Summary

- Flutter Entertainment's revenue increased by 49 percent year on year in H1 FY2020. Business Sporting segment revenue was reported at £924 million and Gaming segment revenue stood at £598 million.

- The Company combined with The Stars Group (TSG) in May 2020.

- WPP PLC’s reported revenue fell by 12.3 percent year on year in H1 FY2020.

- Also, the Company won the new business of close to USD 4 billion.

Flutter Entertainment PLC (LON:FLTR) & WPP PLC (LON:WPP) are two FTSE-100 listed stocks. FLTR and WPP had a market capitalization of close to £19.31 billion and £8.14 billion, respectively. It is mindful to note that FLTR touched its 52-week High of GBX 12,910.00 on 27 August 2020. Shares of FLTR were up by about 0.16 percent and shares of WPP were down by close to 2.11 percent from their previous closing price (as on 28 August 2020, before the market close at 12:10 PM GMT+1).

Flutter Entertainment PLC (LON:FLTR) - Suspended the dividend for FY2020

Flutter Entertainment PLC is a UK based company that operates betting and gaming platforms. The Company owns brands such as Pokerstars, Sportsbet, Skybetting & Gaming and Bet Easy. Flutter Entertainment is listed on the FTSE 100 index.

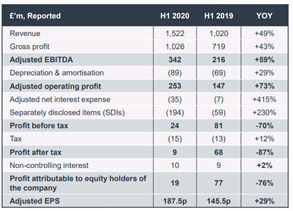

H1 FY2020 results (ended 30 June 2020) as reported on 27 August 2020

(Source: Company website)

In H1 FY20, the Company reported revenue of £1,522 million, which was up by 49 percent year on year from £1,020 million a year ago. The revenue was driven by combination with The Stars Group (TSG). The adjusted EBITDA increased from £216 million in H1 FY19 to £342 million in H1 FY20. However, the profit before tax declined by 70 percent to £24 million in H1 FY20 from £81 million in H1 FY19. The profit before tax was impacted due to TSG merger cost and amortization of acquired intangibles. The earnings per share were 18.1 pence in H1 FY20. As on 30 June 2020, Flutter Entertainment had net debt of £2,899 million. Sports segment reported revenue was £924 million in H1 FY20, which increased by 16 percent year on year from £794 million a year ago. Gaming segment revenue was £598 million in H1 FY20, which increased by 165 percent year on year from £225 million in H1 FY19. The Company has suspended the dividend for FY20.

Merger with The Stars Group (TSG)

Flutter Entertainment completed the merger with The Stars Group on 5 May 2020. The proforma revenue of Flutter included the share of Sports betting of 43 percent, Gaming 30 percent, Poker 19 percent and Retail 3 percent. The global online growth was 29 percent year on year on combination with a wider geographic footprint. Post-merger, only Sportsbet brand would be operational in Australia and Beat Easy customers would be migrated. The merger would bring in synergy, and the work is under process.

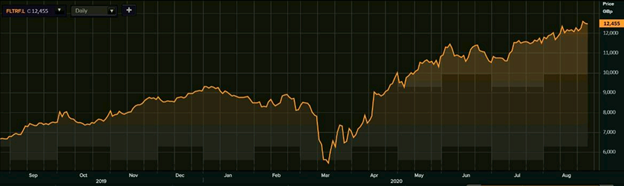

Share Price Performance Analysis

1-Year Chart as on August-28-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Flutter Entertainment PLC's shares were trading at GBX 12,455.00 and were up by close to 0.16 percent against the previous closing price (as on 28 August 2020, before the market close at 12:10 PM GMT+1). FLTR's 52-week High and Low were GBX 12,910.00 and GBX 4,921.54, respectively. Flutter Entertainment had a market capitalization of around £19.31 billion.

Business Outlook

Flutter Entertainment's combination with The Stars Group was value additive as it added brands such as Sky Bet, Sky Vegas and PokerStars to the portfolio. The Company has seen a positive trend after the return of sports recently. It expects a marketing expense of around £50 million in H2 FY20. The proforma capital expense for 2020 would be between £250 million to £270 million. It expects proforma Group EBITDA excluding the US business in the range of £1,175 million and £1,325 million if assuming there is no significant change in the sporting calendar. The US EBITDA loss is expected to be around £140 million and £160 million. In H2 FY20, the Company has plans to go live in Michigan and Tennessee.

WPP PLC (LON:WPP) – Announced the interim dividend of 10 pence per share

WPP PLC is a UK based communication company that offers services such as branding, advertising and public relations. It owns companies such as Groupm, Mediacom, Superunion and BCW. WPP operates in 112 countries, and it is included in the FTSE 100 index.

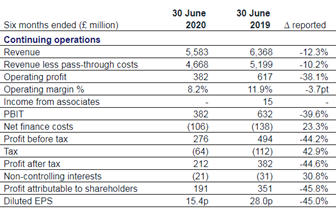

H1 FY2020 results (ended 30 June 2020) as reported on 27 August 2020

(Source: Company website)

In H1 FY20, the Company reported revenue of £5,583 million, which declined by 12.3 percent year on year from £6,368 million in H1 FY19. The revenue less pass-through cost was £4,668 million in H1 FY20 that was down by 10.2 percent year on year from £5,199 million in H1 FY19. The Company generated headline operating profit of £382 million in H1 FY20 that was down by 38.1 percent year on year from £617 million reported a year ago. The operating margin was 8.2 percent in H1 FY20. WPP reported profit before tax of £276 million and earnings per share of 15.4 pence in H1 FY20. The Company reported an operating loss of £2,453 million as it incurred goodwill impairment cost of £2,521 million. WPP PLC won the new business of close to USD 4 billion in H1 FY20 that include clients such as Intel, HSBC and Unilever. WPP declared the interim dividend of 10 pence per share for FY20. As on 30 June 2020, WPP had cash of £2.5 billion and liquidity headroom of £4.7 billion including undrawn credit facilities.

Business and Regional Performance in H1 FY2020

Based on business activity, Global Integrated Agencies division generated revenue of £4,249 million, which declined by 12.8 percent year on year from £4,873 million in H1 FY19. Public Relations segment reported revenue of £447 million, which declined by 5.2 percent year on year from £471 million in H1 FY19. Special Agencies reported revenue fell by 13.3 percent year on year from £1,023 million in H1 FY19 to £887 million in H1 FY20. Based on the regional performance, North America reported revenue of £2,177 million, which declined by 6.7 percent year on year. The UK and West Continental Europe generated revenue of £758 million and £1,093 million, respectively. Asia Pacific, Latin America, Africa, the Middle East and Central & Eastern Europe put together reported revenue of £1,306 million in H1 FY20.

Share Price Performance Analysis

1-Year Chart as on August-28-2020, before the market close (Source: Refinitiv, Thomson Reuters)

WPP PLC's shares were trading at GBX 650.40 and were down by close to 2.11 percent against the previous closing price (as on 28 August 2020, before the market close at 12:10 PM GMT+1). WPP's 52-week High and Low were GBX 1,085.50 and GBX 450.00, respectively. WPP PLC had a market capitalization of around £8.14 billion.

Business Outlook

The covid-19 related issues weighed down on the Company's performance in the first half of the year; however, the business activity has started improving from July 2020. WPP is confident over the resilience of its business model, client base, global footprint and liquidity position. The Company has highlighted that it expects the like-for-like revenue less pass-through growth to be in the range of -10 percent to -11.5 percent for FY20. The headline operating margin is expected in the range of 10.4 percent to 12.5 percent. The expected numbers are as per analyst consensus.