The first Internet bubble, called Dot-Com Boom, emerged between the late 1990s and early 2000s. During the bubble, Internet-based companies in the United States saw crazy investments with their valuations reaching stratospheric levels due to the popularisation of the world wide web. However, once the bubble burst, several of these Internet stocks with dreams of becoming dot-com billionaires have crashed, leaving investors with huge losses. The stock market crash led investors to lose trillions of dollars.

After roundabout two decades, the world is heading towards another Internet bubble burst, this time in China, highlighting that the world is yet to learn its lessons from the first dot-com bubble.

Internet Boom

China is the most populated country in the world. According to the stats released in 2018 by the China Internet Network Information Center (CNNIC), a government agency, the countryâs Internet population is more than 800 million, accounting for more than half of its total population.

Widespread mobile connectivity, huge Internet user base and ability of China-based Internet players to innovate quickly are among the many factors, which resulted in a stellar success of China in the online marketplace. Moreover, the government policy of creating national tech champions, development of Chinaâs broadband infrastructure and surging rates of online transaction growth pushed Internet companies to new heights.

Several Chinese companies operating in Internet-related sectors such as online search, online payments, social media platforms and e-commerce sites have enjoyed success for a quite long time. Until last year in 2018, China-based technology companies witnessed huge investments, pushing their valuations into bubble territory, with several countries looking at China as a source of inspiration for becoming an e-commerce power.

Internet tech giants like Alibaba, Sina, Tencent, Baidu, among others, reported annual sales growth of more than 30 per cent, with strong outlook owing to their leading positions in the concerned sectors. There was a time when global fund managers would invest their funds in a bunch of Internet companies based in China and enjoy high returns. During the period from late 2017 to early 2018, these companies reported record high results.

What Went Wrong?

Since early 2018, it has been much tougher for the Chinese tech companies. For instance, monopoly search engine Baidu, Inc. reported its first loss in the March quarter in 14 years since its listing in 2005. The company attributed the loss to a âchallenging marketing environmentâ, resulting from tighter ad regulations by the Chinese government and ongoing trade dispute between China and the United States. However, according to several market reports, the poor performance of the company impacted its results. The company has also reported a sharp decline in its share prices after registering record high prices during the same period a year ago.

Moreover, the US sanction on Chinese tech giant Huawei is another major example of tough times for Chinese technology providers. The sanction bans American companies from engaging in the sales of their products to the Chinese company. Huawei is too big for the Asian country. As several companies, including Google, have halted their business with Huawei, it is resulting in an existential challenge for the Chinese tech giant on every level. Without Qualcomm, the company doesnât have access to modems worth using, while without Intel and ARM, there is no laptop play and no competitive smartphone processor, respectively. The list of challenges that the company is facing is endless.

There are several other examples of major challenges being faced by once leading tech giants in China. Another dramatic fall of bike-sharing firm Ofo is a warning that Chinaâs tech bubble is dead. Once enjoying billions from backers like Alibaba Group Holding Ltd and Didi Chuxing as well as bike fleets in over 20 countries, the Founder of the company has recently admitted mulling bankruptcy.

The recent failure of Chinese tech-driven companies highlights difficult market conditions for tech providers in the country, as well as a warning for investors in the China tech sector.

US-China Trade War

The US-China conflict, which started in 2018, has not only significantly reduced profits and resulted in new operational risks for the tech firms based in China, but also scared off investors. Though the two super economies are moving towards resuming trade talks, a resolve appears to be quite far.

Recently, the International Monetary Fund revised its forecast for GDP growth in China from 6.3 per cent to 6.2 per cent in 2019, citing trade tensions between the US and China. The technology industry in China is already struggling and the trade war is exacerbating it further.

Impact on Australian Fund Managers

Several Australian fund managers that had invested in Chinese tech stocks have either started selling them or are reducing their position in the wake of the future of the Chinese tech stocks. A fund manager is an investment professional who, on the basis of research and analysis, builds a portfolio and make decisions regarding the purchase and sale.

Let us discuss some of the Australian fund managers that are getting affected by the likely pop up of the China tech bubble.

Forager Funds is a fund manager, serving long-term investors with Forager Australian Shares Fund and Forager International Shares Fund. With funds under management worth around $315 million, the asset management company operates from New South Wales and aims to deliver high returns.

Under its Forager International Shares Fund, the company invests in the securities, which are listed on the stock exchanges, globally. The fund, which invests in 20 to 40 securities globally, offers access to a combination of smaller, deep-value opportunities and large blue-chip companies.

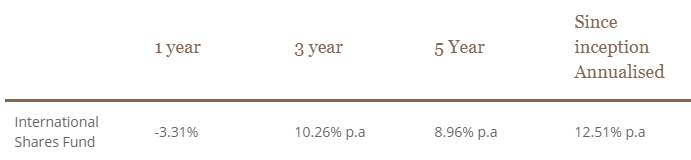

In January 2016, the fund invested in the Chinese tech giant Baidu, factoring in its almost unchanged price from where it started trading in the year 2011. The current situation of the Chinese entity hit the fund hard. As at 28th June 2019, International Shares Fundâs last one year return stands at a negative 3.31 per cent.

Below figure depicts the fund performance (net of all fees) as at June 2019.

(Source: Company Website)

(Source: Company Website)

Loftus Peak is a global fund manager, which offers the Loftus Peak Global Disruption Fund for retail customers, in addition to the Loftus Peak Global Change Portfolio for wholesale or sophisticated investors. Apple, Google and Alibaba are among the major names in the fund managerâs portfolio.

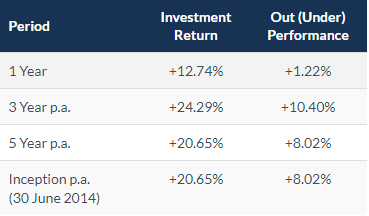

Investment Returns (Source: Company Website)

The Loftus Peak Global Disruption Fund, which was founded on 15th November 2016, is available through the Australian Securities Exchange as a mFund. The fund invests in listed disruptive businesses.

The fund had also invested in Baidu, which was one of the top holdings for the fund, accounting for a 7.2 per cent share, in November 2018. However, in its December 2018 monthly investor letter, the fund had reported Baidu as one of the worst performers. The fund currently holds a smaller portion of the same.

The ongoing trade war between China and the United States, along with the poor performance of some of the technology providers in China in the public markets are expected to have a major impact on the investor sentiments.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.