Highlights:

- Sales of Costco Wholesale (COST) rose over five per cent YoY in November.

- Campbell Soup Company (CPB) announced a quarterly dividend of US$ 0.37 on November 30.

- Total vehicle delivery of Li Auto Inc. (LI) surged over 11 per cent YoY in November 2022.

The third quarter earnings season is on track and investors are keeping a close note of the corporate performances. This year hasn't been smooth for the global financial market, with soaring inflation, jumping interest rates, and recessionary pressures dampening the market sentiments.

While the earnings season has been mixed so far and acted as a double-edged sword, it has also helped in lifting the investors' spirits. The positive earnings were generally lauded by investors, as it reflected the positive health of the companies despite the hovering uncertainties.

On the other hand, the gloomy earnings were also lauded by some investors in recent days, as it indicated that Fed's aggressive approach in bringing down inflation has taken effect.

The market has been highly volatile this year, with inflation topping its multi-decade high level, and the central bank's hawkish push to raise the interest rates at its fastest pace in years.

Having said that, the jump in the policy rates also weighed on the consumers' spending or budget, besides influencing investors' sentiments. It has also spurred fears of a potential recession in the economy.

Cementing bets over the recessionary concerns, several big companies also started laying off their employees. Many believe that the downturn momentum in the market along with the uncertainties could tip the US economy into a recession next year.

So, today we would be taking a close watch on some major companies' stocks that would report their earnings next week. The major firms include AutoZone, Inc. (NYSE: AZO), Campbell Soup Company (NYSE: CPB), Costco Wholesale Corporation (NASDAQ:COST), Broadcom Inc. (NASDAQ: AVGO), and Li Auto Inc. (NASDAQ:LI), among others.

AutoZone, Inc. (NYSE:AZO)

The major American retailer of automotive parts, AutoZone Inc holds a market cap of US$ 48.95 billion. The stock of the company, which sells aftermarket automotive parts and other related accessories, rose 23 per cent YTD and about 42 per cent YoY.

The AZO stock surged over 20 per cent QTD through Wednesday, November 30, and touched its 52-week high of US$ 2,575.285 on November 25, 2022. The automotive retailer would be announcing its latest quarter operating results next Tuesday, December 6, before trading starts on Wall Street.

Meanwhile, in the final quarter of the previous fiscal year, AutoZone Inc's sales rose 8.9 per cent YoY to US$ 5.3 billion, and its diluted EPS rose 13.4 per cent YoY to US$ 40.51 per share.

For fiscal 2022, the retailer of aftermarket automotive parts noted a year-over-year (YoY) growth of 11.1 per cent in its net sales of US$ 16.3 billion.

Campbell Soup Company (NYSE:CPB)

The leading Camden-based food processing firm, Campbell Soul Company holds a dividend yield of 2.8 per cent. The stock of the firm, which makes "well-crafted" soups, simple meals, snacks, and other related products, rose 23 per cent YTD and around 33 per cent YoY.

The CPB stock noted a growth of nearly 14 per cent QTD after closing at US$ 53.67 on November 30, and it was also its 52-week highest level. The food and snacks company would report its Q1 FY23 earnings results on Wednesday, December 7, before trading starts.

In Q4 FY22, Campbell Soup Company's net sales and organic net sales jumped six per cent YoY to US$ 2 billion, and its reported diluted EPS fell 66 per cent YoY to US$ 0.32 apiece on a GAAP basis.

For fiscal 2022, the food processing firm's net sales rose one per cent YoY to US$ 8.56 billion, and its diluted EPS fell 24 per cent YoY to US$ 2.51 per share. Meanwhile, on November 30, the company announced a regular quarterly dividend of US$ 0.37 apiece on Campbell's capital stock (payable on January 30, 2023).

Costco Wholesale Corporation (NASDAQ:COST)

The leading American big-box retail store operator, Costco Wholesale Corporation holds a dividend yield of 0.68 per cent. The stock of the US$ 231 billion market cap firm, which sells electronics, computers, furniture, and several other products, fell five per cent YTD and traded flat on an annual basis.

However, the COST stock rose over 14 per cent QTD through its close on Wednesday, November 30, when it was around 12 per cent down from its 52-week high of US$ 612.27 noted on April 7, 2022.

The big-box retail store operator would be announcing its latest quarterly performance results on Thursday, December 8, after the Wall Street trading ends. Meanwhile, in Q4 FY22, Costco Wholesale Corporation's sales rose 15.2 per cent YoY to US$ 70.76 billion and its net income was US$ 4.20 per diluted share, against US$ 3.76 apiece in Q4 FY21.

Meanwhile, for the four weeks that ended on November 27, 2022, the retailer's sales rose 5.7 per cent YoY to US$ 19.17 billion.

Broadcom Inc. (NASDAQ:AVGO)

The leading chip manufacturing firm, that supplies semiconductor and infrastructure software products, Broadcom Inc would report its latest quarterly earnings results on Thursday, December 8.

Meanwhile, in Q3 FY22, Broadcom Inc's revenue jumped 25 per cent YoY to US$ 8.46 billion, and its diluted EPS was US$ 7.15 per share, against US$ 4.20 apiece in Q3 FY21.

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Li Auto Inc. (NASDAQ:LI)

The Chinese EV maker that has its manufacturing facilities in Changzhou, Li Auto Inc will report its earnings results before trading starts on Friday, December 9.

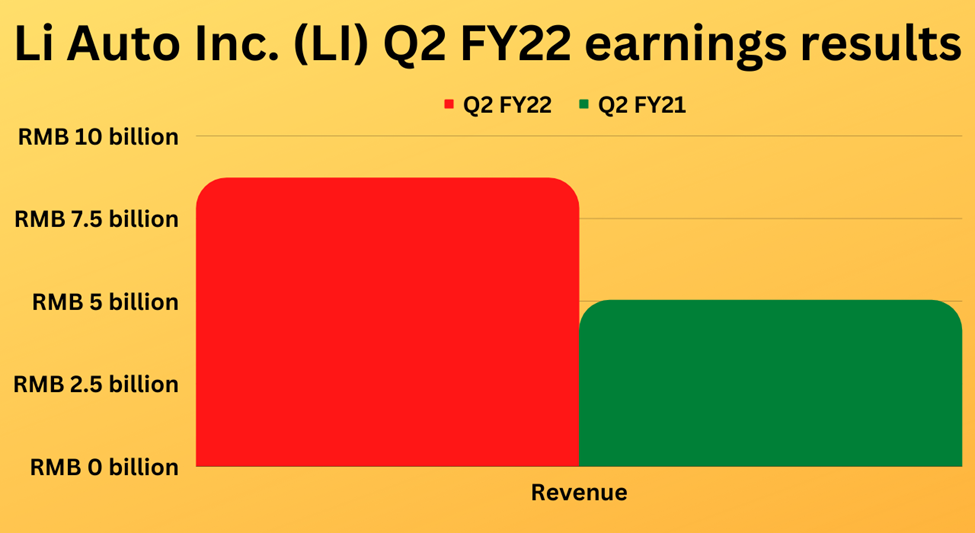

In Q2 FY22, Li Auto Inc's revenue surged 73.3 per cent YoY to RMB 8.73 billion or US$ 1.30 billion, and its net loss rose 172.2 per cent YoY to RMB 641 million or US$ 95.7 million.

Meanwhile, the electric vehicle manufacturer delivered a total of 15,034 vehicles in November 2022, representing a YoY increase of 11.5 per cent.

Bottom line:

The market witnessed unprecedented pressures during the COVID-19 pandemic, and when the economy started coming out of it, the supply-chain concerns slowed down global economic growth.

On the other hand, the war between Russia and Ukraine also played a major role in raising global uncertainties this year, while bumping up the oil, food, and other commodity prices. This has contributed the most to the soaring inflation on a global scale.

Meanwhile, next week is also going to be crucial besides the earnings, with a flurry of key economic data due for release. PCE price index, nonfarm payrolls, and PPI data, among others, are scheduled to be released next week.

These economic data might set the stage for Federal Reserve to plan its next move against inflation. While positive data could help the central bank ease its approach, the alternate metrics could result in a further worsening condition.