US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 38.02 points or 1.16 per cent lower at 3,238.00, Dow Jones Industrial Average Index contracted by 339.92 points or 1.26 per cent lower at 26,665.92, and the technology benchmark index Nasdaq Composite traded lower at 10,476.74, down by 229.38 points or 2.14 per cent against the previous day close (at the time of writing, before the US market close at 3:05 PM ET).

US Market News: The Wall Street retreated as major indices opened in the red. The US Department of Labor reported weekly jobless claims data of 1.416 million for the week ended 11 July 2020. The reported numbers were above the expected 1.3 million jobless claims. Among the gaining stocks, Pulte Group surged by about 10.7 percent after the home building company reported quarterly earnings above streets expectation. Twitter was up by close to 5.2 percent after the company reported growth in users. Tesla shared accelerated by about 1.7 percent after the Group reported revenue of USD 6 billion for the second quarter. Among the decliners, Southwest Airline's shares were down by close to 3.1 percent after the company reported a loss of USD 915 million in the second quarter and warned lower travel demand before the development of coronavirus vaccine. AT&T was down by close to 1.4 percent after the company stated that the pandemic affected its business.

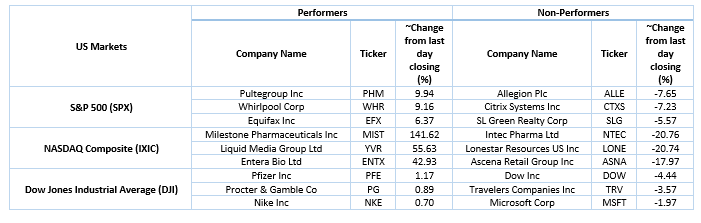

US Stocks Performance (at the time of writing)

European News: London and the European markets trended upwards against previous day fall. As per the Confederation of British Industry's data, the month order book for factory orders increased to -46 in July. The order book was -58 in June. Among the gaining stocks, Unilever advanced by about 7.8 percent after the company reported strong performance supported by in-house eating. Brewin Dolphin was up by about 1.7 percent after the company reported an increase in total funds. Tate & Lyle shares were up by 1.2 percent after the company informed better performance in June as compared to the previous months. Among the decliners, IG Group plunged around 11.4 percent, although the company reported a strong performance for FY2020. Natwest Group declined by about 4.0 percent.

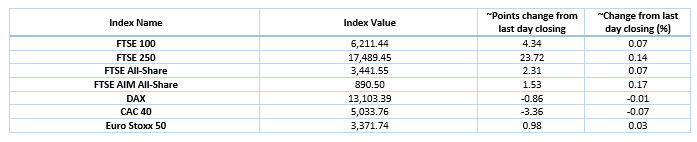

European Indices Performance (at the time of writing)

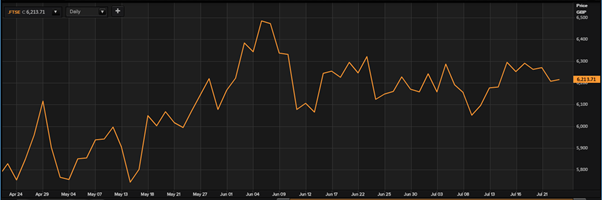

FTSE 100 Index Chart

3 months FTSE 100 Index Performance (23 July 2020), after the market closed (Source: Refinitiv, Thomson Reuters)

Stocks traded with decent volume*: (LLOY) LLOYDS BANKING GROUP PLC; (VOD) VODAFONE PLC; (MRO) MELROSE INDUSTRIES PLC.

Sectors traded in the positive zone*: Consumer Non-Cyclicals (3.95%); Technology (1.01%) ; Basic Materials (0.43%).

Sectors traded in the negative zone*: Utilities (-1.27%); Telecommunications Services (-0.91%), and Financials (-0.85%).

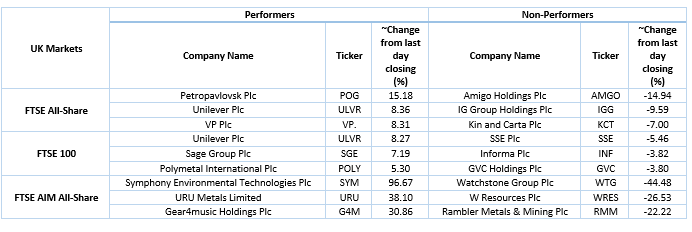

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: WTI crude oil (future) price and Brent future crude oil (future) price were hovering at $41.05 per barrel and $43.33 per barrel, respectively.

Gold Price*: Gold price was trading at USD 1,881.85 per ounce, up by 0.90% from previous day closing.

Currency Rates*: GBP to USD and EUR to GBP were hovering at 1.2732 and 0.9104, respectively.

Bond Yields*: U.S 10-Year Treasury yield and UK 10-Year Government Bond yield were trading at 0.582 per cent and 0.108 per cent, respectively.

*At the time of writing