Highlights

- Rolls-Royce sold its Spain-based ITP aero unit to a consortium led by Bain Capital Private Equity for €1.7 billion.

- Morrison Supermarkets agreed to a £7 billion ($9.5 billion) takeover by Clayton Dubilier & Rice LLC, a US-based private equity firm. CD&R won against the Fortress Investment consortium.

- Playtech sold Finalto, its financial trading division, to Gopher Investments for a cash consideration of $250 million.

Reopening of the economy and increasing vaccination rates is expected to drive the recovery of all sectors to pre-pandemic levels. According to the Office for National Statistics, the UK’s Gross Domestic Product (GDP) grew at a rate of 5.5% in Q2 2021, which was above the market estimate of 4.8% for the quarter. Growth in household consumption levels and the lifting of Covid-19 related restrictions has been instrumental in driving GDP growth in the UK in Q2 2021.

(Data source: Refinitiv)

Here is a review of the investment prospect in three FTSE listed stocks – Rolls-Royce, Playtech & Morrisons.

Rolls-Royce Holdings Plc (LON: RR.)

FTSE 100 listed Rolls-Royce Holdings is an aerospace and defence company engaged in designing, manufacturing and distributing power systems. Last week, Rolls-Royce sold its Spain-based ITP aero unit to a consortium led by Bain Capital Private Equity for €1.7 billion. Recently, it also sold Bergen Engines to Langley Holdings for €63 million and a 23.1% stake in AirTanker to Equitix Investment Management Limited for £189 million. The sales are aimed at rebuilding its balance sheet and supporting medium-term growth.

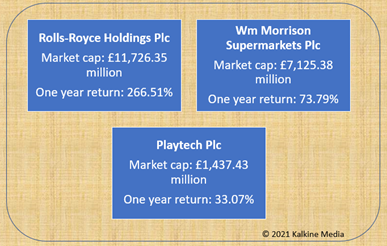

At the close of the day’s trade on Friday 1 October 2021, the shares of Rolls-Royce traded at GBX 142.88, up by 1.96%. The company’s market cap currently stands at £11,726.35 million.

Rolls-Royce Holdings’ revenue for H1 2021 stood at £5,227 million compared to £5,410 million in H1 2020. Its operating profit increased to £307 million from a loss of £1,630 million in H1 2020.

In the last one year, the shares of Rolls-Royce gave a return of 266.51% to shareholders.

Wm Morrison Supermarkets Plc (LON: MRW)

Wm Morrison Supermarkets is one of the leading supermarket chains in the United Kingdom. The company has agreed to a £7 billion ($9.5 billion) takeover by Clayton Dubilier & Rice LLC, a US-based private equity firm. CD&R won against the Fortress Investment consortium.

At the close of the day’s trade on Friday 1 October 2021, the shares of Morrison traded at GBX 297.00, up by 0.85%. The company’s market cap currently stands at £7,125.38 million.

Morrisons total revenue, including fuel, was up by 3.7% year-on-year to £9.05 billion in H1 2021 ended 1 August 2021 compared to £8.73 billion in the same period in 2020. Its statutory profit before tax for H1 2021 declined by 43.4% to £82 million compared to £145 million in 2020. The company expects profit before tax and exceptionals for 2021/22 to be higher than 2020/21 figures.

In the last one year, the shares of Morrison gave a return of 73.79% to shareholders.

Playtech Plc (LON: PTEC)

Playtech is a developer and provider of gambling software solutions. It provides software for online poker rooms, online casinos, online bingo games, scratch games, online sports betting, mobile gaming, online arcade games, and live dealer games. It announced the sale of Finalto, its financial trading division, to Gopher Investments for a cash consideration of $250 million. It also inked a multi-state agreement with New Jersey-based Unibet Interactive to provide its RNG Casino software.

At the close of the day’s trade on Friday 1 October 2021, the shares of Playtech traded at GBX 476.40, up by 1.53%. The company’s market cap currently stands at £1,437.43 million.

Playtech recorded revenue of €457.4 million for H1 2021 ended 30 June 2021 compared to €476.7 million for H1 2020. Its adjusted EBITDA for the period increased to €124.1 million from €109.5 million in H1 2020.

In the last one year, the shares of Playtech gave a return of 33.07% to shareholders.