Dividends are part of the entityâs earnings that are paid to the shareholders of the company. Therefore, it can be said that dividends are part of the income distributed to the shareholders out of the net income earned during the period; net income excludes expenses, taxes, depreciation, amortisation etc. from the total turnover.

The board of a company decides on the dividend to be paid by the company. Mostly, the dividends are paid in cash; however, some companies also offer stock-dividends, dividend reinvestment plans. Also, dividends are not just paid by the companies; ETFs and managed funds also pay dividends.

Frequency of the dividends varies across the spectrum of the company. A company can pay dividends- monthly, quarterly, semi-annually and annually as well. Further, the companies pay dividends based on the profitability of the business; also stages of the business â like growth stocks, which are generally growing companies, and the expenses incurred for the development of the business lowers the profitability of the company. Meanwhile, the large and matured companies pay better dividend due to the capability of a large-scale business in earning profits.

At times, the companies pay extra-dividend or special dividend. Generally, this happens when a company achieves some unexpected high-income, which could be unexpected high-value order, profits from the sale of a business, cost-cutting initiatives and contingent income from petitions etc. In the recent past, Woolworths Group Limited (ASX: WOW) had a dividend component of A$24.15 in its buy-back program from the sale of its petrol business.

In this article, we would discuss two stocks with over 70% dividend pay-out ratio, as per the last full-year results:

Rural Funds Group

Rural Funds Group (ASX: RFF) owns high-quality agricultural assets in Australia. The group leases out its assets to generate stable income along with value growth on those assets to generate capital growth for the investors. RFF is a stapled security, a constituent of S&P/ASX 300 & S&P/ASX Small Ordinaries etc.

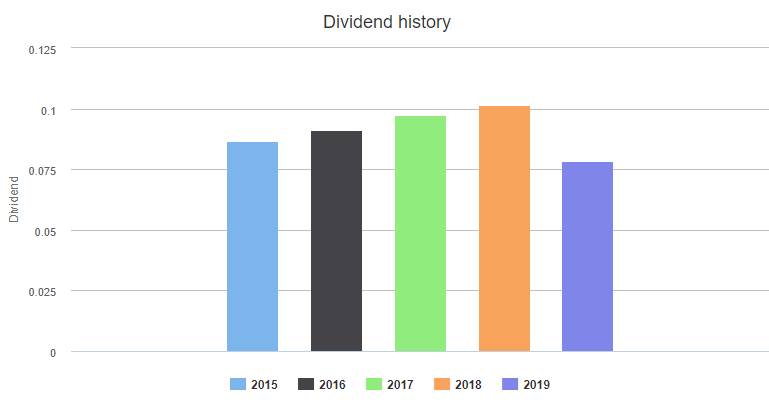

The group distributes the dividend on a quarterly basis. Currently, the annual dividend yield of the stock stands at 4.44%. In the year 2018, the group had distributed an annual income of ~A$0.1 per stapled security. Currently, the group has announced cumulative dividends of ~A$0.08 per stapled security for 2019 period, and the latest dividend has been scheduled to be paid on 31 July 2019.

Previously, in 2015, the group distributed an annual income of ~A$0.09 per stapled security. Subsequently, in 2016, the annual dividend amount rose a little bit, and a rounded figure was ~A$0.09 per stapled security. In 2017, the group distributed an annual income of A$0.1 per stapled security.

Dividend Growth (Source: ASX)

Dividend Growth (Source: ASX)

Based on the figures from the last FY close, the dividend pay-out ratio of the stock for the financial year 2017-2018 was ~71%, which depicts the capability & commitment of the company to pay the dividends. Alternatively, it means that the company has paid 71% of the diluted income in dividends.

On 05 July 2019, the group notified about the Distribution Reinvestment Price (DRP) for the dividend announced on 3 June 2019. Previously, RFF announced the dividend of AUD 0.026075, and the ex-date was 27 June 2019 while it is scheduled to be paid on 31 July 2019. Subsequently, the DRP price is A$2.27, with a DRP discount rate of 1.5%. Notably, the election period closed on 1 July 2019, and the issue date of it is scheduled on 31 July 2019.

On 15 July 2019, RFF stock was trading at A$2.38, down by 0.418% (at AEST 11:53 AM). The performance of the stock over the past one year has been +13.81%, and its year-to-date return has been +9.13%., The market capitalisation of the stock is ~A$798.89 million along with ~334.26 million shares outstanding.

Super Retail Group Limited

Super Retail Group Limited (ASX: SUL) is a retailing company in Australia. It is classified under the sector Consumer Discretionary, the stock of the company constitutes to S&P/ASX 200, S&P/ASX 200 Consumer Discretionary (Sector), S&P/ASX Dividend Opportunities Index and more.

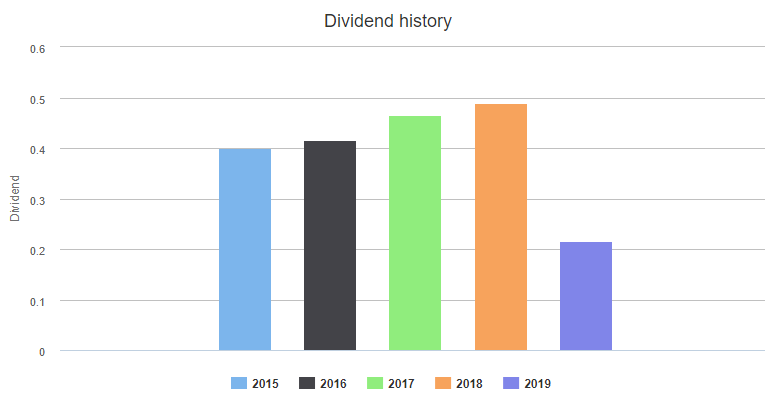

The retailing house distributes income or dividend on a semi-annual basis. As on 12 July 2019, the annual dividend yield of the stock is 5.21%. Previously, in 2015, the group distributed an income of ~A$0.40 per security. Subsequently, in 2016, the dividend amount rose a little bit to ~A$0.42 per security. In 2017, the group distributed an annual income of A$0.47 per stapled security.

In the year 2018, the retail group had distributed an annual income of ~A$0.49 per security. For the six months period, ended 29 December 2018, the retail group had paid a fully franked dividend of AUD 0.215, on 28 March 2019.

Based on the figures from the last FYâs close, the dividend pay-out ratio of the stock for the financial year 2017-2018 was ~75%, which depicts the capability & commitment of the company to pay the dividends. Alternatively, it means that the company has paid ~75% of the diluted income in dividends. In addition, the stock of the company is also recognised in the S&P/ASX Dividend Opportunities Index that tracks best paying dividend companies.

Dividend Growth (Source: ASX)

Dividend Growth (Source: ASX)

In June 2019, the company announced the appointment of Mr Benjamin Ward as the Managing Director of Auto. Accordingly, he would be joining the executive leadership team on 29 July 2019. Also, Mr Ward had demonstrated experience in retailing, product-sourcing, merchandise and store management expertise for close to 25 years. Prior to this appointment, he was based in Germany with ALDI Supermarkets.

In April 2019, the group presented trading update for the first seventeen weeks of the second half of the 2018-19 financial year. Notably, the CEO of the group spoke about the initial focus of the group for 100 days, during his tenure since February 2019.

Mr Anthony Heraghty, Chief Executive Officer of SUL, stated that despite the challenging environment business showed strength, and network of stores, e-commerce, sector leading brands, and loyal customer base collectively helped the company achieve such results.

On 15 July 2019, SULâs stock was trading at A$9.54, up by 1.274% (at AEST 11:55 AM). The performance of the stock over the past one year has been +10.82%, and its year-to-date return has been +37.92%. The market capitalisation of the stock is ~A$1.86 billion along with ~197.38 million shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.