US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 7.72 points or 0.23 per cent higher at 3,406.68, Dow Jones Industrial Average Index expanded by 37.50 points or 0.13 per cent higher at 27,977.97, and the technology benchmark index Nasdaq Composite traded higher at 11,219.08, up by 77.51 points or 0.70 per cent against the previous day close (at the time of writing, before the US market close at 11:55 AM ET).

US Market News: The US market trended downward as the US weekly jobless claims increase. The US weekly jobless claims increased to 884,000 for the week ended 5 September 2020 against expected 850,000. Meanwhile, the Core Producer Price Index (PPI) increased by 0.4 percent month on month in August 2020 against expected 0.2 percent. Among the gaining stocks, RH shares surged by around 22.2 percent after the company reported a quarterly profit of USD 4.9 per share. The cloud security company Zscaler gained by around 2.8 percent after the company reported earnings better than the estimates. Citigroup gained by close to 0.1 percent after Jane Fraser was appointed as the new CEO of the company. Among the decliners, GameStop shares plunged by 9.3 percent after the company reported a quarterly loss. Yum China declined by around 4.7 percent after the company got listed on the Hong Kong Stock Exchange.

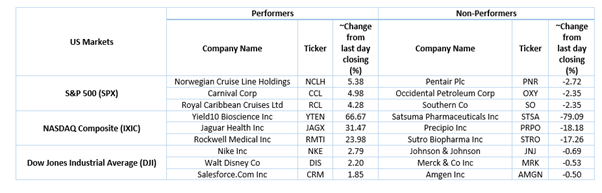

US Stocks Performance*

European News: The UK and European markets retreated on Thursday as clarity over Brexit deal continues to hang on. Meanwhile, the UK’s House Price Balance reported by RICS increased by 44 percent in August 2020 against an expected increase of 25 percent. Among the gaining stocks, Dixons Carphone was up by around 6.1 percent, although the company reported lower mobile sales. DX Group shares were up by close to 3.1 percent after the company announced the expansion of the depot network. Among the decliners, Dunelm plunged by close to 10.1 percent after the company reported lower sales due to the shutdown of stores. Morrisons was down by around 4.4 percent after the company reported a decline in profit. Shares of real estate stock British Land fell by about 3.1 percent after the company announced that its CEO would step down.

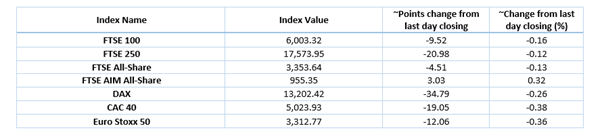

European Index Performance*

FTSE 100 Index One Year Performance (as on 10 September 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Vodafone Plc (VOD); BP Plc (BP.).

Top 3 Sectors traded in green*: Consumer Cyclicals (+1.67%), Energy (+1.03%) and Telecommunications Services (+0.82%).

Top 3 Sectors traded in red*: Healthcare (-0.62%), Utilities (-0.57%) and Consumer Non-Cyclicals (-0.22%).

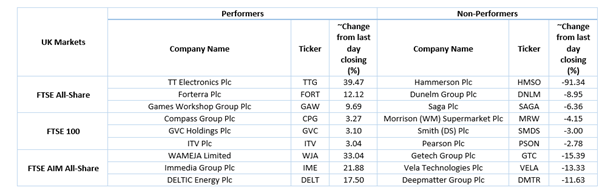

London Stock Exchange (LSE) : Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $40.32/barrel and $37.57/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,965.70 per ounce, up by 0.55% against the prior day closing.

Currency Rates*: GBP to USD: 1.2844; EUR to GBP: 0.9235.

Bond Yields*: US 10-Year Treasury yield: 0.689%; UK 10-Year Government Bond yield: 0.219%.

*At the time of writing