamond rig. This effort aims to unlock the deeper sulphide potential within the system.

PGM has planned diamond drilling at Xanadu in Q3 2024, targeting mineralisation associated with geophysical anomalies and mineralised structures.

Further, the company has completed a maiden drill testing at the Hermes project and has plans for further exploration activities.

High-grade thick intersections at Brimstone

The Brimstone Project has potential for high-grade gold and is located near the high-grade, Penny’s Find deposit owned by Horizon Minerals Ltd.

A recent drill program at the Garibaldi prospect indicated high-grade and thick intersections for gold. Historical drilling indicated a substantial number of broad widths and high-grade gold mineralisation. The company is evaluating options on how to best unlock the value of the project.

To summarise, Platina Resources is actively working to unlock its projects’ potential in Western Australia’s gold-rich regions. The company is well-funded with AU$8.3 million in cash and potential milestone payments of AU$10.7 million to move forward with its ongoing exploration activities.

PGM shares traded at AU$0.024 on 13 June 2024.