Summary

- Retail businesses with online presence navigated well through the COVID-19 pandemic with increased sales and impressive financial performance.

- Wesfarmers delivered total online sales growth of 89% in the calendar YTD period and total online sales grew 60% on a financial YTD basis.

- Coles Group reported a 12.9% increase in Q3 revenue, hiring additional 12,000 team members, and diligently contributing to expedite Australia’s economic recovery.

- Woolworths’ planned distribution centres at Moorebank Logistics Park to enhance the group’s capacity to grow and advance localised ranging efforts.

- City Chic’s recent stores’ closure to minimally impact its earnings, partly reflecting the transition to online shopping.

- com’s underwritten $ 100 million institutional placement receives strong support from existing shareholders and new investors; funds to be utilised to enhance financial flexibility to proactively act on future value accretive opportunities.

As the coronavirus (COVID-19) pandemic situation remains unresolved, technology has turned out to be a saviour for businesses to reach home-stricken consumers online. Amid social restrictions and other measures to contain the virus spread, retail businesses with online presence largely benefitted, demonstrating the significance of going digital in these times.

Good Read: Shopping Habits Under Lockdown Likely to Persist Post COVID-19 Pandemic

Having an established online presence not only helps in reaching a larger consumer base but also in providing a myriad of product options in a single place.

The following ASX-listed retail sector players with digital businesses have sustained well through the challenging times and are continuing to thrive in the market mayhem caused by COVID-19.

Wesfarmers Limited (ASX: WES)

Perth-based retail giant Wesfarmers Limited, established in 1914, has diverse business operations including coal mining and production, industrial and safety product distribution, gas processing and distribution, and chemicals and fertilisers manufacturing in Australia, New Zealand, United Kingdom, and other regions, globally.

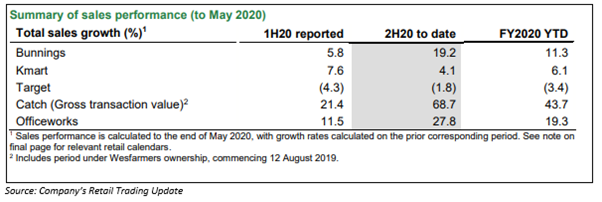

Trading Update: On 9 June 2020, Wesfarmers provided a trading update, informing that each of the businesses remains vigilant in prioritising the safety of team members and customers. WES Managing Director Rob Scott stated that the group acknowledges the incredible efforts made by team members to support one another and the community during the devastating bushfires and the ongoing pandemic.

The group’s retail networks have been restored to full operation in New Zealand and north-western Tasmania.

In the calendar year-to-date (YTD) period, retail businesses registered total online sales growth of 89%, while on a financial YTD basis, total online sales across the group grew 60% to $ 1.4 billion. The online sales growth highlights significant investments in e-commerce capabilities and larger customer base engaged in shopping online during the pandemic.

Must Read: With numerous people at home amid COVID-19, Wesfarmers gain traction

Coles Group Limited (ASX: COL)

Leading retailer, Coles Group Limited has been operating for more than 100 years in Australia. The group has a network of over 2,500 retail outlets and leading brands in supermarkets, liquor, fuel, convenience, financial services, and a 50% interest in Loyalty Pacific Pty Ltd, which owns and operates Australia’s leading loyalty program, flybuys.

Must Read: 3D’s of Stocks’ Investing Strategies – Diversification, Dividend-Payments & Defensive

Q3 FY20 Results: On 29 April 2020, the group announced its update on the third quarter 2020 sales results with key highlights being:

- Increase of 12.9% in revenue to $ 9.2 billion.

- Strong performance by supermarkets in January and February 2020 prior to the impact of COVID-19, and comparable sales growth of 13.1% achieved in Q3, marking 50th consecutive quarter of comparable sales growth.

- Under the supermarkets segment, Coles online sales revenue grew by 14% in the third quarter. The group made investments in online capacity to support the growing demand for online delivery.

- In January and February 2020, liquor segment was negatively impacted by bushfire smog over capital cities and floods. Regardless, liquor achieved comparable sales growth of 7.2% for Q3. Refreshed websites across all three Liquor banners, delivering online sales growth of 34% during the period.

- During Q3, Express fuel volumes peaked at ~70mL per week, prior to getting materially impacted by fewer vehicles on the roads due to COVID-19 led restrictions late-Q3, closing the third quarter period at ~50mL per week.

Coles is already taking steps to help restore the country’s economic recovery, hiring additional 12k team members, as well as continuing its multi-billion-dollar capital and operating expenditure plans to underpin future growth.

Woolworths Group Limited (ASX: WOW)

Woolworths Group Limited is an Australia-based retail giant, operating general merchandise consumer stores and supermarkets. The group is engaged in procurement of food, liquor, and other products in Australia and New Zealand.

NSW Grocery Supply Chain Transformation and Trading Update: On 23 June 2020, Woolworths Group announced plans to develop two new facilities in Sydney, Australia, subject to receiving NSW Government planning approval. Construction of an automated regional distribution centre and a semi-automated national distribution centre is expected to be completed by end-2023. The group expects realising initial benefits in FY25.

However, the distribution centres at Moorebank Logistics Park are expected to materially enhance the group’s capacity to grow, advance localised ranging efforts, improve efficiency, and provide improved and safer experiences.

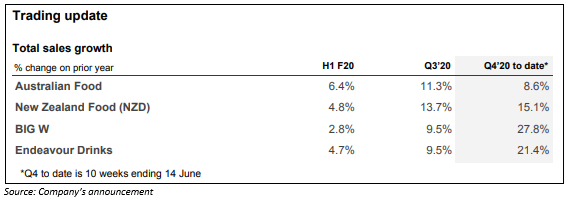

The group also informed that trading has remained strong in the fourth quarter of FY20 to date, with the exception of Hotels where venues were closed until end-May 2020 and have just started entering different reopening phases.

The group currently expects to report EBIT of $3,200 - $3,250 million for FY20, with full-year results due for release in late-August 2020.

Do Read: Lateral Gains through Supermarket and Retail Stocks

City Chic Collective Limited (ASX: CCX)

City Chic Collective is a global omni-channel retailer, providing plus-size women’s apparel, footwear and accessories via a collection of customer-led brands including City Chic, Avenue and Hips & Curves. The group operates multiple websites in Australasia and the US; marketplace and wholesale partnership with US retailers; and a wholesale business with European and UK partners.

Must Read: Fashion Retailers in Spotlight

Store Closures: Recently on 15 June 2020, City Chic Collective announced that the group has finalised negotiations with landlords and has agreed reduced rents during store closures and market appropriate go-forward rents.

The group gets ~ two-third of its total sales via the online platform. With recognition of the ongoing shift to online, City Chic has decided to close around 14 holdover stores, reflecting focus on appropriate store economics. Currently, the group operates a network of 92 stores across Australia and New Zealand, which are fully operational following the lifting of COVID-19 restrictions and the shutdown of a few stores is going to minimally impact City Chic’s earnings.

Despite implementing a number of measures to minimise the impact of COVID-19 and the recent store closures, City Chic has a strong cash position with significant headroom in its $ 35 million debt facility, expiring February 2023, according to a late-March CCX update.

Kogan.com Ltd (ASX: KGN)

Kogan.com, the holding company for several retail and services businesses, is well known for price leadership through digital efficiency and focus on manufacturing in-demand, affordable and easily accessible products and services.

Capital Raising: During mid-June 2020, the group announced to have completed its underwritten $ 100 million institutional placement at an offer price of $ 11.45 per new share. The placement received a strong support from existing shareholders and new investors. The funds raised have been indicated to be directed towards providing financial flexibility to act quickly on future value accretive opportunities.

Besides, Kogan.com has a disciplined approach to capital deployment and a proven track record of delivering operating leverage.

The group has also declared offer of new shares under a non-underwritten Share Purchase Plan for ~$ 15 million to existing shareholders at 7.00pm (Melbourne time) on 9 June 2020 (Record Date). The SPP offer will provide each eligible shareholder with the opportunity to apply for a maximum of $ 30k worth of new shares at the same issue price offered under the placement.

Business Update: Active customer base of the group grew by 126k in May 2020 to reach 2,074,000 at 31 May 2020. Gross sales grew by over 100%, gross profit went up by more than 130% and adjusted EBITDA increased by over 200% across 4QTDFY20, according to the 5 June update. Cash with the group stood at $ 58.6 million at 31 May 2020, with the debt facility drawn to $ 26.0 million.

Good Read: A look at Kogan.com Share Price: A rich list e-tailer