In a company filing made by Babcock International Group Plc (LSE:BAB) with the London Stock Exchange as on June 17, 2019, at 07:00 AM GMT, the board of the aerospace and defence business group rebuffed Serco's approach for an all-equity merger of the two companies.

The board of the Babcock together with its counsellors have diligently considered the proposal offered by the Serco Group Plc (LSE:SRP) and came out with a conclusion that there is no strategic merit in combining these two entities. The proposed combination is not in the best interests of shareholders, customers and other stakeholders, the board added.

The later one has approached twice its peer Babcock over probable £4 bn deal that would have jolted the UKâs defence industry by compounding two biggest defence suppliers.

Babcock also mentioned that, on January 23, this year, Serco presented an unsolicited and highly preliminary proposal to the company and after deliberate study of the proposal, the board has unanimously rejected the Sercoâs proposal.

However, before Mr Soames took charge in 2014, as the chief of the Serco Plc, the group was at the verge of bankruptcy. In the FY19, Serco reported a pre-tax profit of £74 mn against the £235 mn of pre-tax profit recorded by the Babcock International Plc and Sercoâs revenue during the FY19 was at £2.8 bn against the Babcockâs revenue of £4.5 bn respectively.

One analyst commented that Serco's margins are lower than the Babcock, and the group is concentrating on turnaround its operational performance and also estimated that the following years will be challenging.

Babcock International Plc: Key highlights

Post the things made clear by the Babcock, its shares have surged around 1.5% at the London Stock Exchange. However, during the previous session, the stock has touched a high of GBX 488, which was around 5.0 above the June 14, closing price.

Daily price chart (as on June 18, 2019), before the market close. (Source: Thomson Reuters).

At the time of writing, (before the market close, at 02:06 PM GMT), shares of the BAB were quoting at GBX 471.1 and declined marginally against the yesterday's closing price. In a year-ago period, its shares have registered a 52w high price level of GBX 846.40 and a 52w low price level of GBX 410.10, and at the current trading level, the stock was trading around 44 per cent below the 52w high price level and approximately 15 per cent above the low-price level.

On a YoY basis, Babcock's stock has plunged by around 44%, and in the last month, the stock was down by approximately 9%. However, the dividend yield of the company stood at 6.36%, which is considerably above the benchmark yield, though, the yield is higher on account of the steep plunge the stock witnessed in the past one year.

Also, its shares were trading considerably below the 200-day simple moving average price, which is bearish technical measure, and the near term recovery is challenging for the stock.

In the FY19, the group has an underlying operating profit of £588.4 mn, which was marginally above the underlying operating profit of the FY18 data. On a statutory basis, operating profit has recorded a decrease of 47% and stood at £196.5 mn against £370.6 mn recorded in a year-ago period.

Underlying revenue for the FY19 stood at £5,160.6 mn and narrowed by 3.8% on a YoY basis. Although, statutory revenue reported a decrease of 4.0% to £4,474.8 mn.

Operating cash flow during the financial year ended March 31, 2019, stood at £617.8 mn against the operating cash flow of £495.2 mn recorded in the FY18 and recorded a growth of 24.8%. Free cash flow during the period stood at £323.7 mn against the free cash flow of £250.2mn in the year-ago period.

Groupâs underlying pre-tax profit was at £517.9 mn and recorded a marginal surge against the previous year. However, statutory pre-tax profit stood at £235.2 mn and declined considerably against the pre-tax profit of £391.1 mn recorded in the previous financial year.

Underlying basic earnings per share grew by 1.2% to 84.0 pence against 83 pence per share reported in the FY18. However, statutory basic earnings per share of the group plunged by 40.7% to 39.5 pence per share.

As on March 31, 2019, the Net debt of the company stood at £957.7 mn and reduced by 14.1% from £1,115 mn recorded in a year-ago period. However, Net debt to EBITDA ratio narrowed marginally to 1.4x against 1.6x recorded in the same period of the previous financial year.

Full-year dividend improved by 1.7% to 30.0 pence per share against 29.5 pence per share recorded in the previous financial year.

Groupâs combined order book and pipeline stood at £31bn and remained flat against the previous year order book of £31bn.

In the FY19 Annual Report, the group mentioned that there could be a potential decline in the FY20 revenue on account of the number of step downs and this could affect the top-line by £410 mn and operating profit by £63 mn. For FY20, the group expects an underlying revenue of £4.9 bn and to maintain an underlying margin including JV between 10.7% to 11.0%.

During the FY20, the group also estimates a Free cash flow (after pension payments) over and above £250 mn and focus on narrowing its debt size.

The group has an outstanding market capitalisation of £2.43 bn and listed on the FTSE 250 index on the London Stock Exchange. However, the group has lost around 40% of its market capitalisation in the past year.

Serco Group Plcâs stock performance

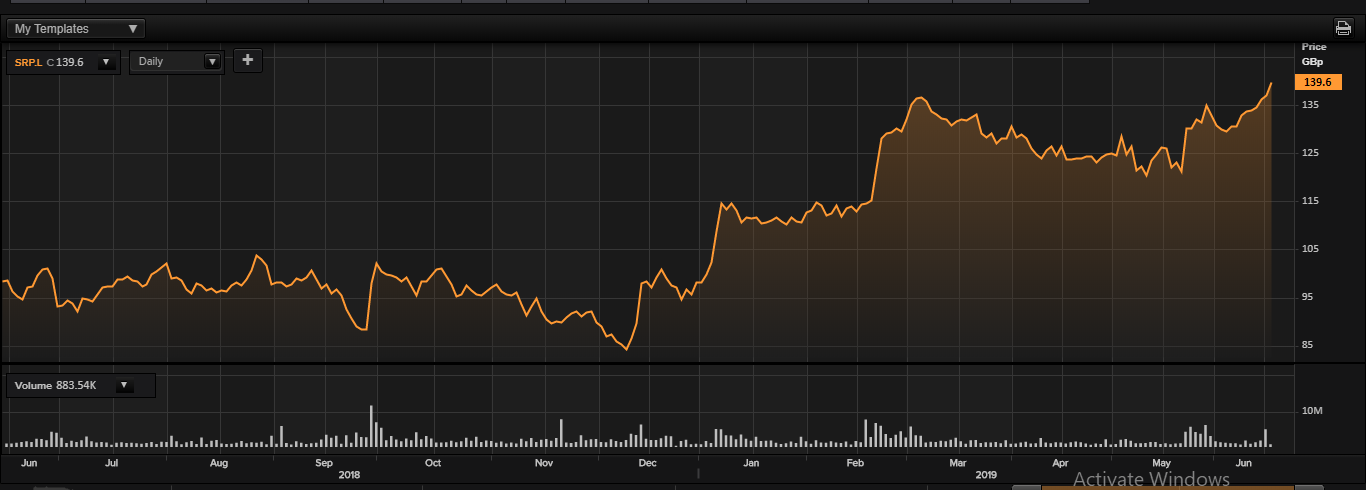

Daily price chart (as on June 18, 2019, at 03:29 PM GMT), before the market close. (Source: Thomson Reuters).

At the time of writing (before the market close, at 03:29 PM GMT), shares of the SRP plc were quoting at GBX 139.6 and added 2.80 points or 2.04% against the previous day closing price. Post its proposal rebuffed by the Babcock Plc, its shares have surged by around 2.6 per cent. In today's market session (before the market close), its shares have registered a 52w high price of GBX 139.80, and in the past 52wks, it has touched a low of GBX 83.50. On a YoY basis, the stock has delivered a price return of approximately 40 per cent and on a year-to-date basis, the stock was up by 43 per cent.

At the current trading level, the stock was trading considerably above the 30-day, 60-day and 200-day simple moving average prices (SMA), which is a bullish technical measure and carrying the potential to register other highs in the near term. Its 14-day RSI stood at 67.53, which is strengthening the potential upside move.

From the volume standpoint, the 5-day average daily volume in stock was around 5.26 per cent above the 30-day average daily volume traded on the London Stock Exchange.

However, the stock is carrying a beta of 1.33, which indicates it is highly volatile against the benchmark index.

At the current trading level, the outstanding market capitalisation of the group stood at £1.68 billion, and the group is a key constituent of FTSE All-Share and FTSE 350 indices.