Summary

- As reported by the Office for National Statistics, Consumer Price Inflation (CPI) in the UK increased to 0.6 percent in June 2020 from 0.5 percent in May 2020.

- The Euro against the dollar was trading near four months high at EUR/USD 1.14 over hopes of a stimulus package from the European Central Bank.

- AB Dynamics suspended the interim dividend to preserve cash.

- Both companies, rFpro and DRI, acquired by AB Dynamics in 2019, performed well and made positive contributions to the business performance.

- Surface Transforms raised £2.25 million through placed shares and open offer.

- Surface Transforms won a new contract for the supply of carbon-ceramic brake discs to Koenigsegg Gemera.

Given the above market conditions, we will review two stocks - AB Dynamics PLC (LON:ABDP) & Surface Transforms PLC (LON:SCE). As on 15 July 2020, before the market close at 12.57 PM GMT+1), the stock price ABDP was down by 0.57 percent, whereas SCE was up by 8.98 percent against the previous day closing. Let's walk through their financial and operational updates to understand the stock better.

AB Dynamics PLC (LON:ABDP) – Remains debt-free with substantial liquidity headroom

AB Dynamics PLC is a provider of automotive tests and verification products & solutions. The Company classifies the business under Laboratory testing & simulation and Track testing. Track and testing include services such as track test services, advanced driver assistance systems (ADAS) test products and driving robots. AB Dynamics evaluates the performance of safety systems in the vehicles. In 2019, the Company acquired rFpro and Dynamic Research Incorporated. The Company is included in the FTSE AIM 100 index.

H1 FY2020 results (ended 29 February 2020) as reported on 22 April 2020

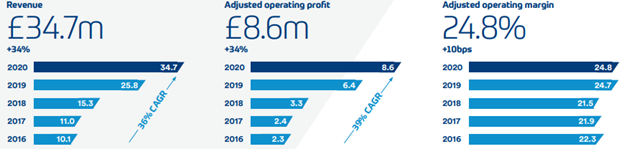

The Company generated revenue of £34.7 million, which increased by 34 percent year on year mainly driven by acquisition and international expansion. The underlying revenue growth was 11 percent year on year. The addition of DRI and rFpro has boosted business performance and increased the customer base. The adjusted operating margin improved by 34 percent year on year to £8.6 million that reflected a gross margin of 24.8 percent in H1 FY20. The adjusted profit before tax was £8.7 million, with adjusted diluted earnings per share of 31.2 pence. As on 29 February 2020, the Company had a cash balance of £35.1 million, and it suspended the interim dividend to preserve cash. The Company does not have any debt on the balance sheet. In the business category, Track and testing revenue increased by 29 percent to £29.6 million, whereas laboratory testing and simulation business revenue was up by 82 percent to £5.1 million.

Financial Performance in H1 FY2020

(Source: Company Website)

Share Price Performance Analysis

6-Month Chart as on July-15-2020, before the market close (Source: Refinitiv, Thomson Reuters)

AB Dynamics PLC's shares were down by 0.57 percent against the previous day closing and trading at GBX 1,743.00 (as on 15 July 2020, before the market close at 12.57 PM GMT+1). Stock 52-week High and Low were GBX 2,850.00 and GBX 855.00, respectively. The Company had a market capitalization of £392.35 million.

Business Outlook

The Company has enough inventory to meet the near-term demand and expects the supply-chain to remain resilient. The order intake has been steady underpinned by diverse customer base and geography; however, few bulk orders for capital equipment have been deferred. AB Dynamics would continue to invest in the application of the ERP system, which is expected to become live-in FY2021. In the current uncertain situation, the Company has delayed construction at North site and has also postponed acquisition opportunities. The liquidity headroom provided by zero debt and ample cash position would help the Company to capitalize on long-term growth opportunities.

Surface Transforms PLC (LON:SCE) – Start of production date deferred for few OEMs due to the pandemic

Surface Transforms PLC is a UK based Company engaged in the engineering and manufacturing of carbon-ceramic materials that are used to make disc brakes. The disc brakes have extensive application in the automobile and aircraft sector. The Company sells the retrofit kits for the sports car. Surface Transforms is included in the FTSE AIM All-Share index.

Seven months result (for seven months to December 2019) as reported on 22 June 2020

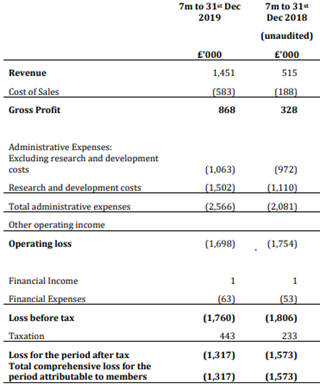

The Company generated revenue of £1.4 million for seven months in FY19; the revenue was £0.5 million for the same period in FY18. Robust OEM orders and sales drove the revenue. The operating margin is expected to improve in 2020 as Cell One OEM came online. The total loss after taxation for the reported period was £1.3 million; the Company made a capital investment of £0.6 million in seven months. As on 31 December 2019, the Company had cash of £0.7 million. The Company has secured a seven years contract worth €11.8 million from German automotive for OEM 5; the production would start from October 2021.

Recent Events

- On 8 June 2020, the Company won a contract worth over £5 million from Koenigsegg. The deal is for the supply of carbon-ceramic brake discs to Koenigsegg Gemera starting from mid-2022 and ending in mid-2027.

- On 9 April 2020, the Company placed 10,806,995 new shares at 13 pence per share and raised approximately £1.4 million. It also announced an issue of 2,307,692 new shares under open offer at 13 pence per share to raise £0.3 million. The open offer was oversubscribed by 473 percent as reported on 1 May 2020.

Financial Summary for seven months ended 31 December 2019.

(Source: Company Website)

Share Price Performance Analysis

6-Month Chart as on July-15-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Surface Transforms PLC's shares were up by 2.00 percent against the previous day closing and trading at GBX 25.00 (as on 15 July 2020, before the market close at 10.58 AM GMT+1). Stock 52-week High and Low were GBX 28.94 and GBX 13.00, respectively. The Company had a market capitalization of £37.88 million.

Business Outlook

Due to Covid-19, the start of production date for a few OEM has deferred, and the initial production ramp-up rate has slowed; however, no orders were lost due to the pandemic. The Company would focus on winning more contracts in 2020. It remains on track to complete the system integration of OEM Production Cell One, which is expected to start production and to deliver parts for new contracts. The Cell One facility is expected to generate potential revenue of £6 million in Q3 2020. The Company is confident of achieving positive adjusted EBITDA in 2021 and positive earnings before tax in 2022.