Summary

- Kazera’s shares jumped as the company identifies 3 minerals in commercially feasible quantities

- The company provided a 112 per cent year-to-date return

- Kazera Global and Manschaft Mining and Energy have signed an MoU for EPL licences

The shares of Kazera Global plc shot up by 5.88 per cent on 1 December as it released its market update of its operations in its Namibia project. The company’s stocks were trading at a value of GBX 0.90 before the market closed on that day. The AIM-listed company made significant progress by securing new assets and licenses.

Further, the company provided a 111.76 per cent return on price on a YTD basis owing to its performance. After witnessing the 52-weeks low of GBX 0.16 on 19 March, the AIM stock reached its 52-weeks high level of GBX 0.98 after 8 months on 20 November.

(Source: Refinitiv, Thomson Reuters)

The investment company, Kazera Global plc was established in 2006. It mainly focuses on opportunities in the energy and resources sectors, but not just limited to these. The company’s first investment was made in African Tantalum (Pty) Ltd. It is a Namibia-based mining company focussed on tantalite concentrate. Kazera has a 100 per cent stake in this project.

Moreover, the company has made an investment in South African diamond and Heavy Mineral Sands, focusing on the production of diamonds. Currently, it has a 76 per cent stakes in the project.

The company has successfully identified the existence of 3 separate minerals in commercially feasible quantities, following the exploration of just 30 per cent of Namibia’s Tantalum valley mine. They are tantalite, lithium, and feldspar with grades exceeding 25, 4, 12 per cent respectively.

More good news is expected to follow because until now, the company has explored less than one-third of the Tantalum valley mine.

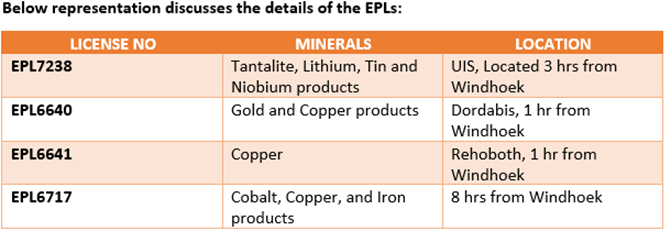

Kazera Global and Manschaft Mining and Energy have signed an MoU (Memorandum of Understanding) according to which Kazera has been granted an exclusive right for evaluating 5 specific licences by Manschaft. These exploration and prospecting licences (EPLs) are owned by Manschaft Mining and Energy in Namibia’s central and north western sections.

(Source: Source: Company's Regulatory News Service, LSE)

Kazera Global’s Chief Executive Officer, Larry Johnson said that the company was making progress and anticipated that the next year would be an exciting one. He added that Kazera is fortunate enough to be sitting on areas which are a rich source of minerals.

The company’s board is expecting to receive the proceeds of the first sale of the diamonds very soon, based on the auction announced last month. It is also reported that substantial progress has been made in the legal processes for acquiring the rights of South Africa’s Heavy Mineral Sands.