Highlights

- 88 Energy (ASX:88E) has executed a Rig contract for Hickory-1 exploration well drilling operations

- 88E will be using Nordic-Calista LLC’s (Nordic) Rig-2 for the drilling operations

- As per the company, Hickory-1’s planning and permitting activities are on track, and the company has scheduled spud for late February/early March 2023

- The company has renamed Icewine East as Project Phoenix, shifting its focus from the unconventional HRZ play to proven oil-bearing conventional reservoirs

Alaska and Texas-focused oil exploration player 88 Energy Limited (ASX:88E) has executed a rig contract for drilling operations at the Hickory-1 exploration well. As per the contract, 88E will use Nordic-Calista LLC’s (Nordic) rig-2 for the drilling operations on the Alaskan North Slope.

The rig is single moduled and self-propelled, thus eliminating extended rig up/down. As per the company, it is capable of providing significant efficiencies during the winter exploration season.

It incorporates a 464k lbs triple mast with a 600HP AC top drive.

Hickory-1: appraising 647 million barrels of oil

As per 88E, the Hickory-1 exploration well is designed to appraise six key reservoir targets and 647 million barrels of oil. The targets lie within the SMD, SFS, BFF and KUP reservoirs.

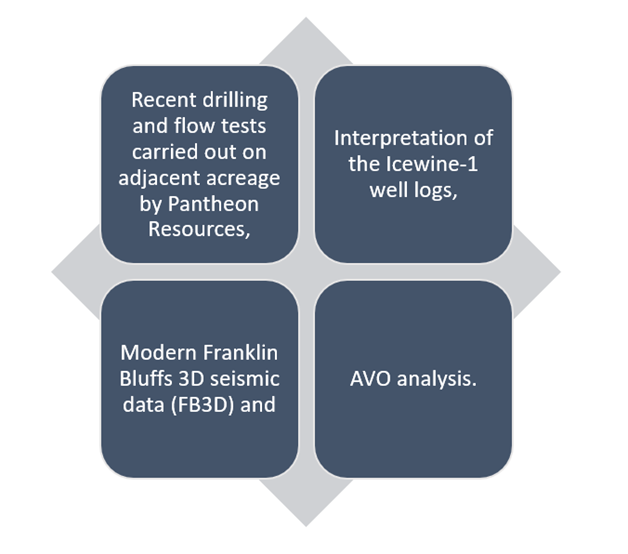

The company believes the following activities have significantly de-risked the well:

Source: © 2022 Kalkine Media®, Company update dated 7 December 2022

88E has scheduled spud for late February/early March 2023 to a permitted total depth of 12,500 feet.The company has stated that permitting and planning handled by the project manager, Fairweather, LLC, are on track for the exploration well.

Using the above data, the company has planned an optimal drilling location adjacent to the Dalton Highway. The company highlights the site intersects and will test the substantial potential oil volumes noted across all mapped play fairways.

Project Phoenix focuses on proven oil-bearing conventional reservoirs

88E has renamed Icewine East as Project Phoenix. As per the company, the new name reflects its focus on proven oil-bearing conventional reservoirs instead of the unconventional HRZ play.

The company identified these oil-bearing reservoirs during the drilling and logging of Icewine-1 and 2, and more recently, those were flow tested by Pantheon Resources.

Phoenix strategically placed with a possibility of term extension

The Dalton Highway-located project boasts the Trans-Alaska Pipeline System (TAPS) running through the acreage.

The company has received a notice from the Alaska Department of Natural Resources (DNR) for the Project Phoenix unit application.

As per the notice, the application is open for public comment until 31 December 2022, with the deadline of 1 March 2023 for the issuing of the decision by the DNR.

The company has emphasised that the unit approval will extend project leases beyond their primary term and provide an agreed program to assess:

- Acreage commercialisation

- Development and production pathway

Share price: 88E shares traded at AU$.0105 each on 9 December 2022.