Summary

- Ocado Group's Retail division revenue increased by 27.2 percent year on year in H1 FY2020.

- Ocado Group highlighted the growth in grocery basket size, but the increase in orders remained flat in H1 FY2020.

- Ocado Group raised close to £1.0 billion through the placement of shares and issue of senior unsecured convertible bonds.

- WM Morrison Supermarket's like for like sales excluding fuel were up by 5.7 percent year on year in Q1 FY2021.

- WM Morrison Supermarket's home delivery more than doubled through its online platform.

- WM Morrison Supermarkets secured revolving credit facility of £300 million in Q1 FY2021.

Ocado Group (LON:OCDO) & WM Morrison Supermarkets (LON:MRW) are two consumer stocks listed on the FTSE-100. Based on 1- year performance, shares of OCDO and MRW were up by around 95.41 percent and 9.62 percent, respectively (on 21 August after the market closed). The revenue for OCDO and MRW grew at a CAGR of about 5.9 percent and 2.1 percent, respectively between FY2016 and FY2019.

Ocado Group (LON:OCDO) - Expects good online grocery demand in 2020

Ocado Group is a UK based group that is engaged in the online grocery business. The Group categorizes the business under Retail and Solutions. Ocado Solutions provides a technology solution to grocers around the world to engage in online grocery services. Ocado Group is included in the FTSE 100 index.

H1 FY2020 results (ended 31 May 2020) as reported on 14 July 2020

In H1 FY20, Ocado Group reported revenue of £1,086.8 million, which increased by 23.2 percent year on year from £882.3 million in H1 FY19. EBITDA for the Group declined by 35.5 percent year on year to £19.8 million in H1 FY20 from £30.7 million a year ago. The loss before tax was £79.7 million in H1 FY20. As on 14 July 2020, Ocado Group had cash of £2.3 billion including £1.0 billion of funds raised. As on 10 June 2020, Ocado Group raised gross proceeds of £657.0 million through the placement of new shares and £350.0 million via senior unsecured convertible bonds.

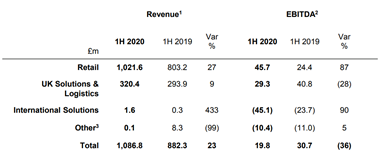

Performance by business activity in H1 FY2020

(Source: Group website)

By business activity, Retail division added revenue of £1,021.6 million in H1 FY20 that was up by 27.2 percent year on year from £803.2 million a year ago. In H1 FY20, Ocado Retail witnessed a rise in basket size as it grew by 28 percent year on year, but the growth of the orders remained zero. The retail segment experienced demand more than the capacity due to covid-19, but the margins remained low. In order to cater to increasing demand, the units picked per labour hour (UPH) in mature customer fulfilment centre (CFS) increased to 170 in H1 FY20 from 159 in H1 FY19. The deliveries per van per week (DPV) declined to 175 in H1 FY20 from 192 a year as the basket size increased, but the orders were flat. UK Solution & Logistics segment generated revenue of £320.4 million, which increased by 9.0 percent year on year from £293.9 million a year ago. International Solutions business reported revenue of £1.6 million in H1 FY20.

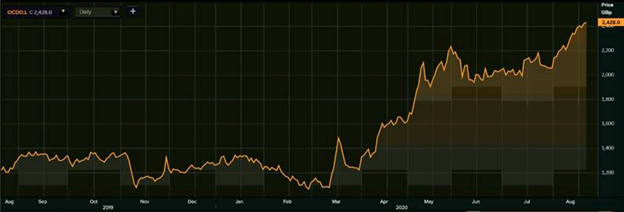

Share Price Performance Analysis

1-Year Chart as on August-21-2020, after the market closed (Source: Refinitiv, Thomson Reuters)

Ocado Group PLC's shares closed at GBX 2,428.00 (as on 21 August 2020). OCDO's 52-week High and Low were GBX 2,443.00 and GBX 994.01, respectively. Ocado Group had a market capitalization of around £18.16 billion.

Business Outlook

The Group suspended the guidance for retail sales, but it expects the demand to remain robust for online grocery sales. It highlighted that the online share of grocery in the UK almost doubled in June 2020 compared to the same period last year. International Solutions business segment is expected to generate revenue of less than £10.0 million in 2020. Ocado expects capital expenditure of close to £600 million in 2020. The Group stated that the insurance claims for the Andover fire had been accepted and it has received £94 million related to insurance claims and expects to receive the remaining payment over time.

WM Morrison Supermarkets PLC (LON:MRW) – Selected Wincanton PLC for the transport management contract

WM Morrison Supermarkets PLC is a UK based group that is engaged in the business of grocery and clothing retail. The Group sells the products through online channels and stores, and it operates close to 492 stores in the UK. WM Morrison Supermarkets is listed on the FTSE 100.

Recent Events

- On 12 August 2020, WM Morrison Supermarkets announced that Susanne Given and Lyssa McGowan were appointed as the Non-Executive Directors of the Group.

- On 18 June 2020, the Group announced that it had selected Wincanton PLC for management of its transport and VMU operations at Willow Green, Bridgewater. The engagement also involves TUPE transfer of 250 employees and both will work together on improving the logistics channel for Morrison's stores. Wincanton is a third-party logistics company based in the UK.

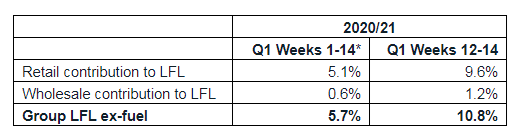

Q1 FY2021 sales update (for 14 weeks from 3 February to 10 May 2020) as reported on 12 May 2020

(Source: Group website)

The Group like for like sales excluding fuel were up by 5.7 percent year on year, of which retail sales were up by 5.1 percent year on year, and wholesale sales increased by 0.6 percent year on year. The Group sales, including fuel, were down by 3.9 percent year on year in Q1 FY21. The Group opened two new stores in Amble and Bradwell. In Q1 FY21, the business was impacted due to the lockdown as a limited number of customers were allowed in the store at a time with fewer trading hours. However, the conditions improved in the last few weeks of the quarter as trading hours resumed to normal with customers adapting to the social distancing norms. The Group has more than doubled the home delivery through its online channel. WM Morrison Supermarkets partnered with Deliveroo for delivery of groceries from 130 stores owned by the Group. During the quarter, the Group attained three new revolving credit facility of £100 million each and extended one credit facility of £100 million. It has a total credit facility of £1.75 billion at the end of Q1 FY21.

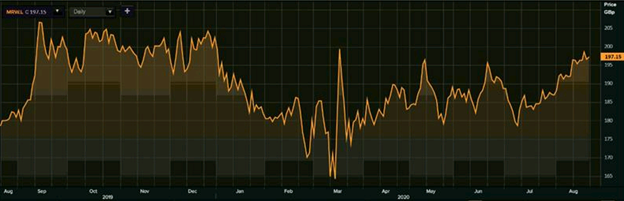

Share Price Performance Analysis

1-Year Chart as on August-21-2020, after the market closed (Source: Refinitiv, Thomson Reuters)

WM Morrison Supermarkets PLC's shares closed at GBX 197.15 (as on 21 August 2020). MRW's 52-week High and Low were GBX 210.00 and GBX 157.55, respectively. WM Morrison Supermarkets had a market capitalization of around £4.75 billion.

Business Outlook

The Group is focused on providing access to the citizens to its store and supplies during the pandemic. It is unable to determine the impact of the current situation on its sales. WM Morrison Supermarkets could cater to the in-home eating demand that has increased in recent times with its current capacity. The current situation has weighed down on some of the costs, and it has negatively impacted the cafe and fuel business that is expected to improve in the second half of the financial year.