Summary

- Cineworld Group generated revenue of USD 712.4 million in H1 FY20, which fell by 66.9 percent year on year.

- The Group recognized a total impairment charge of USD 954.7 million in H1 FY20.

- Mitchells & Butler’s like-for-like sales grew by 1.4 percent year on year in August 2020.

- The sales in August 2020 were supported by the UK government's Eat Out to Help Out scheme and reduction in the VAT.

Recently the UK government has set out new guidelines related to covid-19 restrictions under which the hospitality venues would be open until 10 PM and restaurants and pubs are restricted to table service only. It would be important to watch out how the new restrictions would pan out on already struggling restaurant and entertainment business.

Cineworld Group PLC (LON:CINE) - 561 cinema halls are operational

Cineworld Group PLC is a UK based entertainment group that owns and operates cinema halls. It is the second-largest Company in the cinema business by the number of screens after it acquired Regal Entertainment Group. The Group runs theatres in ten countries, and it has 778 sites and around 9,500 screens.

H1 FY2020 results (ended 30 June 2020) as reported on 24 September 2020

(Source: Group website)

The first half of 2020 was a challenging period for the companies in the leisure and entertainment business as the sites worldwide were closed due to the lockdown and government restrictions. Cineworld Group generated revenue of USD 712.4 million in H1 FY20, which fell by 66.9 percent year on year from USD 2,151.2 million in H1 FY19. It had a total of 47.5 million admissions in H1 FY20 that was much lower than 136.0 million admissions in H1 FY19. T

he adjusted EBITDA was 53.0 million in H1 FY20 that excluded the covid-19 related costs, legal and transaction-related costs. Cineworld Group posted a loss of USD 1,582.5 million in H1 FY20 against a profit of USD 117.4 million in the same period last year. The loss per share was 115.3 USD cents. In H1 FY20, the Group recognized a total impairment charge of USD 954.7 million, of which USD 342.1 million was for goodwill impairment, and USD 227.3 million was related to the property plant and equipment. As on 30 June 2020, Cineworld had net debt of USD 8,192.4 million, which increased by USD 512.4 million from 31 December 2019. The increase in net debt was mainly due to the net use of cash during the lockdown period when the Group was not generating any income.

Operational Highlights

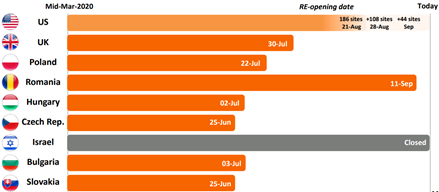

Cinema closure and reopening timeline

(Source: Group website)

Cineworld Group operates 780 cinema sites in ten countries, and all the sites were closed between mid-March and late-June. As on 24 September 2020, 561 sites were operational; however, 200 sites in the US, six in the UK and 11 in Israel are still closed. The Group started reopening the cinema states from the end of June under the increased safety measures and in-line with government guidance, but all the cinema sites are still closed in Israel. In June 2020, the Group terminated its deal with the Cineplex due to the breach in the agreement.

Performance by Region and Division

Based on business division, Box Office generated revenue of USD 391.3 million in H1 FY20, which declined by 69.2 percent year on year from USD 1,268 million in H1 FY19. Retail division revenue fell by 67.4 percent year on year to USD 203.6 million in H1 FY20. Based on the regional performance, the US under the Regal brand generated sales of USD 501.3 million in H1 FY20, which was down from USD 1,613.9 million a year ago. UK & Ireland generated revenue of USD 123.8 million that was down by 60.9 percent year on year. Rest of World segment revenue was USD 87.3 million, which slipped by 60.5 percent year on year in H1 FY20.

Safety measures taken by Cineworld post reopening

(Source: Group website)

Share Price Performance Analysis

1-Year Chart as on September-25-2020, after the market close (Source: Refinitiv, Thomson Reuters)

Cineworld Group PLC's shares last traded at GBX 43.01 and were up by close to 3.99 percent against the previous closing price (as on 25 September 2020). CINE's 52-week High and Low were GBX 235.20 and GBX 18.29, respectively. Cineworld Group had a market capitalization of around £566.59 million.

Business Outlook

The Group had a challenging H1 FY20, and it has acknowledged the fact that if the government puts stringent measures on social gatherings then it might have to shut down the cinema halls or it has to postpone the movie release. The outlook of the future performance remains highly uncertain, and till date, the pandemic hurt the trading activity of Cineworld, and it is currently assessing different options to raise funds. The Group has faith in the resilience of its business model, and hopefully people would go out to watch the movies on the big screen when the condition gets better.

Mitchells & Butlers PLC (LON:MAB) - 95 percent of the estates are operational

Mitchells & Butlers PLC is a UK based company that runs restaurants and pubs. The Company owns brands that include All Bar One, Ember Inns, Browns and Sizzling Pubs. It operates around 1,650 pubs in the UK.

Trading update for 51 weeks ended 19 September 2020 as reported on 24 September 2020

(Source: Company website)

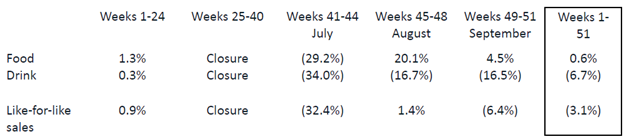

The restaurants and pubs have been operating for 11 weeks since they reopened in July after closing in March 2020. The Company resumed operations in July 2020 amid the social distancing norms and the government guidelines, and it reported a decline of 32.4 percent year on year in like for like sales in July 2020 as compared to the same period last year.

In August 2020, the like-for-like sales grew by 1.4 percent year on year, which was supported by the government's Eat Out to Help Out policy and reduced VAT rate. The sales during the first three weeks of September 2020 have subsided due to covid-19 related restrictions, and like-for-like sales were down by 6.4 percent year on year. Based on the year to date (YTD) performance, the sales were down by 35.4 percent year on year. As on reported date, Mitchells & Butlers had liquidity headroom of nearly £240 million that includes cash of £100 million and unsecured loan facility of £140 million.

Highlights of Mitchells & Butlers

(Source: Company website)

Share Price Performance Analysis

1-Year Chart as on September-25-2020, after the market closed (Source: Refinitiv, Thomson Reuters)

Mitchells & Butlers PLC's shares closed at GBX 135.20, up by close to 1.05 percent against the previous closing price (as on 25 September 2020). MAB's 52-week High and Low were GBX 483.00 and GBX 92.30, respectively. Mitchells & Butlers had a market capitalization of around £574.27 million.

Business Outlook

The Company had a difficult trading period during the lockdown, but now almost 95 percent of the Company's estates are operational. The operating scenario has completely changed after reopening amid the new safety measures and client sentiments. The outlook of the operation remains very challenging as recently new restrictions were imposed by the government to curb covid-19 cases. Mitchells & Butlers are among the market leaders in the dine-out industry, and it is confident of sustaining the tough times.