The rising inflation rate worldwide has the potential to bring in more investors to the crypto space. Hedge fund managers have reportedly started pitching to invest in cryptocurrencies to protect assets against high inflation.

Canada witnessed the highest inflation rate in a decade at 3.6 per cent. Meanwhile, the Canadian exchanges-listed crypto stocks have started showing improvements. This trend may pick up momentum in the coming week.

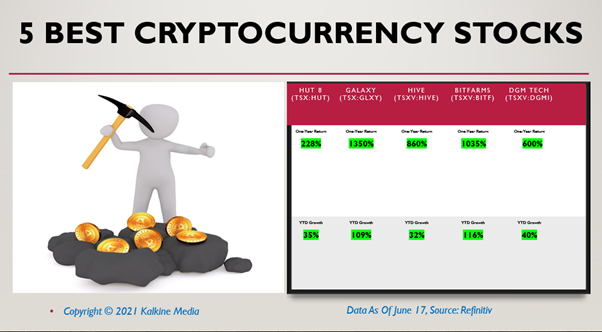

Here are the top five crypto stocks in terms of last one-year price-performance:

1. HIVE Blockchain Technologies Ltd. (TSXV:HIVE)

Stocks of this blockchain firm saw a surge of 860 per cent in the last one year, led by the second wave in the cryptocurrency market. The crypto stock has yielded more than 32 per cent this year.

Its share prices jumped 6.37 per cent on Thursday, June 17, and the trading volume at 2.70 million.

The firm preserves all mined crypto tokens, including Bitcoin and Ether coins, and deposits them in hardware wallets. At the end of the first quarter, it recorded more than 320 Bitcoins and 20,030 Ether tokens.

At the last price of C$ 3.17 apiece, HIVE shares were up 22.42 per cent against its 200-day simple moving average, showing an uptrend.

2. Bitfarms Ltd. (TSXV:BITF)

The crypto mining company’s stock was up more than 11 per cent on Thursday, and its 1.39 million shares were traded. Its one-year yield stands at 1,035 per cent.

Bitfarms mined nearly 1,006 BTC coins as of May 27, valued at US$ 39 million. The firm mines one per cent of existing bitcoins each day using renewable sources of energy.

In the first quarter of 2021, it collected 598 Bitcoin tokens with an expense of US$ 8,400 per coin, representing earnings of US$ 32.4 million. The crypto miner posted earned a profit of 19.2 million for the quarter.

The company currently trades on the Toronto Stock Exchange Venture and is set to debut on the NASDAQ on Monday, June 21st.

3. Hut 8 Mining Corp. (TSX:HUT)

The Bitcoin mining firm has gained 228 per cent in one year, led by the higher crypto prices.

The company claims to hold cryptocurrency inventory for long-term gains.

Hut 8 held 3,271 Bitcoin tokens worth around US$ 242.4 million at the end of the first quarter. It also earns interest at over four per cent from its 1,000 crypto tokens.

This crypto stock nosedived by 23 per cent in the last one week. But it may rebound on the back of the ongoing consolidation of Bitcoin prices.

4. DMG Blockchain Solutions Inc. (TSXV:DMGI)

The blockchain firm bought Bitcoins worth US$ 15 million in the first quarter of 2021 to beef up its digital asset holdings.

Its share price has zoomed 600 per cent in one-year, propelled by the Bitcoin price appreciation.

The company is closely working towards sustainable and transparent mining operations using clean energy as the institutional investors raised environmental concerns around Bitcoin mining.

5. Galaxy Digital Holdings Ltd. (TSX:GLXY)

The cryptocurrency brokerage firm’s stocks have soared 1,350 per cent in one year, driven by the frenzied crypto trading.

Its share was trading at 55 per cent up from the 200-day SMA on Thursday, June 17, indicating its long-term rally potential.

In the first quarter of 2021, Galaxy Digital registered a total digital asset worth US$ 2 billion versus US$ 850 million in Q1 2020.

Please note: The above constitutes a preliminary view and any interest in stocks should be evaluated further from an investment point of view. The reference data in this article has been partly sourced from Refinitiv.