Crude oil prices fell from the level of US$61.41 (Dayâs High on 21 August 2019) to the present level of US$60.33 (as on 22 August 2019 12:25 PM AEST).

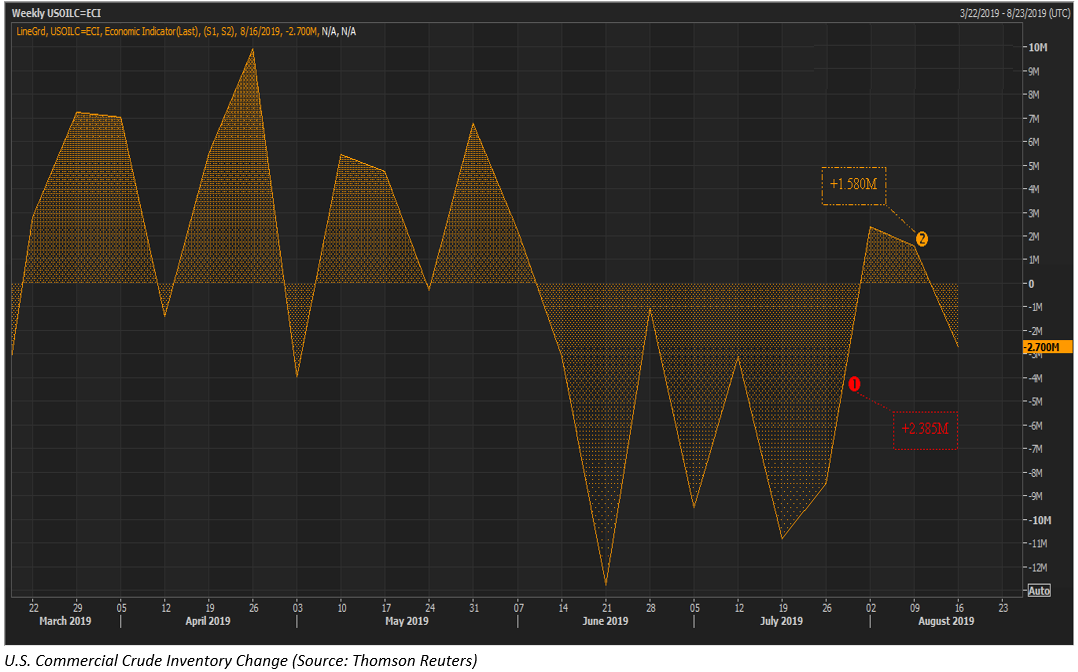

The oil prices rallied yesterday amidst market speculation over escalating middle east tensions along with a decline in the United States Commercial crude oil inventory.

Post two consecutive additions in the United States commercial crude oil inventory, the oil prices fell; however, the decline in the commercial stock for the week ended 16 August 2019 raised speculations over the rise in demand.

Such speculations took the Brent crude oil prices to the level of US$61.41 in the international market yesterday; however, the high domestic production in the United States coupled with a rise in exports and fall in imports unfolded, and the prices were soon dominated by the bears again.

U.S. Oil Figures

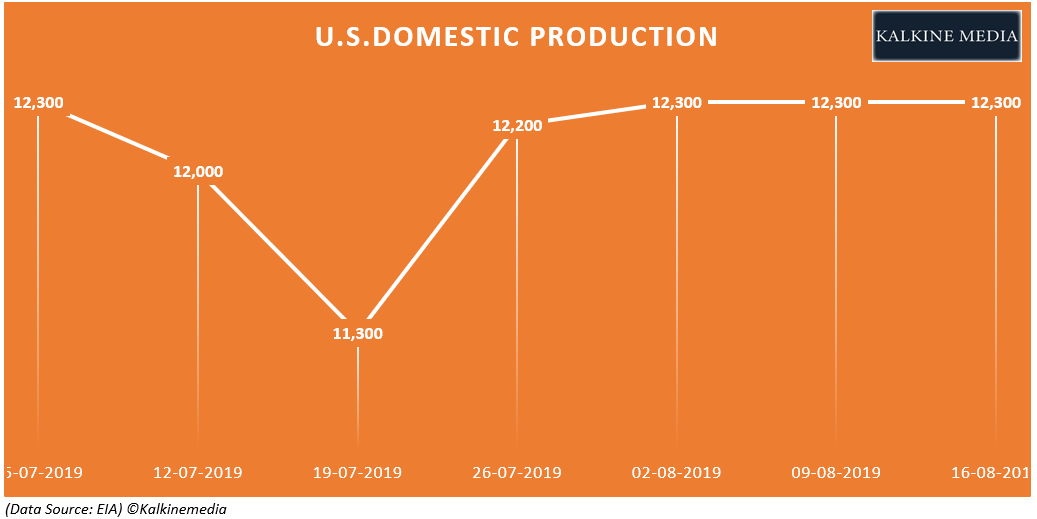

Domestic Production:

The domestic oil production in the United States is currently high and steady at 12,300 thousand barrels per day from the past three consecutive weeks.

The higher domestic production has dragged the monthly as well as the cumulative daily average along with it; and as per the data, the domestic production monthly average stands at 12,275k barrels a day, which is 2 per cent higher from the monthly average of 12,025k barrels a day for the week ended 9 August 2019.

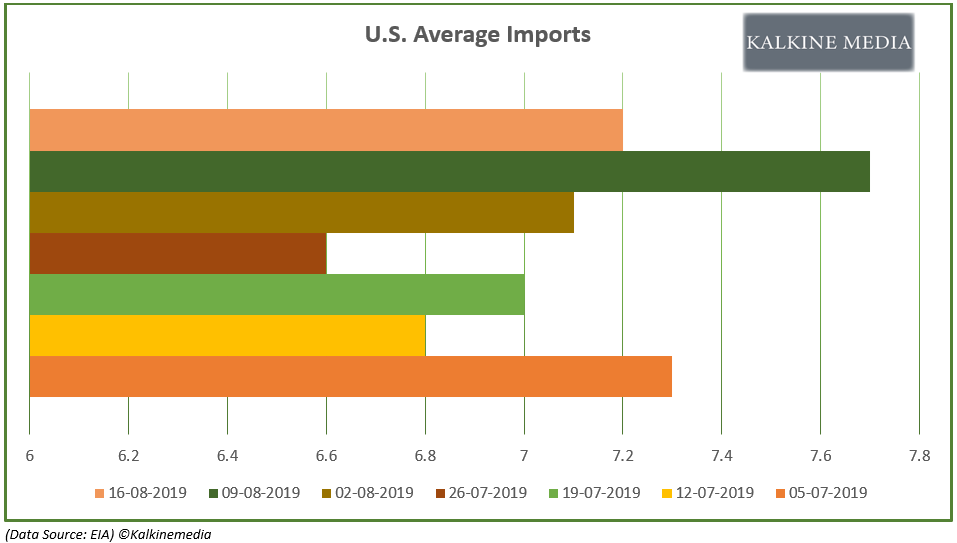

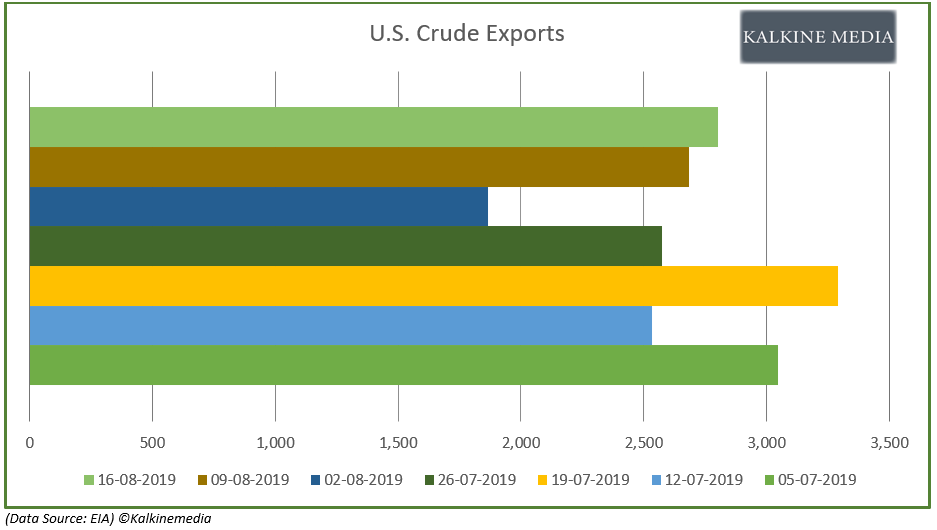

Total Imports and Exports for the Week ended 16 Aug.19:

The total imports in the United States for the week ended 16 August averaged around 7.2 million barrels per day, down by over 6 per cent against the total imports for the previous corresponding period.

While the total imports in the United States declined, the exports from the nation witnessed a surge, which in turn, supported the supply in the global market and exerted pressure on the crude oil prices.

In a nutshell, increased domestic production coupled with a fall in imports and increase in exports provided cushion to the global oil supply chain, which in turn, exerted pressure on crude oil prices.

The oil market is currently trading in line with the EIA forecast for 2019, and the dark clouds over the global economic conditions are also capping the gains in oil prices despite a 1.2 per cent cut in production of total global demand by OPEC and Russia.

While the crude oil prices are feeling pressure in the international market, the ASX-listed energy players such as Origin Energy Limited and Santos Limited have witnessed gap-ups in their opening price.

ASX-Listed Energy Players

Origin Energy Limited (ASX: ORG)

ORG posted a healthy Statutory profit of $1,211 million, which underpinned the growth of 333 per cent in FY2019 on pcp. While the Statutory profit climbed by 333 per cent, the Underlying profit witnessed a growth of 42 per cent and stood at $1,028 million in FY2019.0

The operating cash flow of $1,325 million in FY2019 witnessed an increase of 35 per cent as compared previous corresponding period.

ORG declared a fully franked dividend of 15 cents a share, which took the total dividend for FY2019 to 25 cents a share.

Companyâs Strategy:

The clean energy is showing a global interest, and recently it witnessed a staggering leap in the Australia market with supermarket giant- Coles Group securing clean energy power purchase agreement. While the global push of clean energy is high, ORG is targeting over 25 per cent renewables storage capacity by 2020.

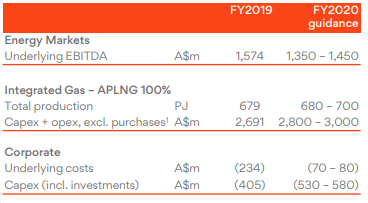

The APLNG (or Australia Pacific LNG) production for FY2019 stood at 225 petajoules, which underpinned the growth of 37.5 per cent as compared to FY2018. In which Origin holds 37.5%

APLNG also generated 160 per cent higher net cash flow of $943 million in FY2019 as compared to the net cash of $580 million in FY2018.

The stock of the company ended 2.36 per cent higher on ASX today at $7.370.

FY2020 Guidance (Source: Companyâs Report)

Santos Limited (ASX: STO)

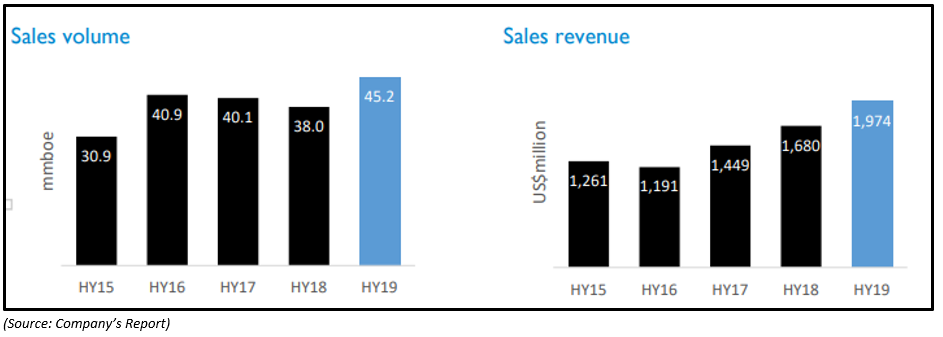

STO presented its interim performance for HY2019, and the company posted a 17.5 per cent rise in revenue from ordinary activities. The revenue from regular activities stood at US$1,974 million in HY2019 against the revenue of US$1,680 in HY2018.

The Statutory profit after tax stood at US$388 million in HY2019, up by 273.1 per cent against the previous corresponding period.

Operations:

On the operational performance counter, the company surpassed the sales volumes and sales revenue of HY2018.

STO produced 37.0 million barrels of oil equivalent during FY2019, which in turn, underpinned the growth of 32.2 per cent from FY2018.

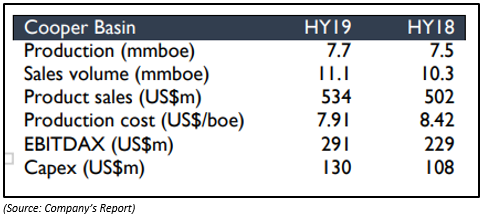

Cooper Basin:

The Cooper Basin operations of the company generated US$534 million of product sales in HY2019, and the further metrics for the prospect stood as:

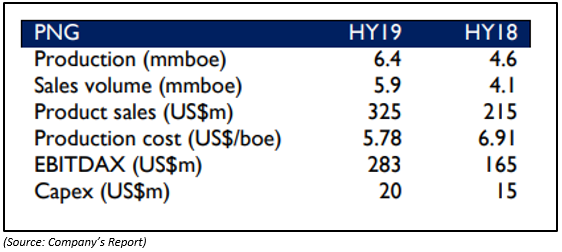

Papua New Guinea Operations:

The production from the PNG prospect stood at 6.4 million barrels of oil equivalent in HY2019, up by almost 40 per cent from the previous corresponding period. Further metrics for the prospect stood as:

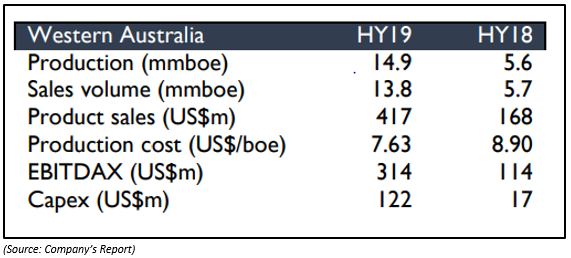

While the Northern Australia prospect of the company witnessed a slight change in metrics, the Western Australia prospect of the company witnessed strong growth.

Dividend:

The company declared an interim dividend of US$0.06 a share during the period, up by 71 per cent as compared to the previous corresponding period.

The shares of the company ended 3.499 per cent higher on ASX today at $7.100.

Oil Search Limited (ASX: OSH)

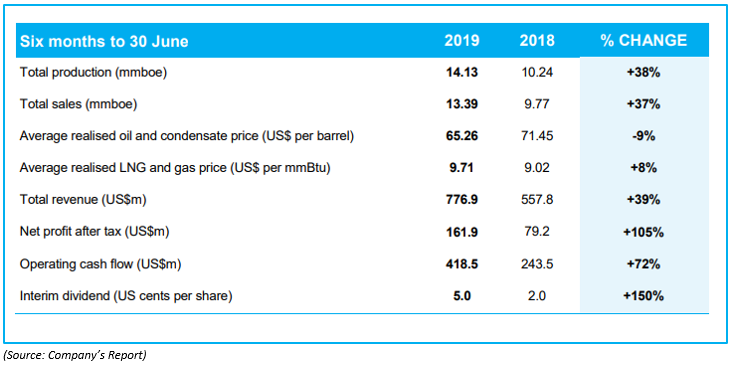

Oil Search recently released its 2019 first-half report for the period ended 30 June 2019. The company posted the total production of 14.13 million barrels of oil equivalent in 1H FY2019, up by 38 per cent as compared to the previous corresponding period.

The total sales of the company increased by 37 per cent to stand at 13.39 million barrels of oil equivalent in 1H FY2019 as compared to 9.77 million barrels of oil equivalent in 1H FY2018.

However, the higher production and sales saw the weaker realised price, and OSH realised an average oil and condensate price of US$65.26 a barrel in 1H FY2019, down by 9 per cent as compared to the average realised price of US$71.45 a barrel in 1H FY2018.

Despite, lower realised price, the revenue of the company surged by 39 per cent to stand at US$776.9 million in 1H FY2019 against the revenue of US$557.8 in 1H FY2018.

The NPAT for the first half (2019) increased by 105 per cent to stand at US$418.5 million as compared to the NPAT of US$243.5 million in the first half of 2018.

OSH witnessed an increase of 72 per cent in the operating cash flow, which stood at US$418.5 million in 1H FY2019.

Dividend:

The company declared a dividend of US$0.05 a share for the first half, which underpinned the growth of 150 per cent as compared to the interim dividend of US$0.02 a share in FY2018.

The shares of the company ended 0.766 per cent higher on ASX today at $6.580.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.