In this article, we would discuss the three stocks with dedicated business in the energy sector. On 6 August 2019, the Benchmark index of Australia S&P/ASX 200 index was trading at 6,484.1, slipping by 156.2 points or 2.4% (at AEST 11:52 AM). Concurrently, the specific S&P/ASX 200 Energy (Sector) index on 6 August 2019, was trading at 10,302.2, down by 334.4 points or 3.25% (at AEST 11: 52 AM).

Oil Search Limited (ASX: OSH)

On 5 August 2019, the company reported an update on the Papua LNG Project in Papua New Guinea. Accordingly, the spokesperson from the concerned ministry had asserted that the discussions by National Executive Council or NEC related to the review conducted by the State Negotiating Team have had concluded that State should remain consistent with the signed agreement, which would be in the best interest of the State.

Besides, the State would discuss a shortlist of matters with the developers, and the discussions by NEC would not impact the general economics, fiscal terms of the Papua LNG Gas Agreement (Agreement). Nevertheless, the matters pertaining to the State would be placed for consideration for the JV partners. The government believes that it would take less than two weeks to conclude the items identified for the discussion.

Peter Botten, Managing Director of Oil Search, stated that the company is encouraged by the decision of the NEC to stand behind the Agreement signed by the government and the PRL 15 JV in April 2019. In addition, he mentioned that the company would support the Papua LNG operator and the government to resolve final questions on the Agreement, which would finalise the Pânyang Gas Agreement to proceed into Front-End Engineering and Design phase of the integrated three train development for the PRL 15 and PNG LNG Joint Ventures.

Besides, the Papua LNG JV have been collaborating with the government to finalise the National Content Plan for Papua LNG to maximise the involvement of PNG citizens, local businesses for the operation and development of Papua LNG Project.

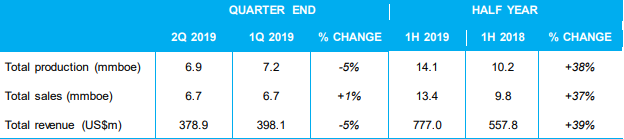

Earlier, last month, the company published its second quarter results for the period ended 30 June 2019. Accordingly, the company recorded total production of 6.9 mmboe, and the PNG LNG Project produced 6.2 mmboe at an annualised rate of 8.4 MTPA during the period. Also, during the 1H 2019, the total production was recorded of 14.1 mmboe, which increased by 38% from 10.2 mmboe in 1H 2018 period.

Second Quarter & Half Year Figures (Source: Companyâs Quarterly Report, July 2019)

Besides, the company had acknowledged the newly formed government in PNG, and it was working with the new government to ensure the development of further LNG capacity in PNG to be achieved in a timely manner, through Elk-Antelope, the existing PNG LNG Project fields and Pânyang.

Reportedly, OSH progressed towards FEED or Front End Engineering and Design entry with the beginning of tendering for the FEED phase engineering studies in the Papua LNG Gas Agreement. Also, the Pre-FEED work on the downstream, Associated Gas Expansion (AGX) progressed during the quarter and discussions have been undergoing on the Pânyang Gas Agreement.

As on 30 June 2019, the company had US$538.3 Million in cash and US$900 million in credit facilities. Further, the company was going through the procedure to conclude a further US$300 million of corporate credit by August 2019 for the Alaskan option payment.

On 6 August 2019, OSHâs stock was trading at A$6.93, down by 2.941% (at AEST 11:56 PM). Over the year-to-date period, the return of the stock has been 2.88%. Besides, the stock has provided with return of 1.85% over the past one month. The market capitalisation of the stock is ~A$10.89 billion, with approximately 1.52 billion shares outstanding.

Origin Energy Limited (ASX: ORG)

On 5 August 2019, the company notified that the Annual General Meeting is scheduled for 16 October 2019. In the latter part of the last month, Origin Energy had reported the Quarterly Production report for the period ended June 2019 (all figures in AUD, unless or otherwise stated). Accordingly, the company had recorded a revenue of $643.4 million in June 2019, up by 36% over June 2018 and down by 16% over the preceding quarter; the growth in y-o-y numbers was driven by higher effective oil prices, while the decreased over the March quarter represent a lower effective oil price in the final quarter.

As per the release, the company received $943 million cash from Australia Pacific LNG (APLNG) in FY2019, which was above the guidance of $850 million. Also, the lower customer accounts and usage dragged down the energy market electricity volumes by 3% in FY2019. Besides, the natural gas volume decreased by 3% depicting less volumes to generation.

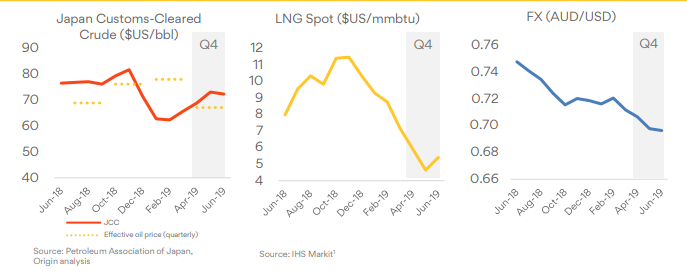

Oil & LNG Markets (Source: Quarterly Production Report, July 2019)

Oil & LNG Markets (Source: Quarterly Production Report, July 2019)

Oil & LNG Markets: Reportedly, the effective oil price for APLNG during the June quarter was US$67/bbl down from US$78/bbl in the March 19 quarter, and the effective oil price for FY19 was US$73/bbl against US$56/bb; in FY18. Also, the JCC was recovered during the June Quarter due to OPEC supply cuts, supply outages in Russia. Besides, the additional supply from new projects and moderated demand added to the continued fall in the spot LNG prices.

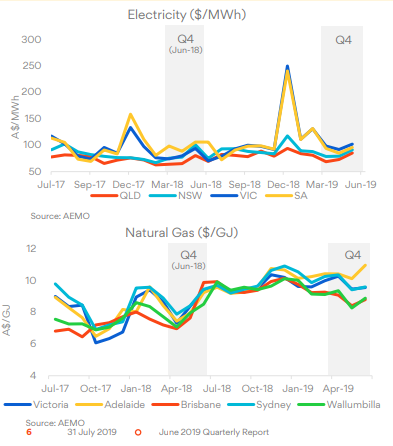

Electricity & Gas Markets

Electricity & Gas Markets (Source: Quarterly Production Report, July 2019)

Reportedly, the average NEM spot electricity price for the June 2019 was $86.8/MWh against $127.4/MWh in the previous quarter and $83.6/MWh in the June 2018; the prices were lower during the June quarter compared with the March quarter due to seasonal demand and extreme weather events in summer. Admittedly, the June quarter witnessed the average domestic spot gas price at $9.53/GJ compared with $9.82/GJ in the March quarter.

Corporate: As per the release, the company kept rehabilitation provisions for several legacy sites which operated gas work in the past. In addition, the company expected that non-cash provision for the FY2019 might increase by $160 to $180 million for the costs associated with the Osborne legacy site identified from the on-site investigations. Besides, the company completed the sale of Ironbark to APLNG for $231 million, and it expects to complete the transaction in August after the clearance received from both the ACCC and FIRB.

On 6 August 2019, ORGâs stock, was trading at A$7.15, down by 3.769% (at AEST 11:58 AM). Over the year-to-date period, the return of the stock has been +17.56%. Besides, the stock has given a return of -2.88% over the past one-month period. The market capitalisation of the stock is ~A$13.09 billion, with approximately 1.76 billion shares outstanding.

Woodside Petroleum Limited (ASX: WPL)

Earlier last month, WPL had announced the results for the second quarter ending on June this year. Peter Coleman, CEO of Woodside, stated that the company had done a commendable job in delivering the Project within the schedule & budget. He mentioned that the company had resumed production from the Vincent wells in July, and work has been ongoing to start the Greater Enfield wells within the coming weeks.

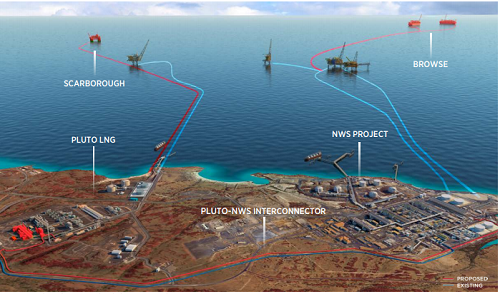

Also, during May 2019, the Browse JV gave a nod to the foundation of design for the Browse to NWS project. Further, the company was working to acquire the necessary regulatory and environment clearances related to the Browse to NWS Project, and Scarborough development. He stated that Browse to NWS Project and Scarborough development would support the companyâs strategy to achieve the future value of the North West Shelf and Pluto LNG facilities.

Additionally, he mentioned that the production & sales had lowered down against the previous quarter due to the developments at Pluto LNG, and the company achieved strong LNG production from the North West Shelf, Wheatstone LNG.

Burrup Hub (Source: Companyâs Investor Site Visit 2019, June 2019)

In May 2019, the company had organised the 2019 Annual General Meeting, and the AGM address was released subsequently. Accordingly, it was asserted that the company made real progress on the growth plans, and concurrently maintained operational excellence throughout the base business while delivering strong financial results.

Also, the net profit after tax recorded an increase of 28% in 2018, which reached more than US$1.36 billion. Subsequently, it helped the company improve the fully-franked dividend to US144 cents per share.

Reportedly, the AGM address conveyed that the growth plans of the company are very important in improving the value of assets while delivering additional LNG when global supply gap has been emerging. Also, the growth plan would improve job prospects, economic growth, taxation revenue.

Besides, the growth plans appeared to be more relevant when the world has been pushing for a sustainable energy path. Further, the energy demand is expected to increase in the coming decades as the greenhouse gas emissions would be consistent with the Paris Agreement.

Subsequently, it was asserted that the world would require more energy with fewer emissions, and to achieve this, the natural gas would provide the potential to substitute the higher emissions fuels, while underpinning the acceptance of renewables.

On 6 August 2019, WPLâs stock was trading at A$32.58, down by 1.897% (at AEST 12:00 PM). Over the year-to-date period, the return of the stock has been +8.92%. Besides, the stock has given a negative return of -8.26% over the past one-month period. The market capitalisation of the stock is ~A$31.09 billion, with approximately 936.15 million shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.