Summary

- COVID-19 pandemic has accelerated growth of the BNPL sector, with social distancing norms and other restrictions driving preference for online shopping.

- PayPal's entry into the space with 'Pay in 4' is expected to take the competition to a new height. Since the announcement, share prices of several BNPL sector players have experienced a hit.

- Afterpay and Zip Co, the two major sector players listed on ASX, were trading downward in early hours on 4 September 2020.

Buy Now Pay Later (BNPL) space has experienced significant growth amid the COVID-19 crisis, as the unprecedented challenging times pushed people towards online mode of shopping and making payments.

Over the recent past, there has been more interest towards buying products on instalment payments without interest. The convenience of paying back the amount in instalments is attracting customers amid the uncertain financial environment. Consequently, number of sector players are witnessing a surge in customers and merchants. However, due to its growing traction, competition is also increasing.

Recently, US-based technology platform company PayPal Holdings, Inc. (NASDAQ:PYPL) announced its expansion into the BNPL space, with new offering 'Pay in 4', which will be available to its 190 million US users. The move marks PayPal's grand entry into the US retail market, which is worth USD 5 trillion. The service is expected to cost less to consumers as well as merchants as compared to what they are paying to existing players in the sector.

Since the announcement, several ASX-listed BNPL sector players have experienced a drop in their share prices. However, senior executives of significant sector players have come forward to address investors’ concerns, highlighting that the sector is growing, and the competition is bound to increase.

Adding to BNPL players’ woes, US stock markets fell yesterday after weeks of gains, putting shares across ASX under pressure.

Also read: BNPL strong run on ASX & changing stance on stimulus: Are stocks done with the run-up?

In that backdrop, let us discuss some of the major ASX-listed players in the BNPL space, covering their latest developments and stock performance.

Afterpay Limited (ASX:APT)

Afterpay Limited (ASX:APT), which is also known as fintech's darling, has delivered a return of more than 173 per cent in the year-to-date period. However, in the last five days, its return was noted at -5.59 per cent. On 4 September 2020 (AEST 12:55 PM), its stock traded at AUD 79.580, down by 5.024 per cent.

The Company announced robust performance for FY20, ended 30 June 2020, registering strong underlying sales and revenue growth.

FY20 financial highlights:

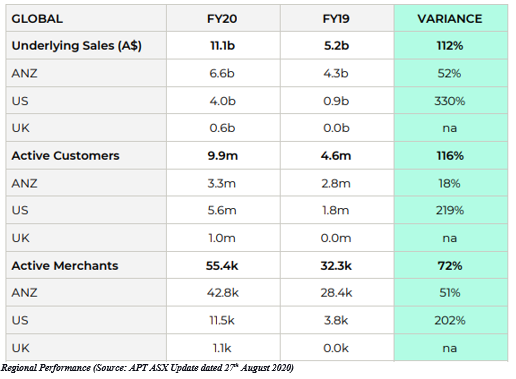

- Underlying sales grew by 112 per cent, total income increased by 103 per cent, active customer base went up by 116 per cent and active merchant base increased by 72 per cent.

- EBITDA (excluding significant items) stood at AUD 44.4 million, up 73 per cent on FY19.

- Net Transaction Margin noted at AUD 250.2 million, up by 101 per cent on FY19.

- Combined pro forma liquidity and growth capacity of over AUD 2 billion can fund more than AUD 30 billion in annualised underlying sales above the current run-rate of over AUD 15 billion.

- It experienced rapid penetration of the US and UK markets.

APT strengthened balance sheet and liquidity position with a successful capital raise of nearly AUD 769.8 million in July 2020.

Strong performance in the last quarter of FY20 has continued into FY21 across all regions. In July and August 2020, the Company experienced accelerated online sales in Australia and New Zealand, while in the US market, underlying sales in July continued at the record levels experienced in Q4. Post FY20, APT witnessed continued growth in merchant acceptance in the UK.

During FY21, the Company plans to invest in enhancing the platform and continuing to grow people resources, pursuing co-marketing opportunities, and consolidating market-leading position in existing markets.

Good Read: ASX 200 Corner: Why investors can't get enough of Afterpay share price bump

Zip Co Limited (ASX:Z1P)

Zip Co Limited (ASX:Z1P) is another major BNPL space player. Its stock has delivered a return of more than 101 per cent in the year-to-date period and a negative return of 19.82 per cent in the last five days. On 4 September 2020 (AEST 01:20 PM), its stock traded downward by 4.916 per cent to AUD 6.770.

On 4 September 2020, S&P Dow Jones Indices announced September 2020 Quarterly Rebalance of the S&P/ASX Indices, according to which Z1P will be added to S&P/ASX All Australian 200 Index, effective on 21 September 2020.

Good Read: How Fintechs helped make investors go happy during COVID-19

Zip Co Limited, on 1 September 2020, announced to have closed the acquisition of QuadPay, Inc. on 31 August 2020. On the same day, the Company also issued AUD 200 million in convertible notes and warrants.

QuadPay is a leading high growth BNPL player in the US market. Under the terms of the acquisition, Z1P has

- Issued 118,776,189 fully paid ordinary shares to the QuadPay shareholders as 'Merger Consideration Shares'.

- Z1P offered 10,480,369 options to existing employees and other option holders in QuadPay to subscribe for new fully paid ordinary shares.

The transaction delivers more than USD 70 million in monthly transaction volume and over 2 million customers to Z1P. The Company is expecting further growth with interest-free instalments transforming the way people make payments in the US.

Zip CEO and Co-Founder, Larry Diamond highlighted Z1P is excited about the acquisition, as the US is a significant part of the Company's global strategy. QuadPay business has continued to deliver strong results, and this merging of the two BNPL market leaders would be significant in capitalising the global opportunity.

Also read: BNPL Bubble: How to work around stop loss + Sezzle - Unicorn on the Move