Summary

- Centamin PLC's revenue grew by 56 percent year on year to USD 448.7 million in H1 FY2020.

- Centamin PLC produced 256.0 kilo ounces of gold in H1 FY2020.

- Centamin PLC expects to produce 510 to 525 kilo ounces of gold in 2020.

- Hochschild Mining reported revenue of USD 232.0 million in H1 FY2020.

- Hochschild Mining reported a net loss of USD 4.3 million in H1 FY2020.

- Hochschild Mining sold 94 kilo ounces of gold and 4,897 kilo ounces of silver in H1 FY2020.

Centamin PLC (LON:CEY) & Hochschild Mining PLC (LON:HOC) are two FTSE-250 listed mining stocks. CEY and HOC had a market capitalization of close to £2.34 billion and £1.21 billion, respectively. The shares of CEY were up by approximately 0.01 percent, and shares of HOC were down by about 0.76 percent, respectively from their previous closing price (as on 25 August 2020, before the market close at 12:20 PM GMT+1).

Centamin PLC (LON:CEY) – No debt on the balance sheet

Centamin PLC is a UK based company that is engaged in the exploration and mining of precious metals. The Company has assets in Egypt, Burkina Faso and Cote d'Ivoire. Centamin PLC is included in the FTSE-250 index.

H1 FY2020 results (ended 30 June 2020) as reported on 4 August 2020

(Source: Company website)

In H1 FY20, the reported revenue increased by 56 percent year on year to USD 448.7 million from USD 288.1 million in H1 FY19. The revenue was supported by higher amount off gold sold and increased price for gold. EBITDA increased to USD 255.7 million in H1 FY20 from USD 117.3 million a year ago. The net income increased from USD 19.6 million in H1 FY19 to USD 74.8 million in H1 FY20. The adjusted free cash flow during the reported period was USD 101.9 million. The capital expenditure was USD 51.7 million in H1 FY20. As on 30 June 2020, Centamin had cash and liquid assets of USD 367 million. The Company does not have any debt on the balance sheet. It announced the interim dividend of USD 6 cents per share given the strength of the balance sheet.

Performance by activity in H1 FY2020

Centamin produced 256.0 kilo ounces of gold in H1 FY20, which increased by 9 percent year on year from 234.0 kilo ounces produced in H1 FY19. The Company sold 270.5 kilo ounces of gold in H1 FY20 at an average realized price of USD 1,657 per ounces. The cash cost for gold produced was USD 642 per ounces, which fell by 7 percent year on year.

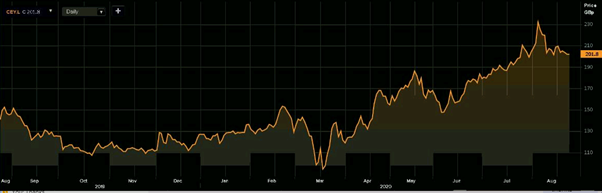

Share Price Performance Analysis

1-Year Chart as on August-25-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Centamin PLC's shares were trading at GBX 201.80 and were up by close to 0.01 percent against the previous closing price (as on 25 August 2020, before the market close at 12:20 PM GMT+1). CEY's 52-week High and Low were GBX 233.30 and GBX 88.28, respectively. Centamin PLC had a market capitalization of around £2.34 billion.

Business Outlook

The Company expects to produce 510 to 525 kilo ounces of gold in 2020 at a cost between USD 630 to USD 680 per ounces. Centamin plans capital expenditure of USD 150 million to USD 170 million in 2020 of which major portion would be invested in H2 FY20. It is expected that the first phase of Sukari Life of Asset would be completed in H2 FY20. The Company is also assessing M&A opportunities.

Hochschild Mining PLC (LON:HOC) - One-off cost of USD 6.6 million related to covid-19

Hochschild Mining PLC is a UK based precious metal mining company. The Company is mainly engaged in the development and production of silver and gold. The Company currently operates three mines of which Inmaculada and Pallancata are situated in Peru, and San Jose is situated in Argentina. The Company owns a 100 percent stake in Inmaculada and Pallancata and owns a 51 percent stake in San Jose.

H1 FY2020 results (ended 30 June 2020) as reported on 19 August 2020

In H1 FY20, the Company reported revenue of USD 232.0 million, which declined by 34.6 percent year on year from USD 354.5 million a year ago. The revenue declined due to the covid-19 related shutdowns. The gross profit was USD 85.1 million that reflected a gross margin of 36.7 percent in H1 FY20. The operating income declined to USD 18.1 million in H1 FY20 from USD 44.7 million in H1 FY19. The profit before tax was USD 13.1 million in H1 FY20 that declined from USD 41.5 million in H1 FY19. Hochschild Mining reported a net loss of USD 4.3 million against a profit of USD 25.1 million in H1 FY19. The Company incurred one-off costs related to covid-19 of USD 6.6 million. As on 30 June 2020, the Company had cash of USD 162 million of which Inmaculada had a positive contribution of USD 59 million. Pallancata and San Jose contributed USD 4 million and USD 22 million, respectively to the cash balance. The net debt was USD 58 million at the end of the reported period.

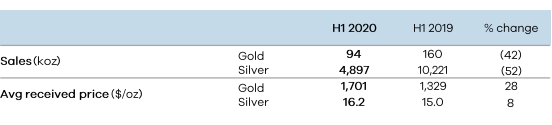

Performance by metal type in H1 FY2020

(Source: Company website)

In H1 FY20, the Company sold 94 kilo ounces of gold, which declined from 160 kilo ounces in H1 FY19. The average sales price for gold increased from USD 1,329 per ounces in H1 FY19 to USD 1,701 per ounces in H1 FY20. The sales of silver were 4,897 kilo ounces in H1 FY20 that were 10,221 kilo ounces in H1 FY19. The average sales price for silver increased from USD 15.0 per ounces in H1 FY19 to USD 16.2 per ounces in H1 FY20. The all-in sustaining cost for silver was USD 11.9 per silver equivalent ounces, and for gold, it was USD 1,026 per gold equivalent ounces.

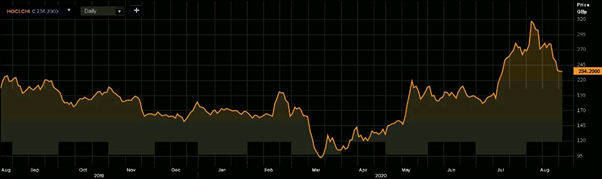

Share Price Performance Analysis

1-Year Chart as on August-25-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Hochschild Mining PLC's shares were trading at GBX 234.20 and were down by close to 0.76 percent against the previous closing price (as on 25 August 2020, before the market close at 12:20 PM GMT+1). HOC's 52-week High and Low were GBX 326.80 and GBX 80.40, respectively. Hochschild Mining PLC had a market capitalization of around £1.21 billion.

Business Outlook

The Company highlighted that all sites are operational. Inmaculada site ramp-up is expected to complete in August 2020, and full production at San Jose is expected to be achieved in Q3 FY20. In Q3 FY20, Hochschild Mining plans to drill 25,000 metres at Inmaculada to incorporate Juliana and Shakira vein. The Company is focused on improving the quality of assets and greenfield programmes are planned in Peru, Canada and the US.