US stock drifted lower on Thursday, April 21, after Fed Chair Jerome Powell signaled more rate hikes to come as early as next month to curb the high inflation in the US economy.

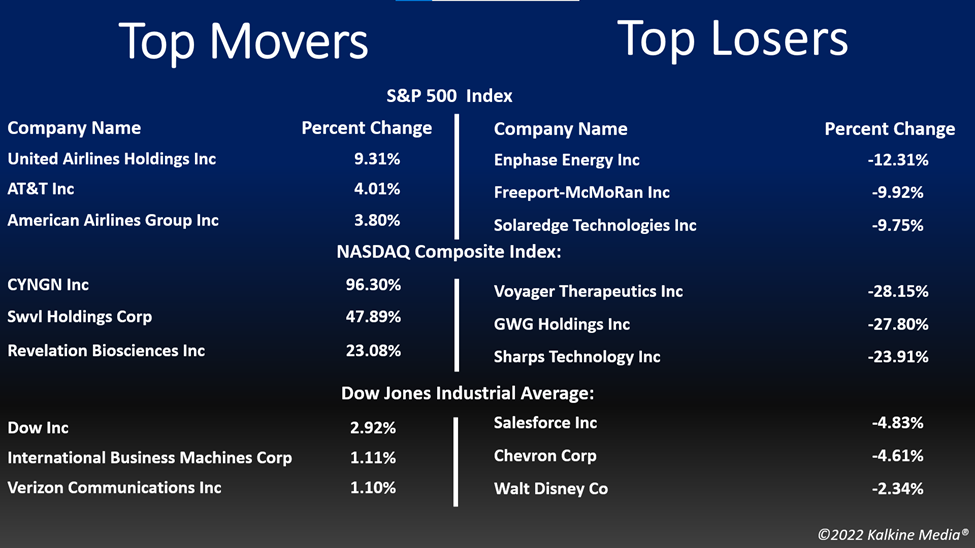

The S&P 500 was down 1.48% to 4,393.66. The Dow Jones fell 1.05% to 34,792.76. The NASDAQ Composite decreased by 2.07% to 13,174.65, and the small-cap Russell 2000 was down 2.29% to 1,991.46.

Powell’s comments triggered a sharp sell-off in growth stocks as investors weighed the impact of higher rates. He also signaled winding back the central bank's US$9 trillion asset portfolio to tackle the price pressure.

The Treasury yields, which move inversely to prices, also rose after his remarks.

Several analysts have forecast a half-point increase in the central bank’s interest rate in May when the Fed officials would discuss the monetary policy at their monthly meeting.

Meanwhile, the Labor Department said on Thursday that the US unemployment benefit claims dropped slightly to 184,000 last week, from 186,000 in the prior week. The decline reflects companies are holding on to their employees amid a tight labor market.

Consumer staples and real estate stocks were the top gainers in the S&P 500 index on Thursday. Nine of the 11 sectors of the index stayed in the red. The energy and communication services sectors were the bottom movers.

EV maker Tesla, Inc. (TSLA) reported strong quarterly earnings on Wednesday, topping estimates. The company said higher vehicle prices helped offset the production costs.

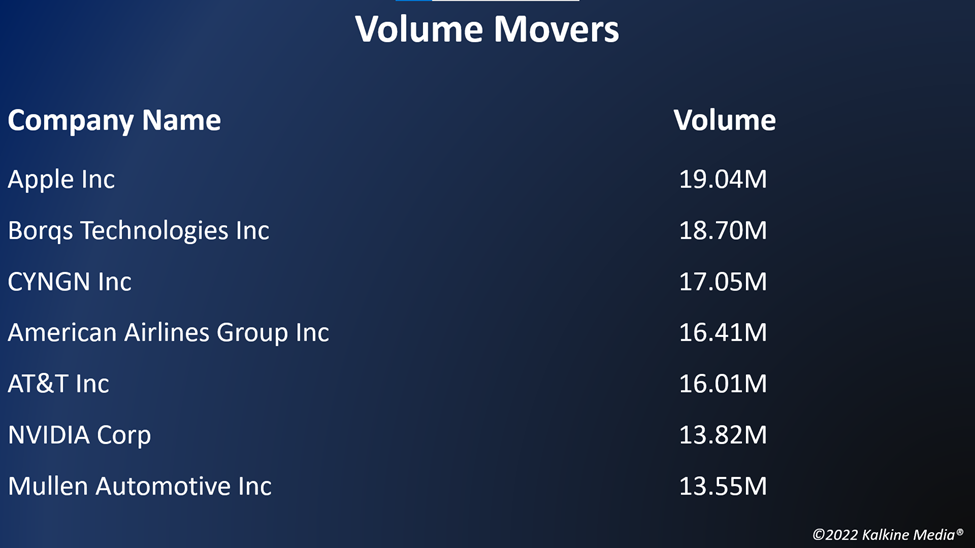

Shares of United Airlines Holdings Inc. (UAL) and American Airlines Group Inc. (AAL) jumped 11.39% and 5.65%, respectively, after the airline companies forecast to return to profit in the ongoing quarter as travel demand boom.

The telecommunication giant, AT&T Inc. (T) stock soared 4.11% in intraday trading after the company reported better-than-anticipated growth in its core wireless segment.

In the consumer staple sector, Philip Morris International Inc. (PM) rose 1.86%, Altria Group, Inc. (MO) increased by 2.29%, and The Kraft Heinz Company (KHC) surged 1.89%. Monster Beverage Corporation (MNST) and Kellogg Company (KG) advanced 2.07% and 1.28%, respectively.

In communication stocks, Alphabet Inc. (GOOGL) decreased by 2.64%, Meta Platforms, Inc. (FB) declined 7.14%, and The Walt Disney Company (DIS) fell 2.28%. Charter Communications, Inc. (CHTR) and Netflix, Inc. (NFLX) tumbled 3.30% and 2.84%, respectively.

In the energy sector, Exxon Mobil Corporation (XOM) plunged 1.27%, Chevron Corporation (CVX) slipped 4.97%, and Shell plc (SHEL) ticked down 2.19%. TotalEnergies SE (TTE) and ConocoPhillips (COP) ticked down 1.37% and 4.15%, respectively.

In crypto space, Bitcoin (BTC) rose 0.61%, while Ethereum (ETH) fell 0.36%. The global crypto market cap ticked up 0.53% to US$1.91 trillion at 3:23 pm ET on April 21.

Also Read: Why is Ankr (ANKR) crypto gaining attention?

Also Read: Why is Livepeer (LPT) crypto rallying?

Also Read: Why is TRON (TRX) crypto riding high?

Futures & Commodities

Gold futures were down 0.12% to US$1,953.30 per ounce. Silver decreased by 2.15% to US$24.727 per ounce, while copper rose 0.64% to US$4.6817.

Brent oil futures increased by 1.82% to US$108.74 per barrel and WTI crude was up 1.96% to US$104.19.

Also Read: Are crypto exchange FTX (FTT), Goldman Sachs exploring collaboration?

Bond Market

The 30-year Treasury bond yields were up 1.83% to 2.929, while the 10-year bond yields rose 2.18% to 2.898.

US Dollar Futures Index increased by 0.20% to US$100.618.