Spectris Plc

Spectris Plc (SXS) is an Egham, the United Kingdom based electrical and electronic equipment company. The company has two major business divisions - Platform business, which provide various business and industrial applications as a part of the solution provision by the company through various digital as well as physical platforms and the Industrial Solutions division which include 8 subsidiary companies that serve sectors like Automotive, Aerospace, Electronics, Energy and also provide support for Academic and theoretical research for the companyâs other businesses.

SXS Share Price Performance

On 20th November 2019, at 09:40 A.M GMT, While writing, Spectris Plcâs share price has been reported to be trading at GBX 2665.00 per share, a decrease of 1.77 per cent or GBX 48.00 per share as compared to the previous dayâs closing price, which was reported to be at GBX 2713.00 per share. While writing, the Spectris Plc share was reported to have been trading 26.66 per cent above the 52 week low share price, which was at GBX 2104.00 per share, that the companyâs shares reached on November 20, 2018. This was also 9.11 per cent below the 52 week high price at GBX 2932.00 per share, which the companyâs share achieved on July 01, 2019. Spectris Plcâs reported market capitalisation (M-Cap) stands at a value of GBP 3.145 billion.

Cobham Plc

Cobham Plc (COB) business is focused around product and services concerning the Aerospace and Defense segment, which can be utilised in remote and difficult conditions to confirm human lives and resources. The organisation's USP lies in AV(Audio/Video) interchanges, information and satellite correspondences, resistance contraptions, refuelling frameworks (Air-to-Air), life support gear as well as flight services. The organisation has a headcount of over 10000 individuals and operates from more than 100 nations. The companyâs four major business segments include Advanced Electronic Solutions, Aviation Services, Communications and connectivity as well as various Mission Systems.

COB Share Price Performance

On 20th November 2019, at 09:50 A.M GMT, While writing, Cobham Plcâs share price has been reported to be trading at GBX 159.90 per share, a decrease of 0.47 per cent or GBX 0.75 per share as compared to the previous dayâs closing price, which was reported to be at GBX 160.65 per share. While writing, the Cobham Plc share was reported to have been trading 65.91 per cent above the 52 week low share price, which was at GBX 96.38 per share, that the companyâs shares reached on January 02, 2019. This was also 6.60 per cent below the 52 week high price at GBX 171.20 per share, which the companyâs share achieved on July 29, 2019. Cobham Plcâs reported market capitalisation (M-Cap) stands at a value of GBP 3.841 billion.

Xaar Plc

Xaar Plc (XAR) is a Cambridge, the United Kingdom-based developer of the industrial inkjet technology. The group is an industry leader in the manufacturing of piezoelectric industrial inkjet printheads. The major applications of their products include 3-D Technology, Ceramics, Graphics and Décor. The major revenue driving factor for the company has been its licensing business. The two major sectors that leverage this technology are Outdoor Advertising and Ceramic Tile Decoration and the company has a stronghold in both these sectors. The application of this technology basically enables Xaarâs customers to facilitate modern solutions to traditional design and printing techniques.

XAR Share Price Performance

On 20th November 2019, at 10:00 A.M GMT, While writing, Xaar Plcâs share price has been reported to be trading at GBX 53.20 per share, an increase of 3.10 per cent or GBX 1.60 per share as compared to the previous dayâs closing price, which was reported to be at GBX 51.60 per share. While writing, the Xaar Plc share was reported to have been trading 36.41 per cent above the 52 week low share price, which was at GBX 39.00 per share, that the companyâs shares reached on September 26, 2019. This was also 68.60 per cent below the 52 week high price at GBX 169.40 per share, which the companyâs share achieved on December 19, 2018. Xaar Plcâs reported market capitalisation (M-Cap) stands at a value of GBP 40.36 million.

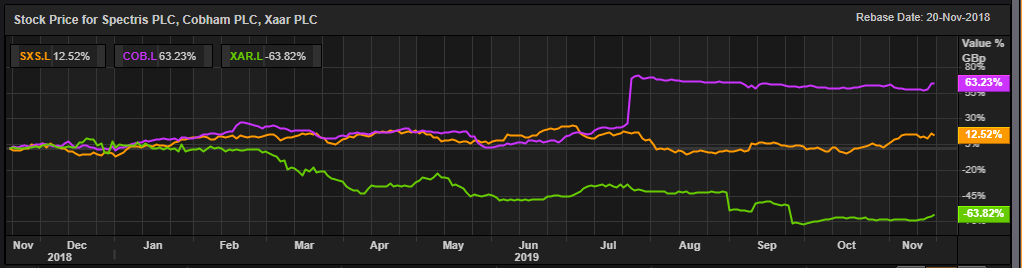

Comparative Share Price Chart of SXS, COB and XAR

Daily Chart as at 20-November-19, before the market close (Source: Thomson Reuters)

XP Power Limited

XP Power Limited (XPP) is a Singapore-based manufacturer and developer of critical power control mechanisms for the electronics sector, which offers power solutions, including DC-DC converters and alternating current (AC)-direct current (DC) power supplies. The companyâs operations are differentiated into three geographical segments: Europe, North America and Asia. Currently, the group is a member of the FTSE All-Share and FTSE techMARK index.

XPP Share Price Performance

On 20th November 2019, at 10:05 A.M GMT, While writing, XP Power Limitedâs share price has been reported to be trading at GBX 2800.00 per share, an increase of 1.08 per cent or GBX 30.00 per share as compared to the previous dayâs closing price, which was reported to be at GBX 2770.00 per share. While writing, the XP Power Limited share was reported to have been trading 50.94 per cent above the 52 week low share price, which was at GBX 1855.00 per share, that the companyâs shares reached on August 01, 2019. This was also 5.72 per cent below the 52 week high price at GBX 2970.00 per share, which the companyâs share achieved on November 11, 2019. XP Power Limitedâs reported market capitalisation (M-Cap) stands at a value of GBP 532.80 million.

Oxford Biomedica Plc

Oxford Biomedica Plc (OXB) is an Oxford, the United Kingdom based Pharmaceutical and Biotechnology company that is engaged in the business of gene and cell therapy. Oxford BioMedica is involved in the research for lentiviral vector as well as cell treatment and therapy, development, testing and production as well as marketing and selling of these medicinal products. The group provides research, development and bioprocessing services of gene and cell therapy.

OXB Share Price Performance

On 20th November 2019, at 10:20 A.M GMT, While writing, Oxford Biomedica Plcâs share price has been reported to be trading at GBX 564.72 per share, a decrease of 0.58 per cent or GBX 3.28 per share as compared to the previous dayâs closing price, which was reported to be at GBX 568.00 per share. While writing, the Oxford Biomedica Plc share was reported to have been trading 22.37 per cent above the 52 week low share price, which was at GBX 461.50 per share, that the companyâs shares reached on September 18, 2019. This was also 28.96 per cent below the 52 week high price at GBX 794.88 per share, which the companyâs share achieved on May 29, 2019. Oxford Biomedica Plcâs reported market capitalisation (M-Cap) stands at a value of GBP 436.11 million.

Computacenter Plc

Computacenter Plc (CCC) is a Hatfield; the United Kingdom based Software and Computer services business that engages in providing information technology solutions related to security, network management, database management, user productivity and in the consultation around IT products. Some of the companyâs products and solutions include Digital Workplace, Cloud Data Centre, Security and Networking. The company is also a major provider of Information technology services to the public sector.

CCC Share Price Performance

On 20th November 2019, at 10:30 A.M GMT, While writing, Computacenter Plcâs share price has been reported to be trading at GBX 1413.90 per share, a decrease of 0.01 per cent or GBX 0.10 per share as compared to the previous dayâs closing price, which was reported to be at GBX 1414.00 per share. While writing, the Computacenter Plc share was reported to have been trading 50.96 per cent above the 52 week low share price, which was at GBX 936.00 per share, that the companyâs shares reached on December 27, 2018. This was also 8.43 per cent below the 52 week high price at GBX 1544.00 per share, which the companyâs share achieved on July 31, 2019. Computacenter Plcâs reported market capitalisation (M-Cap) stands at a value of GBP 1.613 billion.

Spirent Communications Plc

Spirent Communications Plc (SPT) is a Crawley, the United Kingdom based Technology, Hardware and Equipment company that provides various Information Technology solutions to spaces like Communications, Financial Services, Healthcare, Retail, Transportation as well as to Public Sector areas. The companyâs list of solutions includes 5G services, Network Virtualization, Cyber-security, Wireless Devices and services, Military defence and aerospace solutions as well as Automotive solutions.

SPT Share Price Performance

On 20th November 2019, at 10:40 A.M GMT, While writing, Spirent Communications Plcâs share price has been reported to be trading at GBX 209.50 per share, a decrease of 2.56 per cent or GBX 5.50 per share as compared to the previous dayâs closing price, which was reported to be at GBX 215.00 per share. While writing, the Spirent Communications Plc share was reported to have been trading 89.08 per cent above the 52 week low share price, which was at GBX 110.80 per share, that the companyâs shares reached on January 07, 2019. This was also 5.63 per cent below the 52 week high price at GBX 222.00 per share, which the companyâs share achieved on November 18, 2019. Spirent Communications Plcâs reported market capitalisation (M-Cap) stands at a value of GBP 1.315 billion.

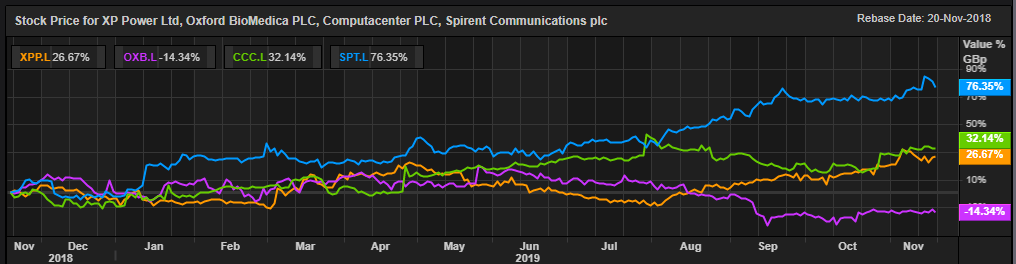

Comparative Share Price Chart of XPP, OXB, CCC and SPT

Daily Chart as at 20-November-19, before the market close (Source: Thomson Reuters)