European News: The London market traded in the red, whereas the European market traded in the green. As the second lockdown hits the UK, the workers on furlough are at the highest level since June 2020. Rishi Sunak states that the UK’s record borrowing is not expected to come down quickly. Among the gaining stocks, Flutter was up by nearly 4.1% and gained the most on the FTSE-100 index. Britvic gained around 2.8% after the company confirmed a full-year dividend. Severn Trent was up by almost 0.1% after it highlighted that the turnover is in line with expectation. Among the decliners, Bodycote was down by around 6.0% after it reported a 20% decline in revenue in recent earnings results. Mitchells & Butlers declined by about 3.5% after it posted a loss in FY20. Shares of Aviva slipped by close to 0.2% after it announced that the final dividend for FY20 is expected around 14 pence.

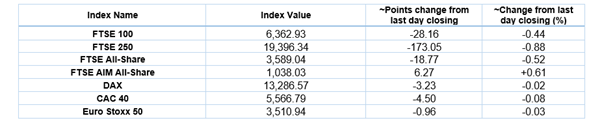

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 26 November 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); International Consolidated Airlines Group (IAG).

Top 3 Sectors traded in green*: Consumer Non-Cyclicals (+0.47%), Consumer Cyclicals (+0.36%) and Healthcare (+0.01%).

Top 3 Sectors traded in red*: Financials (-0.56%), Energy (-0.37%) and Industrials (-0.32%).

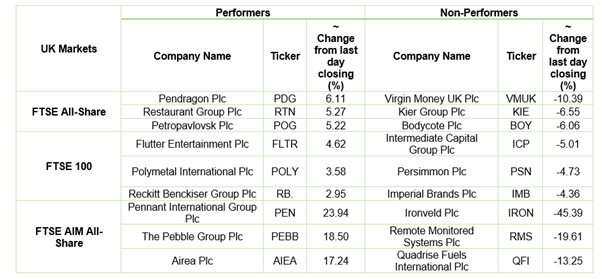

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $47.73/barrel and $45.00/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,808.50 per ounce, up by 0.17% against the prior day closing.

Currency Rates*: GBP to USD: 1.3349; EUR to GBP: 0.8923.

Bond Yields*: US 10-Year Treasury yield: 0.883%; UK 10-Year Government Bond yield: 0.283%.

*At the time of writing