One of the giant cell phones and electrical retailers of the United Kingdomâs (âUKâ), Dixons Carphone Plc (DC.) has endured a drop in sales of mobile but has gained from the rise in sales of Dyson hairdryers and supersize Televisions.

The Currys PC World chains and Carphone Warehouse which are owned by Dixons Carphone reported around 9 per cent drop in like for like cell phone sales in Ireland and UK for the ten weeks till 4th January 2020. But this fall is nullified by a 2 per cent rise in sales of electricals which was better than expected. The sales of cellular phones reported were even worse with a fall of 18 per cent at established stores in the first half of the year 2019. However, the overall group revenue sales were flat compared to that in the prior corresponding period.

The figures released by Dixons Carphone Plc establish the fact that the retailer has weathered the tough electricals market successfully, when it declined by 3 per cent during the Christmas period. The statistics show that the company has performed better than its competitors such as John Lewis, with the sale of 75 per cent more in extra-large Televisions sporting 65 inch screens and Dyson Hairdryer ( which start at £300) where sales increased by more than 20 per cent compared to the year earlier.

The company also sold around 8,000 smart speakers every day while Shark vacuum cleaner sales increased to almost twice in the most recent Christmas trading period compared to the previous corresponding period. Smartwatches of Fitbit, AirPods of Apple broke the records while gamers couldn't get enough pieces of the Nintendo Switch. However, the companyâs Gaming Arenas enthralled shoppers with more immersive experience which drove strong sales & profits.

In the year 2019, the company had released a warning for lower profits, but its stock prices recovered from the fact that trading activities had not worsened. On 21st January 2020, DC. stock increased by 7.02 per cent to 152.45 pence. However, the share price gave up a part of the gain after the company admitted to an error on the figure for sales growth. Additionally, the group is set to record an adjusted profit before tax of £210 million which is below £298 million in year 2019.

The success contrasts sharply to the performance of the companyâs cell phone business, Carphone Warehouse, which is likely to lose of £90 million till the end of April 2020 and will not break even before the year 2022.

As per a media report, Richard Lim, who operates consultancy firm Retail Economics, stated that the companyâs price promise to match prices with any retailer, online or in stores reverberated nicely with shoppers. The coming events such as Olympics, European Championship in football, as well as a new generation of computer consoles are likely to sustain sales revenue growth in the year 2020.

Alex Baldock, the companyâs chief executive, stated that cell phone sales were hit because consumers were using their cell phones for a longer period of time, such as delaying a second purchase for three to four years before purchasing a new one. This trend will change once the 5G next-generation smartphones launch in the year 2020. He further said that additional consumers are also choosing for low-cost sim-only deals, purchasing phones and sim cards individually.

Â

Dixons Carphone Plc

Dixons Carphone Plc (LON: DC.) is a prominent international mobile and electrical retailer and services company for consumers, which employs more than 42,000 people in nine countries. The company supports every customer in order that they Enjoy Amazing Technology no matter how they choose to shop with the company. It is a market leader in the Ireland & UK, all the way through the Nordics and in Greece. With a complete variety of support and services, DC. Makes it simple for consumers to select, discover and enjoy the best technology for themselves. The companyâs core multichannel operations are backed by a state-of-the-art repair facility in Newark, UK and an extraordinary delivery network and sourcing office in Hong Kong.

Trading Updates

On 21st January 2020, the company released trading updates for ten weeks ended 4th January 2020.

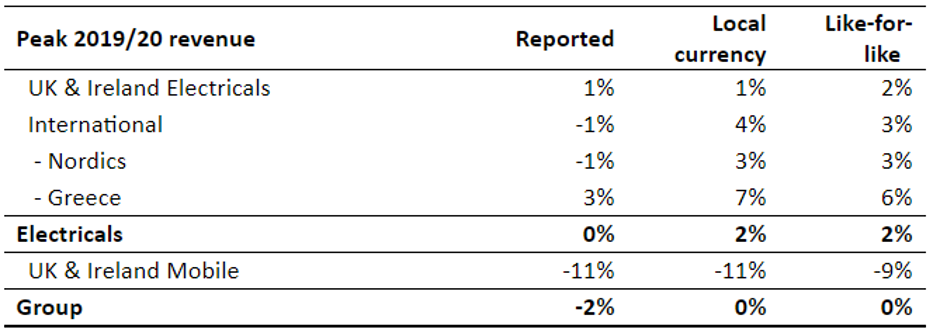

The company's reported that revenue rose by 1 per cent, and revenue in local currency increased by 1 per cent with regards to UK & Ireland Electricals for ten weeks ended 4th January 2020.The international revenue decreased by 1 per cent whereas international revenue in local currency increased by 4 per cent for ten weeks ended 4th January 2020.Â

The UK & Ireland Mobile segment reported revenue decline by 11 per cent as well as local currency revenue decline which was in line with it.Â

(Sources: LSE)

News UpdatesOn 9th January 2020, the company notified that the UK Information Commissioner's Office has issued a notice for Monetary Penalty with respect to the historic unauthorised access of consumer data which was announced on 13th June 2018 and 31st July 2018. The UK Information Commissioner's Office enforced a penalty of £0.5 million under the Data Protection Act 1998.

Financial PerformanceOn 12th December 2019, the company announced unaudited results for the half-year ended 26th October 2019.

The group adjusted profit before tax decreased to £24 million in H1 2019/2020 as compared to £60 million in H1 2018/2019. The Group statutory loss before tax decreased to £86 million in H1 2019/2020 as compared to £440 million in H1 2018/2019.

The UK & Ireland Electricals revenue decreased by 1 per cent whereas like for like revenue remained unchanged in H1 2019/2020. The International revenue increased by 1 per cent with like-for-like income increased by 3 per cent in H1 2019/2020.

The UK & Ireland Mobile revenue decreased by 18 per cent whereas like-for-like revenue also reduced by 10 per cent in H1 2019/2020.

The company informed that the company is carrying out a transformation which will result in improving customer satisfaction throughout the group. The multichannel/online growth in electricals increased by 11 per cent with around 81 stores in UK having been re-configured.

The capital expenditure decreased to £200 million in H1 2019/2020 as compared to £275 million in H1 2018/2019 because of rephasing of IT pay and adjusted net debt was likely to be the lesser on a year-on-year basis

Share Price Performance

At the time of writing, on 22nd January 2020 as at 08:43 GMT, the share price of Dixons Carphone plc (DC.) trading at GBX 151.60 per share on the London Stock Exchange, a downside of 0.56 per cent or GBX 0.85 per share, versus previous dayâs closing price of GBX 152.45 per share. The companyâs market capitalisation was reported at £1,768.74 million at the time of writing. The free float and share outstanding of the DC were reported at 1.02 billion and 1.16 billion.

Dixons Carphone plcâs (DC.âs) share price of GBX 166.45 as on 13th December 2019 was its 1-year peak price, whereas the share price of GBX 90.00 as on 20th June 2019 was the 1-year low share price. The current share price was lower by 8.92 per cent from the 1-year high price, whereas it was higher by 68.44 per cent from the 1-year low price.

While writing, the beta of the Dixons Carphone plc (DC.) share was stated at 1.43, which shows higher volatility as compared to the benchmark market indexâs movement.