Summary

- As per the Eurostat report, the annual inflation in the Euro area increased to 0.3 percent in June 2020. The inflation was 0.1 percent in May 2020.

- Office for National Statistics reported that the gross debt of the UK government was £1,877.5 billion at the end of the financial year ending March 2020, which is close to 84.7 percent of the GDP.

- Kromek Group won a contract extension from the Defense Advanced Research Projects Agency of USD 5.2 million to develop a device to identify airborne pathogens.

- Kromek manufactured and sold medical ventilators in the UK and globally under license from Metran.

- Cyanconnode Holdings received the order from Genus Power Infrastructures Limited for £3.3 million to supply advanced metering infrastructure.

- Cyanconnode Holdings secured loans against tax credits expected to be received in 2020.

Given the above market conditions, we will discuss two stocks - Kromek Group PLC (LON:KMK) & Cyanconnode Holdings PLC (LON:CYAN). KMK is a healthcare stock, whereas CYAN is a telecom stock. As on 17 July 2020 (before the market close at 11.29 AM GMT+1), KMK was up by 0.68 percent whereas CYAN was flat against the previous day closing. Let's walk through their financial and operational updates to understand the stock better.

Kromek Group PLC (LON:KMK) – Set to deliver over 2,000 ventilators by the end of July 2020

Kromek Group PLC is a Technology Company that develops and distributes radiation detection products. The Company produces a range of products from radiation detectors to finished products, such as software and electronics with extensive application in medical, security and nuclear markets. The Company has operations in the UK and US and is headquartered in Durham county. The Company sells its product directly and via distributors and OEMs. The Company is included in the FTSE AIM All-Share index.

FY2020 Trading update (ended 30 April 2020) as reported on 1 May 2020

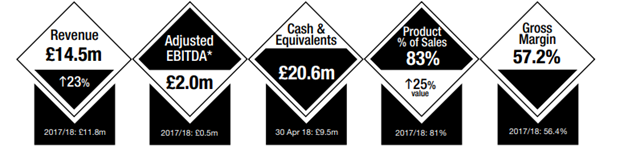

The Company believes in posting revenue of £14.5 million for FY2020 that would be in line with the previous year. The adjusted EBITDA for FY20 would be at the breakeven level. The business witnessed some disruption in the supply due to the Covid-19 impact post-February 2020. The customers, suppliers and sub-contractors struggled due to the imposed constraints. The business was usual till February 2020, delivering on the previously won contracts. As on 30 April 2020, the Company had liquidity of £10 million including undrawn credit facility of £3 million and five-year term-loan of £2 million. In response to the pandemic, the Company had cut-down all discretionary expenses and capital expenditures that are expected to translate to an annualized saving of close to £3 million. On 15 April 2020, the Company announced that it would manufacture and sell medical ventilators. The ventilators would be sold worldwide under the license from Metran. The Company is expected to produce over 2,000 ventilators by the end of July 2020.

New Contract Win

Kromek won a contract extension from the Defense Advanced Research Projects Agency (DARPA) of USD 5.2 million to develop a device to identify pathogens. The Company earlier completed a base contract for development of a vehicle-mounted biological-threat identifier in December 2018. The deal is extended to develop extensive area biological surveillance system to detect airborne viruses and bacteria. The contract is extended until June 2021. The new system would support the prevalent SIGMA network of DARPA for biological threats. The system after development would be used in high fall areas, and the detected sample could be mapped to GPS position for future decision making to deal with bacteria and viruses.

Financial Highlights FY2019

(Source: Company Website)

Share Price Performance Analysis

1-Year Chart as on July-17-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Kromek Group PLC 's shares last traded at GBX 16.99 (as on 17 July 2020 before the market close at 11.29 AM GMT+1). Stock 52-week High and Low were GBX 28.00 and GBX 9.00, respectively. The Group had a market capitalization of £58.14 million.

Business Outlook

The Company expects to continue the momentum and deliver the multi-year contracts. The existing agreements give better visibility over the future revenue; the next project pipeline remains robust. The Company restrained from providing any guidance for FY21. However, the Kromek is confident of its technical and manufacturing skills that would enable it to identify opportunity in the short-term and strengthen the position in the long-term.

Cyanconnode Holdings PLC (LON:CYAN) – Lower revenue due to delay in the roll-out of orders

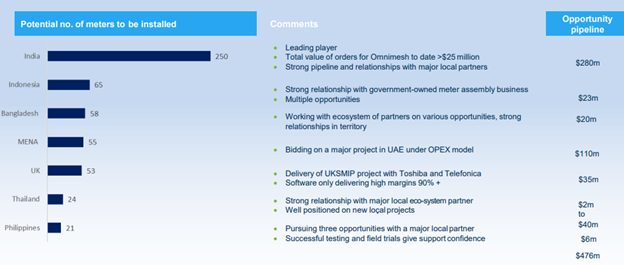

Cyanconnode Holdings PLC is a UK based Company founded in 2002 and listed on the FTSE AIM All-Share index. The Company provides Omnimesh solution in the smart digital grid. Cyanconnode generates revenue by perpetual license, term license, support & maintenance contract and royalty licensing. Some of the critical target countries for the Company include India, Indonesia, Bangladesh and the MENA region.

FY2019 Interim results (ended 31 December 2019) as reported on 31 March 2020

The reported revenue declined to £2.3 million in FY19 from £4.5 million in FY18. The lower revenue was mainly due to the delay of new tenders and roll-out of existing tenders in India; one of the primary markets of the Company. The operating loss narrowed to £5.4 million from £6.3 million in FY18, down by 14 percent due to a reduction in operating costs. The diluted loss per share was 2.51 pence per share in FY19. As on 31 December 2019, the Company had cash and cash equivalent of £1.1 million.

FY2020 Updates

The Company received the order for 142,000 modules worth £3.3 million from Genus that is secured by a letter of credit. The Company received close to £1 million cash from debtors in the Q1 FY20. In FY20, Cyanconnode expects to receive £0.8 million as R&D tax credits against which it had secured loan in March 2020. The Company launched Omnimesh Cellular products that included Dual SIM Cellular Network Interface Card. In January 2020, the Company received the order from Genus Power Infrastructures Limited for £3.3 million to supply advanced metering infrastructure as well as support & maintenance. The project is in India, and it is expected to be completed in fifteen months, where 80 percent of the revenue would be recognized. The remaining 20 percent of the revenue would be identified during the seven months of support & maintenance. In June 2020, the Company shipped 10,000 Omnimesh enabled smart meters as part of the contract.

Growth Markets and Opportunity Pipeline

(Source: Company Website)

Share Price Performance Analysis

1-Year Chart as on July-17-2020, before the market close (Source: Refinitiv, Thomson Reuters)

CYAN's shares last traded at GBX 4.45 (as on 17 July 2020 before the market close at 11.29 AM GMT+1). Stock 52-week High and Low were GBX 5.80 and GBX 1.25, respectively. The Group had a market capitalization of £8.16 million.

Business Outlook

The Company is focused on delivering products to keep project timeline on track. To make through the uncertain times, the Company has secured funding against the tax credits. The Company expects to receive orders from India, and it is participating in the tenders. It will convert all the conventional electricity meters to pre-paid smart meters within three years.