US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 10.11 points or 0.28 per cent lower at 3,625.30, Dow Jones Industrial Average Index decreased by 139.85 points or 0.47 per cent lower at 29,906.39, and the technology benchmark index Nasdaq Composite traded higher at 12,056.15, up by 19.36 points or 0.16 per cent against the previous day close (at the time of writing, before the US market close at 11:00 AM ET).

US Market News: The key indices of the Wall Street retreated on weak jobless data reports. The US GDP grew at 33.3% quarter on quarter in Q3 2020 that was below expected 33.2% growth. The initial jobless claims were reported at 778,000 against 730,000 expected. Among the gaining stocks, Nordstrom shares surged by nearly 17.1% after its online sales increased by 37%. HP gained around 4.6% after it posted quarterly earnings of 62 US cents per share. Among the decliners, shares of GAP plunged by nearly 18.4% after it reported it reported earnings below estimates. Deere slipped by about 1.2%, although it reported earnings above estimates.

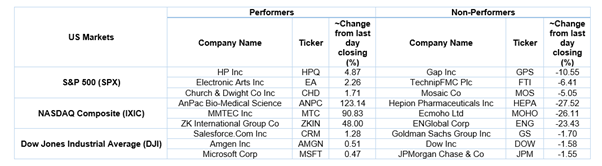

US Stocks Performance*

European News: The London and European markets traded in the red as the covid-19 infections continue to climb. The UK government borrowing is expected to reach £394 billion and states that the economic emergency has just begun. Among the gaining stocks, Melrose Industries gained around 2.4% after it stated that the company at the top end of the board's expectation. Babcock was up by close to 0.1% after it reported an increase in the order book. Among the decliners, shares of Future plunged by around 15.7% after it announced that it would acquire the entire issued share capital of GoCo Group. Vivo Energy was down by nearly 4.0% after it appointed Johan Depraetere as the Chief Financial Officer. Virgin Money shares declined by about 3.9% after it reported a contraction in lending.

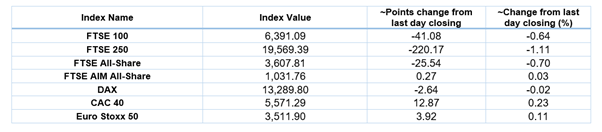

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 25 November 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); International Consolidated Airlines Group (IAG).

Top 3 Sectors traded in green*: Consumer Non-Cyclicals (+1.47%), Utilities (+0.34%) and Consumer Cyclicals (+0.31%).

Top 3 Sectors traded in red*: Energy (-1.65%), Financials (-1.41%) and Basic Materials (-1.02%).

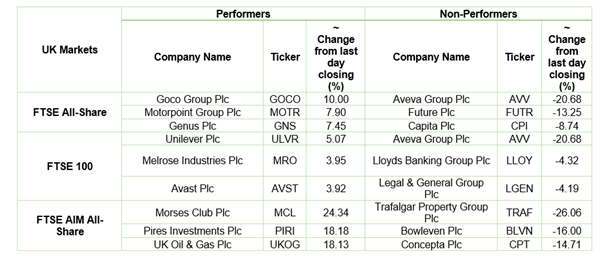

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $48.81/barrel and $46.13/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,807.25 per ounce, up by 0.15% against the prior day closing.

Currency Rates*: GBP to USD: 1.3382; EUR to GBP: 0.8906.

Bond Yields*: US 10-Year Treasury yield: 0.870%; UK 10-Year Government Bond yield: 0.311%.

*At the time of writing