Summary

- As per the Office for Budget Responsibility report, the British economy could slump by around 14 percent in 2020.

- The London stocks retreated with apprehensions over the second wave of coronavirus. The FTSE-100 was down by 0.29 percent to 6,158.23 (as on 14 July 2020, before the market close at 12.06 PM GMT+1).

- Genus PLC paid an interim dividend of 9.4 pence per share for H1 FY2020.

- Genus PLC expects currency headwinds, and macro uncertainties would weigh down on the Company's performance in the H2 FY20.

- Indivior appointed Mark Crossley as the new Chief Operating Officer of the Company.

- Indivior increased the provision to USD 621 million for litigation matters related to the US Department of Justice.

Given the above market conditions, we will review two healthcare stocks - Genus PLC (LON:GNS) & Indivior PLC (LON:INDV). The shares of both GNS and INDV were trading down by 0.82 percent and 3.91 percent (as on 14 July 2020, before the market close at 11.42 AM GMT+1), respectively, against the previous day close price. Let's review their financial and operational updates to understand the stocks better.

Genus PLC (LON:GNS) - Revenue growth is driven by strong volume and royalty

Genus PLC is a UK based Animal Genetics Company that caters to dairy, meat, and pork food production sectors. The Company offers genetically improved breeding animals as semen or embryo to the farmers. Genus operates under two division: Genus PIC and Genus ABS. Genus PIC provides technical guidance and pig breeding stock to optimize the genetic potential for commercial pork producers.

H1 FY20 (ended 31 December 2019) as reported on 27 February

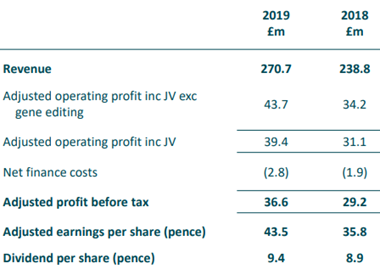

The Company generated revenue of £270.7 million, which was up by 13 percent on constant currency against H1 FY19. The operating profit excluding JVs and profit before tax increased by 21 percent and 27 percent to £34.4 million and £36.6 million, respectively, when compared with H1 FY19. The Company generated free cash flow of £10.5 million. The Genus PIC business reported revenue of £146.5 million in H1 FY20, which increased by 15 percent on constant currency against H1 FY19. The PIC revenue was supported by restocking in China due to the spread of African Swine Fever. The Genus ABS business revenue increased by 10 percent on constant currency to of £118.0 million, underpinned by strong demand for patented beef genetics. The net R&D expenditure was £30.8 million for the reported period, the expense for porcine and bovine was £12.0 million and £9.7 million, respectively. The net debt of the Company was £107.2 million at the end of December 2019. The Company paid an interim dividend of 9.4 pence per share for H1 FY20, which was up by 6 percent year on year.

H1 FY2020 Financial Summary

(Source: Company Website)

Share Price Performance

1-Year Chart as on July-14-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Genus PLC's shares were down by 0.75 percent against the previous day closing and trading at GBX 3,422.00 (as on 14 July 2020, before the market close at 11.40 AM GMT+1). Stock 52-week High and Low were GBX 3,760.00 and GBX 2,460.00, respectively. The Company had a market capitalization of £2.24 billion.

Business Outlook

The Company expects the currency headwinds, and macro uncertainties would weigh down on the Company's performance in the second half of FY20. The Company is expanding the production capacity of Sexcel; fertility sexed genetics. The Company is working on the beef genetics program that is expected to contribute 25 percent of the total sales of Genus ABS business.

Indivior PLC (LON:INDV) – Company is focussed on resolving the legal matters

Indivior PLC is a Pharmaceutical Company, which is engaged in the development, manufacture, and sale of prescription drugs. Indivior products include Suboxone film, Suboxone tablet, Subutex tablet, Sublocade injection, Nalscue and Perseris.

Q1 FY2020 Results (ended 31 March 2020) as reported on 14 May 2020

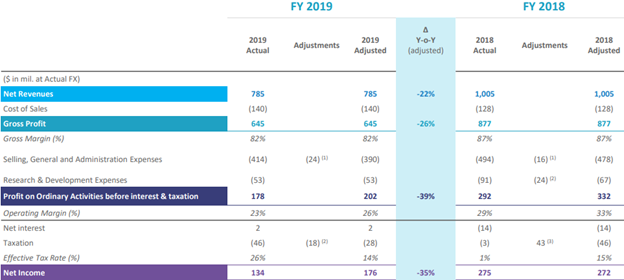

The total net revenue declined by 35 percent at constant currency to USD 153 million. The net revenue in the US fell by 48 percent due to the subdued performance of buprenorphine and naloxone generic film products. The net revenue in Rest of the World increased by 26 percent on the back of modest volume growth in Australia and prior revenue adjustment in Canada. The adjusted operating profit was down from USD 102 million to USD 3 million in Q1 FY20, which was due to legal expense and higher marketing expense for SUBLOCADE. The Company reported adjusted net loss of USD 163 million. Indivior had cash of USD 912 million. The patient enrolment for SUBLOCADE and PERSERIS injections declined in mid-March due to the coronavirus impact; however, the SUBOXONE Film continued to do well. Indivior increased the provision for litigation matters to USD 621 million from USD 438 million, which is related to charges of fraud and conspiracy in the marketing of SUBOXONE Tablet in April 2019.

Recent Events

- On 30 June 2020, the former CEO of the Company, Shaun Thaxter, was considered guilty due to one of the wrongdoings under the Responsible Corporate Officer Doctrine. Mr Thaxter reached an agreement with the US Department of Justice (DOJ) in his capacity.

- On 29 June 2020, Mark Crossley was appointed as the Chief Operating Officer of the Company. Mr Crossley was previously Chief Financial and Operations Officer of the Company.

FY2019 Financial Summary

(Source: Company Website)

Share Price Performance

1-Year Chart as on July-14-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Indivior PLC's shares were down by 4.21 percent against the previous day closing and trading at GBX 80.85 (as on 14 July 2020, before the market close at 11.40 AM GMT+1). Stock 52-week High and Low were GBX 99.75 and GBX 32.90, respectively. The Company had a market capitalization of £621.53 million.

Business Outlook

The Company has withdrawn FY20 guidance given the challenging economic scenario. Further, the Group would focus on maintaining a constant supply of medicines amid the pandemic. The Company has many medicines and drugs under different phases of regulatory approval or review. The investments and business activity for research and post-development study for few medicines continue to be on track. The Company's short-term focus is to resolve legal matters.