US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 13.79 points or 0.42 per cent higher at 3,265.63, Dow Jones Industrial Average Index expanded by 292.78 points or 1.10 per cent higher at 26,973.65, and the technology benchmark index Nasdaq Composite traded lower at 10,697.34, down by 69.75 points or 0.65 per cent against the previous day close (at the time of writing, before the U.S market close at 12:05 PM ET).

US Market News: The Wall street opened in green as major indices advanced. The US Congress is discussing new covid-19 economic package, but as per the industry experts, it is unlikely for the bill to be passed in July. Among the gaining stocks, Philip Morris was up by close to 5.2 percent after the company reported better sales and earnings in its second-quarter result. Coca Cola inched up by about 3.0 percent after the company said it expects the demand to improve as the lock-down ease and reported earnings better than the street's expectation. Similarly, IBM was up by about 2.2 percent after the company posted earnings better than the market consensus and highlighted robust demand for cloud computing business. Among the decliners, Adobe was down by close to 1.6 percent after the company announced it would partner with IBM to develop marketing software for the banking industry. Microsoft's shares were down by close to 0.9 percent after LinkedIn, a networking site owned by the company, announced 960 job cuts due to the pandemic.

S&P 500 (SPX)

Top Three Performers*: Occidental Petroleum Corp (OXY), Diamondback Energy Inc (FANG), and Devon Energy Corp (DVN) stocks jumped by 9.56 per cent, 9.38 per cent and 9.10 per cent, respectively.

Non Performers*: ServiceNow Inc (NOW), Regeneron Pharmaceuticals Inc (REGN) and Tractor Supply Co (TSCO) shares decreased by 2.49 per cent, 2.19 per cent and 2.03 per cent, respectively.

NASDAQ Composite (IXIC)

Elite Three Performers*: Midatech Pharma Plc (MTPH), Immuron Ltd (IMC) and Verb Technology Company (VERB) shares traded in the green zone and expanded by 168.24 per cent, 84.44 per cent and 67.77 per cent, respectively.

Worst Three Performers*: Bio-Key International Inc (BKYI), ACADIA Pharmaceuticals Inc (ACAD) and Limelight Networks Inc (LLNW) shares contracted by 29.72 per cent, 16.93 per cent and 14.25 per cent, respectively.

Top Performing Sectors*: Energy (+2.15 per cent), Consumer Non-Cyclicals (+1.85 per cent) and Basic Materials (+1.62 per cent).

Top Worst Sectors*: Healthcare (-0.27 per cent), Consumer Cyclicals (-0.18 per cent) and Technology (-0.15 per cent).

Dow Jones Industrial Average (DJI)

Best Three Performers*: Exxon Mobil Corp (XOM), Chevron Corp (CVX) and Boeing Co (BA) shares were in bright spot and surged by around 3.98 per cent, 3.92 per cent and 3.73 per cent, respectively.

Worst Performer*: Goldman Sachs Group Inc (GS) shares plunged by 0.11 per cent.

European Markets: The London’s broader equity benchmark index FTSE 100 traded at 8.21 points or 0.13 per cent higher at 6,269.73, the FTSE 250 index snapped at 115.98 points or 0.67 per cent higher at 17,501.83, and the FTSE All-Share Index ended 7.84 points or 0.23 per cent higher at 3,468.85, respectively. Another European index STOXX 600 increased by 1.19 points or 0.32 per cent, at 376.70. Among other major European indices, CAC 40 index increased by 11.10 points or 0.22 per cent and ended the trading session at 5,104.28; DAX index closed the session at 13,171.83, up by 124.91 points or 0.96 per cent.

European News: London and the European markets advanced over European Union stimulus package. The Office for National Statistics reported that the UK's net borrowing was £127.9 billion between April 2020 to June 2020. Meanwhile, the European Union agreed on a deal to provide a recovery package of €750 billion. Among the gaining stocks, Midatech Pharma soared by about 310.00 percent after the company entered into a research collaboration with a European affiliate of a global pharma company. Ted Baker was up by about 11.9 percent after the company reported better than expected trading performance. Among the decliners, GVC Holdings plunged around 13.2 percent following the investigation of the company's Turkish business by British tax authorities. BHP Group was down by about 2.8 percent despite posting increased iron ore output in the fourth quarter. Similarly, TalkTalk declined by about 1.5 percent.

London Stock Exchange

Top Three Performers*: BLOOMSBURY PUBLISHING PLC (BMY), Ted Baker Plc (TED) and Trainline Plc (TRN) accelerated significantly by 12.00 per cent, 11.90 per cent and 10.67 per cent, respectively.

Worst Performers*: GVC Holdings Plc (GVC), Motorpoint Group Plc (MOTR) and SPIRENT COMMUNICATIONS PLC (SPT) plunged by 13.05 per cent, 7.31 per cent and 7.01 per cent, respectively.

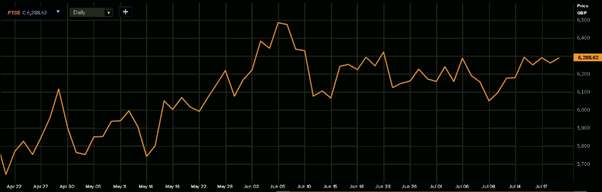

FTSE 100 Index Performance

3 months FTSE 100 Index Performance (21 July 2020), before the market close (Source: Refinitiv, Thomson Reuters)

Best three Gainers*: Hargreaves Lansdown Plc (LON: HL.), Rolls-Royce Holdings Plc (LON: RR.) & MELROSE INDUSTRIES PLC (LON:MRO) leapt up by 10.82 per cent, 5.89 per cent and 5.01 per cent, respectively.

Non Performers*: GVC Holdings Plc (LON:GVC), BHP GROUP PLC (LON:BHP) and PERSIMMON PLC (LON:PSN) traded in the red zone and decreased by 13.37 per cent, 3.16 per cent and 2.95 per cent, respectively.

Stocks traded with decent volume*: (LLOY) LLOYDS BANKING GROUP PLC; (BARC) BARCLAYS PLC; (RR.) Rolls-Royce Holdings Plc.

Top Sectors traded in the positive zone*: Telecommunications Services (+1.50 per cent), Energy (+1.42 per cent) and Financials (+1.40 per cent).

Top Sectors traded in the negative zone*: Basic Materials (-1.74 per cent) and Healthcare (-1.04 per cent).

Crude Oil Future Prices*: WTI crude oil (future) price and Brent future crude oil (future) price were hovering at $42.01 per barrel and $44.37 per barrel, respectively.

Gold Price*: Gold price was trading at USD 1,844.75 per ounce, up by 1.50% from previous day closing.

Forex Rates*: GBP to USD and EUR to GBP were trading at 1.2765 and 0.9040, respectively.

Bond Yields*: U.S 10-Year Treasury yield and UK 10-Year Government Bond yield were tilting at 0.605 per cent and 0.133 per cent, respectively.

*At the time of writing

.jpg)